What's The Best Bank Account?

There's No One Miracle Account

Before we begin, let's identify one huge fact: There is no one bank account that is the best for everyone. What may be the most advantageous account for Mr. Rich may not be most advantageous to Average Joe. Here's some factors that affect what the best account for you will be:

- Do I travel outside the country often?

- Do I write a check frequently?

- Is my daily balance above or below $15,000?

- Is it below $25,000?

- What region of the country am I in?

That being said - there is no such thing as the best bank. But there is such a thing as the best bank for you. After a few years of trying banks, these are my top 3 picks. It's up to you to determine which is best for you!

Capital One 360

Capital One takes a real knock at major banks with their 360 checking and saving products. Though there are not many Capital One owned ATMs, 360 allows you to access your money with no fees at AllPoint ATMs, which are largely located across the United States, Mexico, Canada, the UK, and more!

The Good:

- No Fees - You can even avoid overdraft fees by adding a line of credit to your checking account!

- Free Checkbooks

- High Interest Checking Accounts - Currently .85%

- Withdraw Your Money Through a Huge ATM Network

The Bad:

- Perhaps the Worst Mobile App Ever - It's awful. Slow and it tends to crash.

- Cash Deposit Unfriendly - Unless you are near a Capital One Bank or an ATM that is OWNED by Capital One, good luck getting your money back into the bank.

Suntrust "Signature Advantage Account"

Here's a bank to go to if you're an avid flyer with some extra cash lying around. For account holders with $25,000 you can enjoy an account loaded with all the usual premium bank account features, plus a debit card that earns Delta SkyMiles points! If you're looking for a premium bank account, SunTusts' offer can't easily be beaten.

The Good

- Delta SkyMiles Debit Card

- Withdraw at any ATM - Suntrust will reimburse your account for any out of network charges you incur

- Unlimited Personalized Checks

- Free Small Safe Deposit Box

The Bad

- You'll pay $25.00 a month if you don't have at least $25,000 in your account

- Regional Bank - Just like with Capital One, it's going to be hard to deposit cash with Suntrust if you aren't close to one of their branches or ATMs

- Over Simplified Website - It can be a pain finding advanced features on your Suntrust account, because of the basic approach Suntrust has chosen for their website.

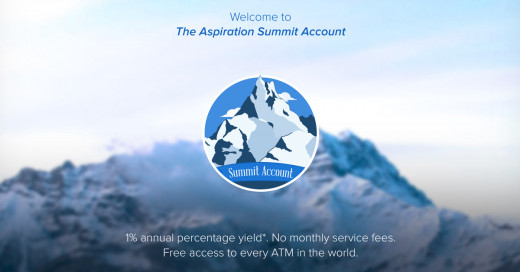

Aspiration "Summit Account"

This is my personal favorite choice for top bank. Aspiration is a start-up bank (FDIC Insured of course) that as you can see in the above image has really brought some interesting ideas into the picture! To be fair there's still much for them to work on (like mobile apps), but it's a promising product and certainly something to keep your eye on!

The Good

- Good Interest Rates - .25%, 1.00% when your balance exceeds $2,500

- Withdraw Anywhere, Deposit Almost Anywhere - Though Aspiration is an online only bank, they've stepped their game up by allowing you to deposit at any ATM branded "NYCE." That's over 300,000 ATMs!

- No Fees - There is a fee for over-drafting though!

- Fantastic Website! - Seriously, no other website could be as easy to use as Aspirations!

The Bad

- There's a Waiting List - Currently over 50,000 people in line for an Aspiration Summit Account

- Mobile Apps Still to Come - I have a really hard time believing this, but it's true! Still looking for mobile support at this time

- No Physical Branches

In the End....

There's a lot of banks out there, and there some fantastic names beyond these three. What you really need to ask yourself is, "What features matter the most to me?"

My personal choice is Aspiration, because the ATM convenience is the most important to me. Whatever bank you end up with, my hope is that it will serve you the way you need it to!