Why You Should Shop for New Car Insurance at Least Once Each Year

You Should Review Your Car Insurance Options Every Year

Car insurance is just like any other major expense you might incur. Not only should you shop around for the best deal when you first insure your car, but you should shop around everytime your insurance provider raises your rates. It ires me when I get a rate increase, even though I have no dings on my driving record, and I don't think I should have to share the increased risk caused by bad drivers.

If you search around and ask for quotes from various insurance companies, you most likely will find one that will offer you a better rate for comparable coverage than your current provider. As soon as you get a quote from a company that is going to give you a better rate, notify your current insurance provider and let them know that you intend to jump ship unless they match or beat the rate being offered. Some companies will even give you a better deal if you get one of their plug-in devices that monitors your driving habits over a certain period of time. If you are a good driver, this can get you an even better rate sometimes than the best rate quoted by a company that does not offer this option.

How Does eSurance Stack Up Against the Competition

One of the newest entries into the insurance game is eSurance, and it seems that they are becoming a major competitor to other more well-known companies such as AllState, StateFarm, Traveler's, and Geico. I have never had insurance with any of these companies, but I have had occasion to compare prices recently between eSurance and my current provider. eSurance came in at $44.00 per month less than my current provider; however my current provider gave me the option to use one of their driving monitoring systems which could potentially reduce my rate by another $18.00 per month.

Gull Wing Mercedes Collector Car

Save Money on Car Insurance? Track Your Driving Habits.

Do You Make it Part of Your Annual Routine to Re-Evaluate Your Car Insurance?

Where to Look for Important Information Before You Start Shopping Around

Before you begin your quest for a better insurance rate, there are a few key things you should know.

- What is the financial strength of the companies you are considering?

- How do they rank for customer satisfaction?

- How easy is it to file a claim?

- What states do they operate in?

- If you file a claim, will you rates go up and by how much?

Although, price is an important consideration, it isn't the ONLY consideration. It's no point to shop a company that doesn't operate in the state you live in for certain. You also want to make sure that the company has the financial resources to pay a claim, should you have one. You will also want to know how you are going to be penalized if you file a claim. Some companies won't raise you rates if the claim is less than a certain dollar amount. I have not had any recent car insurance claims; however, I have had two recent home insurance claims for wind damage and hail damage to my house. My carrier raised my rates by $200.00 per year, and now I am shopping around for new homeowners insurance, but even though rates have been raised, so far I have not found anyone who will beat my current carrier's rate.

To find information that might be relevant for your search, a couple of good sources are A.M. Best and J.D. Powers. J.D. Powers gives ratings for customer satisfaction and A.M. Best rates companies based on their financial strength. The J.D. Powers rating is a ranking out of 5 stars, where 5 stars is the best. A.M. Best rates companies for financial strength such as A, AA, or AAA and credit ratings such as A, A+, and A++. When comparing Geico vs. eSurance both have a pretty strong rating for finacial strength, but neither one has a paricularyly impressive rating for customer satisfaction. If you can find a company that gives you a great rate, has a AAA finacial strength rating, and has an A++ credit rating, plus a 5 star customer satisfaction rating, then you've found your ideal match.

There are More Things Than Just Safe Driving That Can Save You Money

Of course being a safe driver will save you money on your insurance, but there are other things that can help you lower you rates too. Some of them are aftermarket additions that you can add to your car if it isn't already equipped with them. Nearly all modern cars now come equipped with air bags and seat belts, but you can also save money if you add anti-theft devices to your vehicles. Car alarms can also save you some money. Keeping your car parked in your garage, if you have one, can also save you some coin. If you drive less than a certain number of miles each day, you can get a rate for a pleasure vehicle, so if you live in an area where there is public transportation, you can not only save money on your auto insurance, you can also save gas money.

Quick List of Companies to Compare Prices

Where to Check Car Insurance Prices

|

|---|

eSurance

|

Geico

|

State Farm

|

Nationwide

|

Traveler's

|

Liberty Mutual

|

MetLife

|

AllState

|

Eerie

|

Progressive

|

This list is by no means all-inclusive, just some starting suggestions. There is no particular order in this list, nor is there any preference of one company over another.

