What are ethical banks?

How is ethical banking different from traditional banking.

In simple terms, an ethical bank is exactly that - a bank with ethics. This is not the same as the mission statement often emphasised by traditional world banks. Most big banks have those and they are usually high-faluting sentences about being open at convenient times and listening more to their customers.

That is just so much hot air ... and about as measurable.

Ethical banking is not the same thing. By way of contrast an ethical bank thinks long and hard about the businesses it invests in and how these companies impact on the planet … and on other people.

Ethical banks are usually smaller … and so safer.

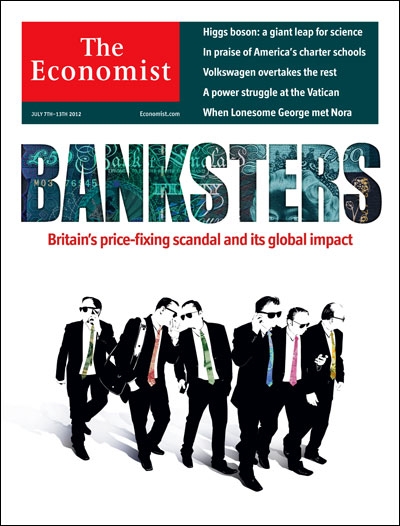

The mainstream banks’ no-longer-so-hidden ethos of 'greed is good' is not for ethical banks, so they are usually smaller institutions, smaller, but more importantly, safer.

The dubious and secretive financial dealings of the over-powerful and greedy worldwide banking sector that continues to force the planet to its knees, causing untold misery to thousands, does not apply to ethical banks.

When the ambitions of investment bankers in the traditional sector got out of hand many of us were financially hurt and the ripple effect from this is still at the forefront of economic debate at the current time.

The most worrying factor is that the world economy seems totally unable to lift itself out of this malaise as it has done in the past. This can only be down to the unwise, high risk investments made by those in the traditional banking sector.

The ethics of ethical banking.

Quite apart from not lending money to the obviously morally suspect businesses, i.e those involving child labour or trading in armaments for example, many ethical banks also support initiatives to improve many aspects of modern life such as community projects or in the areas of sustainability and the environment.

This can mean that they will not approve a loan to any business that pollutes the environment unless that business agrees to clean up its act and, until the company does actually does that, it must pay a higher rate of interest on any loans taken out. This higher rate will then subsidise the lower rate of interest that a more compliant company would be paying.

The economic carrot principle.

In this way an ethical bank does not simply ignore such companies as those that are, say, environmentally defective, but by lending with judicious clauses it has the leverage (the future promise of a lower interest rate) to encourage them to change their ways for the better. A case of the carrot rather than the stick.

This means that the bank can be acting as a force for beneficial change and how many banks run on traditional lines can say that?

As traditional banks have had to rein in much of their further investment to so many businesses and projects in order to survive and build up their own collateral again, it has been left to the ethical banks to step into the breach. This can only ever be a good thing.

Why have ethical banks stayed safe in the banking crisis?

As ethical banks have never indulged in the wild speculations of sub-prime mortgages, hedge funds, insane ‘virtuals’ and all the other dubious high-risk banking strategies aimed at boosting banker’s bonuses, they have not only remained solvent but relatively well funded, even if not in the ludicrous monopoly money figures of the big four. This in turn has helped them to continue to support companies throughout the whole of the economic meltdown.

The catch is, and there is always a catch, that ethical banks have been limited in their lending capabilities as they do not have those same fiscal reserves as the major global banks had.

This however has worked out in their favour when the major player banks became exposed to all the bad debts they had incurred by injudicious lending and their strategy of taking high risk opportunities.

Opportunities whose risk of failure has been demonstrated so spectacularly in the last few years.

Ethical banking: putting morality before money.

Most of us like to think we are good people. More importantly than that, most of us are good people, innately. We donate, many of us, to disaster funds, charities and street buskers, we help out the neighbour in need and sign petitions to support others bravely taking it upon themselves to fight, on our behalf, the inequities and injustices in life.

In Britain we do our best for the environment by recycling our waste and installing solar panels, private wind turbines and water meters to reduce our usage of natural resources. But we could easily do more for the planet and the global community, and help ourselves at the same time.

By putting what money we manage to save into an ethical bank for it to use on worthwhile projects as we earn interest, we would not only protect our own investments but also give ourselves the satisfaction of also doing good, however passively.

Our efforts to build a fairer, more sustainable world could be as simple as moving our money to an ethical bank.

And, for ourselves, simply allowing the everyday ebb and flow of a basic current account with an ethical bank should ensure that we are never one of those poor people who has to queue outside a failing mainstream bank in order to wrest what is left of our money out of it.

The reason for this hub.

This hub was written in response to a headline that read 'Financial Services: business almost back to normal'.

But do we want normal when what is conjured up is the frightening spectre of Ferrari driving fat cat wide boys (excuse my metaphors) playing with the world's money? A hugely self-regarding sector that threatens to take its ball home if it doesn't get million pound bonuses annually.

Now, more than ever, is the time to move our money to bankers with integrity, because we now know all too well what the alternative is.

The Co-operative Bank in the UK has always been an ethical bank which consulted its customers on new ethical initiatives. Most western countries now have at least one bank running on these principles but even this long-standing bank has now sadly fallen into its own decline of double-dealing and corruption.

For a full list of current ethical banks go to see: http://en.wikipedia.org/wiki/Ethical_banking

or the Triodos Ethical Bank on

http://www.triodos.co.uk/en/personal/?gclid=COWcyr6hkqgCFYFB4Qod3kyWBg