Why Are Financial Institutions Reluctant To Offer Higher Return Yields?

Financial Institutions Play On Customers' Fears

Banks, savings & loans, credit unions and other financial institutions like insurance companies do not have any problems recruiting customers to "invest" money in their passbook and certificate of deposit (COD) accounts. Despite the fact that these financial institutions offer ridiculous low return yields on their two favorite products, customers and potential customers line up to hand over their money. Many of these financial institutions offer similar return yields, and simply do not even try to compete with each other. It is not inconceivable to see yields less than one percent (1%). Why are these financial institutions able to get away with offering these low yields on their products? They play upon the fears of their customers as well as potential customers. They constantly remind their customers that they are the "safe alternative" to any other investment vehicle. They also remind their customers that they are back up by the Federal Depository Insurance Corporation (FDIC), if even if they were to go bankrupt, or ever become insolvent, the FDIC would literally guarantee every account up to two hundred and fifty thousands dollars ($250,000.00); in other words, they would never lose one penny as long as their account balances are below the FDIC guaranteed amount. How could any customer or potential customer dismiss such an appealing offer. They can safely save their money in a financial institution that is almost infallible. The only negative pitch is that say that they offer competitive yield when in fact they offer negative real returns on the savings. However, given the fact that majority of their customer base is completely ignorant about time value of money, it is not too hard for bankers to overcome any objections to their ridiculously low return yields.

Impact of Low Yields

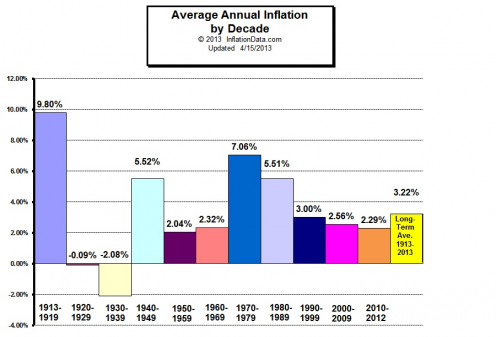

Because financial institutions' customers are not aware of the benefits of compound interest, or the impact that it has on the growth of their money over time, they are content to settle for low yielding simple interest yields. In most cases, these yields are so low that when inflation is taken into account, the real returns on passbook savings and COD accounts are actual negative. What exactly does that mean? It means that if inflation is currently running at two and half percent (2.5%) in the U.S., but banks, savings & loans and credit unions are merely paying one quarter (1/4) of one percent (1%) on six month COD account, then the customer's real return on that investment is negative two and quarter percent (2.25%). Because they chose that investment vehicle for their money, the customer is actually worse off after the six month period. Why? Because of the loss of purchasing power as a result of the customer settling for one quarter (1/4) of one percent (1%) rather than finding an alternative investment with a greater effective yield. Some may say that the negative real return should be viewed as an opportunity loss. In general, these types of losses are characteristic of investment or savings vehicles with relatively low return yields. However, many bank customers are quick to point that they would rather experience negative real returns which they cannot readily perceive than monthly or quarterly brokerage statements which readily show the constant volatility of risk assets (stocks and related assets).

Why Are Bank Customers Afraid of Risk Assets?

The financial institutions will continue to maintain what seems to be monopoly for attracting money from customers and potential customer who are simply afraid to risk their money in the capital markets. According to the December 2014 issue of DRIP Investors, the wealth gap in America continues to widen because the majority (51%) of Americans continue to avoid investing in risk assets. Thus, many are inclined to accept low return yields despite the fact that those low yields mean that they will constantly lose purchasing power because of inflation, and it will take a longer period of time for their money to double (more or less one hundred years). The banks do not help with their scare tactics, but the FEAR comes from many bank customers not understanding the dynamics of the capital markets and the U.S. Stock Market in particular. Many of them do not understand that the Stock Market is up around seventy five to eighty percent (75 to 80%) of the time. In addition, they do not consider the relatively high dividend yields offer from solid blue chip companies which have been around for decades. They do not understand that many of the blue chip companies also offer dividends (portion of earnings) which are much more attractive than the return yields on passbook savings and COD account. If nothing else, the dividend yields of stocks would allow bank customers to stay abreast of inflation, and eliminate any negative real returns on their savings. Despite this fact, many bank customers are simply terrified of risk assets, and simply cannot be persuaded to risk a few thousand dollars in a stock with a decent dividend yield.

Until the time comes when bank customers overcome their morbid fear of alternative investment vehicles to passbook saving and COD accounts, the financial institutions will continue to use their customers' money to earn thousands, millions and possibly billions. However, they will continue to offer ridiculously low return rates because they simply do not have to compete with other entities, or institutions for their customers' money. Customers and potential customers are readily willing to pour money into financial institutions like banks and credit unions because they view them as the beacon of safety, or safe harbors for their money, if you will. These customers are not concerned that the financial institutions are making huge profits, and giving them very little in return for parking their money in passbook savings and COD accounts. As long as they are able to see earnings statements which simply present a fiscal illusion (hide the fact that there are negative real returns because of the effects of inflation), with apparent positive earnings, they will continue to entrust financial institutions (banks in particular) with their hard-earned money for safe keeping, if you will.