Collector Car Innsurance

Specialty Vehicle Insurance

Many people have specialty vehicles that require being insuranced just like a regular daily driver automobile. Not all insurance companies offer insurance for these vehicles, and even if the carrier you are getting the best overall deal from on your regular family car(s) does, they might not have the best deal on specialty vehicles. Various types of specialty vehicles that need insurance are:

- Collector Cars

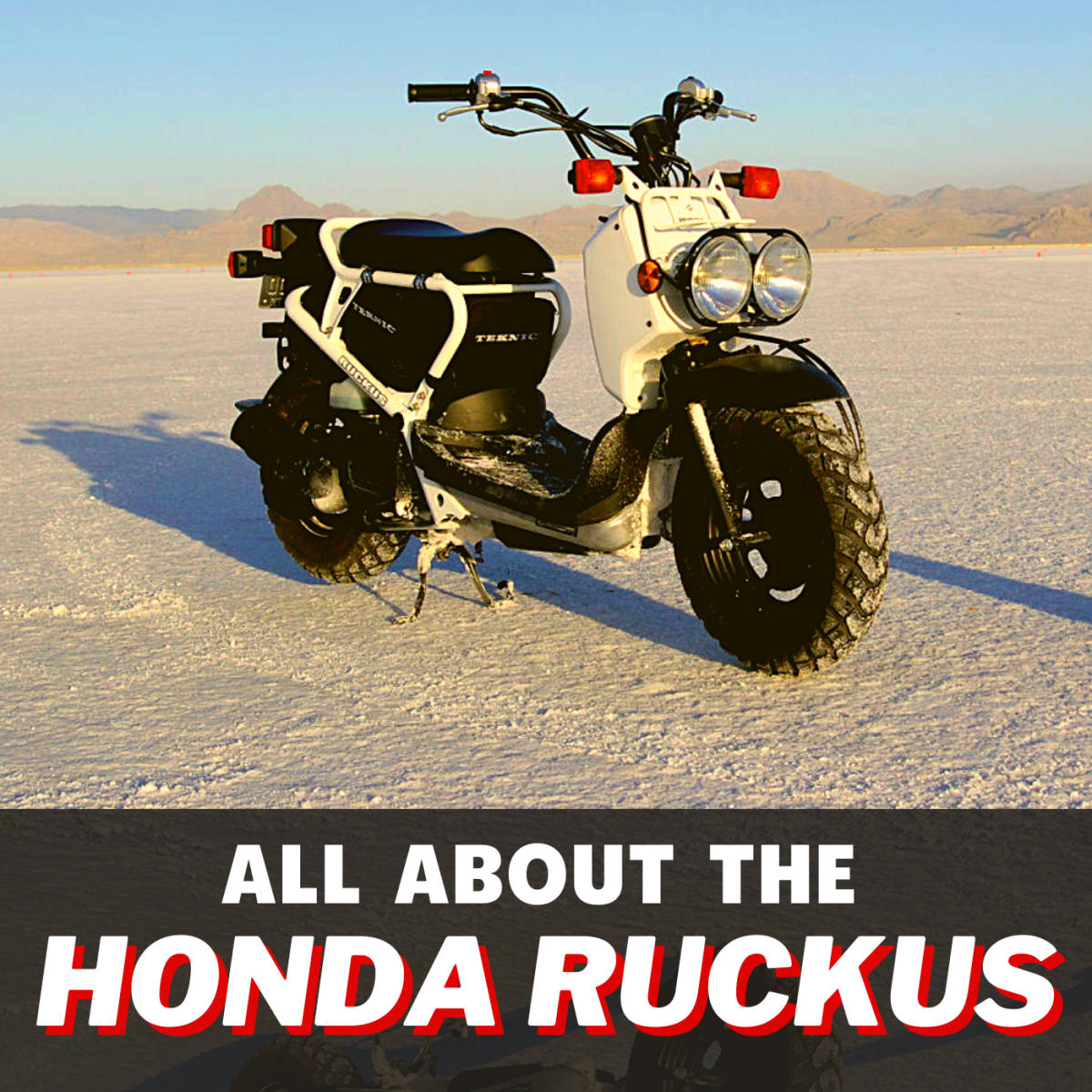

- Motorcycles

- RVs

- Boats

- Trailers

- 5th Wheels

Collector Car Insurance

- The Truth about Classic Car Insurance

Are you dreaming about owning a classic car and wondering about the facts of getting classic car insurance? This article will give you the truth you need to know before owning one. We will talk about the difficulties in getting classic car... - Vintage / Classic Car Insurance Options

Vintage car insurance is different than ordinary automobile insurance since vintage autos have different needs. Used mainly for presentation, these automobiles are dated from the end of the first world war until around 1930, but may be accepted as - Grundy Insurance

Grundy Insurance offers Agreed Value coverage for everything important in your world. From classic cars and antique boats, to daily drivers, motor homes, motorcycles, special collections and more—Grundy covers it all in one convenient place.

Car Insurance Company Rating WebLinks

- Home | My Classic Car with Dennis Gage

My Classic Car is a weekly television program that captures America’s love affair with the automobile and Dennis Gage, the handlebar mustachioed host, takes you along for the ride! - www.jdpowers.com

- A.M. Best Company

A.M. Best Company provides news, credit ratings and financial data products and services for the insurance industry.