The Source of Money

Ever ponder where that $20 dollar bill came from as you are handing it over to the clerk for some small (and getting smaller) piece of merchandise?

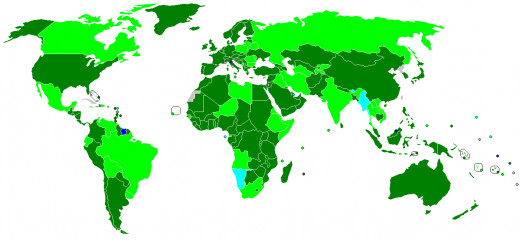

We can all come up with the snap answer. The government prints it right? Well, in most countries, this is actually wrong. The government does put an order in for the creation of money, but it is simply a loan request and they are not the only source.

Those orders are placed with privately owned central banks and the charter banks all have the ability to create money using fractional reserve banking regardless on if the government ordered that money into circulation or not. The central bank sets the primary interest rate on this new money, in some countries this is directed by a finance minister but in others it is not.

Where does money come from?

Never Ending Debt

What this means is that the money has debt attached to it before it gets into circulation. This type of system can only lead to collapse and financial disaster as the ever mounting debt cannot be paid off as every time you print a 1 dollar bill it actually COSTS you $1.07. Where does the money come from to cover off the extra .07 cents per dollar? The government borrows it from the federal reserve, thus increasing the debt load with each new dollar created. This debt cannot be paid off at all regardless of economic policy as the money is created with debt already attached. Paying off the national debt would require all the money currently in circulation and that would still not be enough to pay it all off.

We are mostly led to believe that our taxes go to pay off programs for the poor, infrastructure, healthcare, etc.? They don't, in most western countries taxes go towards paying off the interest on the national debt and the national governments borrow money from their respective central banks in order to cover the social programs and infrastructure of a nation. Eventually the debt becomes more than the taxable people of a nation state can handle and you get a collapse.

Saving money won't help as the value of each dollar is devalued as the collapse approaches thus wiping out regular savings and most investment funds.

The only way to stave off this collapse is to tax people beyond reasonable means as a way to maintain the interest payments. This is also unsustainable.

How tolerant would you be of workplace mistreatment if you had no debt?

Debt Slaves

Where does it end? Well the equation is simple; Debt = Slavery. I'm sure we have all heard the term 'wage slave'.

Anyone who owes money for a home or a car loan or credit cards is, in essence, required to work in order to maintain the payments. Employers know this which is why any employer loves to hire people in debt as they do exactly what they are told regardless of what that is usually as they need the money.

That is the path to our enslavement, money. You work for it, you earn it, you save it, you spend it but it in the end all you ever need is more.

Governments really need to take back control of the creation of money.

We spend the majority of our lives doing what we have to do instead of what we want to do.

Is debt the only reason you are working today?

Time for a change but be careful

Changing this system will not be done easily. Political leaders have been assassinated just for suggesting it in the past. Those who control the banks are quite happy with the status quo.

They use threats, deception and even murder to keep themselves at the top of the heap and any nation that opposes this monetary system seems to very quickly find itself in a war.

In the end it will be us (The average middle class citizen) who will pay the ultimate price for this type of system as the government generated debt resulting from this type of banking is entirely left to the middle class to pay off. Even when the banks start to buckle under the weight of the debt they themselves generated, it is us who bails them out through taxation.

Please rate and review

- Bill Still: The Secret of Oz - YouTube

best documentary of 2010 published in 2009 2009 Bill Still :What's going on with the world's economy? Foreclosures are everywhere, unemployment is skyrocketi... - Where Does Money Come From? The Giant Federal Reserve Scam That Most Americans Do Not Understand

How is money created? If you ask average people on the street this question, most of them have absolutely no idea. This is rather odd, because we all use - Central bank and monetary authority websites

A detailed listing of central banks everywhere - Central bank - Wikipedia, the free encyclopedia

Wikipedia's definition of a central bank

This content reflects the personal opinions of the author. It is accurate and true to the best of the author’s knowledge and should not be substituted for impartial fact or advice in legal, political, or personal matters.

© 2012 Robin Olsen