What is 401(k)?

401(k) plan is one of the most common retirement savings plan in the United States of America. This plan is a tax-advantaged, defined contribution plan offered by the US employers to their employees. 401(k) is a qualified retirement plan, which means that it is eligible for special tax benefits under the Internal Revenue Service (IRS) guidelines.

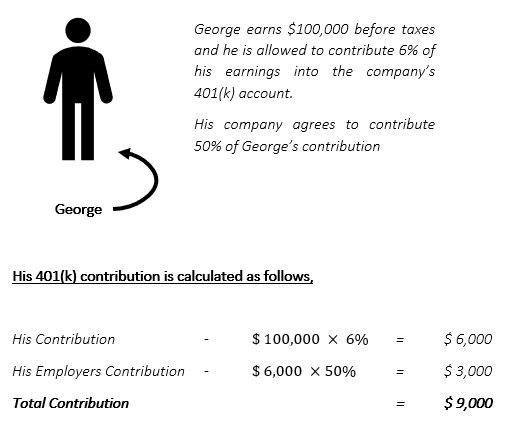

You can contribute a certain portion of your salary to this 401(k) plan. The employer might contribute a certain percentage to your retirement account. The below figure illustrates the matching concept of the 401(k) plan.

Since this contribution is tax-deductible, George has to only pay income tax for the income he receives after the deducting the contribution. He needs to pay taxes when he withdraws money from his account. Usually, this happens in retirement or after 60 years when his tax bracket is lower.

Some companies contribute a certain percentage of their profits to the employee's 401(k) account instead of matching the employees' contribution. The concept is known as 'Profit Sharing'

If you leave the organization or if the organization fires you, you are given the option to withdraw the money invested in your 401(k) account but you need to pay taxes and a penality. However, you can also rollover your contribution to another registered retirement account like an IRA (Individual Retirement Account).

How the Employers benefit from 401(k)

The management of the organisations too can benefit from this 401(k) scheme.

- The Employee Acquisition team can use 401(k) as a tool to attract potential candidates to their organisations. Job Seekers are very keen on these benefits schemes.

- When the organisation offers these kinds of benefit schemes, they can easily retain their existing staff members.

Types of 401(k)s

There are two main types of 401(k) plans that you can select to contribute your money.

1. Traditional 401(k) plans

Under the traditional 401(k) plan, you contribute your money before you pay your taxes. You have to pay the taxes when you withdraw your money from the retirement account.

If you are withdrawing cash from your traditional 401(k) account before retirement, you have to pay the penalty for the entire balance.

2. Roth 401(k) plans

Under Roth 401(k) plan, you contribute your money after you pay your taxes and you are not required to pay the taxes when you withdraw your money at retirement. This plan was created in 2006 by a provision of the Economic Growth and Tax Relief Reconciliation Act of 2001.

If you are withdrawing money from your Roth 401(k) account before retirement, you have to pay the penalty only for the gains of your account

Which 401(k) plan to select ?

So which type of 401(k) account should you select to invest? Which account type has the most benefits to you? You should consider the tax rates before deciding the account type.

- If you assume that the tax rates in your retirement will be higher than what you pay now, then you should invest in a Roth 401(k) account.

- If you assume that the tax rates in your retirement will be lower than what you pay now, then you should invest in a Traditional 401(k) account.

Contribution Limits

The followings are the limits that you should consider when contributing to your 401(k) accounts,

- In 2019, you can contribute a maximum of $ 19,000 per annum (In 2018, the contribution limit was $ 18,500 per annum). If you have multiple 401(k) accounts (both Traditional & Roth), the total contribution shouldn't exceed $ 19,000. However, your contributions to other retirement accounts such as IRAs doesn't impact the contribution limit of 401(k). If you are over 50 years, you can contribute an additional $ 6,000 as a catch-up contribution to your 401(k) accounts.

- The general contribution limit on the total Employer and Employee contribution is $ 56,000 per annum or 100% of the employee's contribution, whichever is lower. The same catch-up contribution of $ 6,000 is applicable if you are over 50 years. The total annual contribution limit with the catch-up contribution is $ 62,000.

The summary of the contribution limits are as follows,

Contribution Limit

| 2018

| 2019

| Difference

|

|---|---|---|---|

Maximum Individual Contribution Limit

| $18,500.00

| $19,000.00

| $500.00

|

Maximum Individual Contribution Limit + Catch-up Contribution

| $24,500.00

| $25,000.00

| $500.00

|

Total Contribution Limit (Employer + Employee)

| $55,000.00

| $56,000.00

| $1,000.00

|

Total Contribution Limit + Catch-up Contribution

| $61,000.00

| $62,000.00

| $1,000.00

|

* the Catch-up contribution of $ 6,000 is only applicable for the citizen above 50 years.

Have you planned your retirement? If you haven't planned your retirement, click on the below link to find more details on planning your retirement

- How to Plan your Retirement

Retirement is one of the most important milestones of a person's life. To spend a comfortable retirement, you need to have a solid retirement fund. So that you don't need to be a trouble to your family and your loved ones.

Which 401(k) account type suits you?

Do you have a 401(k) account? Let us know in the comment section :-)