How to Stop Overdrawing Your Account.

Overwhelming

Are you overwhelmed with an overdrawn bank account (also called insufficient funds) several times a month (or a week)? You are not alone, many people do because it's hard to know how the system works. Many people check their account balance and assume they have plenty of money based on that balance. The truth is that many transactions do not go through at the time they are completed. This means the balance you see when you check at the bank, on line, or at an ATM could be, and usually is, incomplete and therefore, incorrect. It does not mean that the bank made a mistake. I would like to explain how everything works (or at least some of it) and maybe you will have a little easier time with your bank account.

Maintaining an 'unhealthy' account (many overdrafts and bounced checks for example) could land you in jail for fraud. By learning how to monitor your correct balance, you can avoid these problems in the future. No more overwhelming accounts, fees, or aggravation.

Deposits

When you deposit a check into a bank account, whether it is a savings account or a checking account, the bank takes your check and gives you a deposit slip telling you your new balance. What the slip doesn't say, and what many banks fail to tell you, is that the bank may 'hold' the funds until the check clears the bank it was drawn on. In other words, when your bank actually receives the money from the other bank. This could take from ten days to two weeks, or more if the check is international.

Ask your bank if there will be a hold on your funds and how long they expect the hold to be. If you attempt to use the funds of the check before the bank has released it, then you are overdrawing your account. Some banks will not put a hold on a check if you still have enough in the bank to cover the check. But, be warned, that money will be frozen until the bank receives the money.

If you need the money immediately, such as going out with friends, try cashing your check at a store or something similar. They will, most likely, charge you a small fee for cashing the check, but at least you have the rest of the money. If the check is a personal check, though, most stores will not cash it unless it is your check made out to them and you have purchased a certain amount of product.

Cash that you deposit into your bank account is usually available for immediate withdrawal; however, if the deposit was made on a weekend or holiday, the bank does not apply the deposit to your account until the following 'business' day which could delay your ability to use the cash. Also, some banks have a limit on how much you can withdraw at one time, how often you withdraw from the account, or a daily amount limit for withdrawals. This means a large deposit of cash made on the weekend or a holiday may not be available until the next business day (the next day the bank is open).

Protecting your Cash

Over a weekend or holiday, you are better off keeping your cash until the bank reopens. This way you will have access to it if, and when, you need it. You can put the majority of the cash into a lock box or safe for safe keeping. I use a Sentry lock box for my important papers and cash. It was not that expensive and is fire proof up to a certain degree of heat. Also it uses a key to open which reduces the risk of theft.

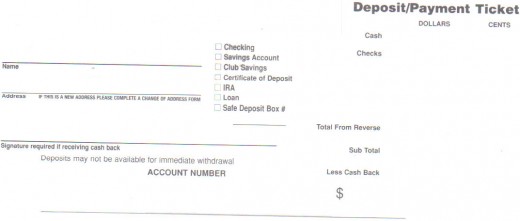

These are Forms Your Bank May Use

Click thumbnail to view full-size

Your Checks

Checks that you write against your account could be processed by your bank immediately or up to ten days after you write the check. This depends on when the company deposits the check, which bank they use, and whether it is a weekend or holiday. Many companies now use 'electronic funds transfer' which means they send the check information through the phone lines and the bank 'reserves' the money for that company and the funds are electronically transferred to them. This means that the funds are sent immediately even though you wrote a check.

Never expect that a check will not be processed immediately by the company accepting your check. Writing a check that you do not have the funds to cover is called writing a 'bounced' or 'rubber' check and is illegal. Accidents do happen and miscalculations can cause you to overdraw your account, but the bank will not be tolerant if the 'miscalculations' happen too often.

When writing a personal check, or cashing another companies check a bank or store may ask for your ID to ensure the check is yours. Try not to get angry if they ask you to identify yourself because the practice is a protection for all people. How you ask? If someone steals a check from you and tries to cash it somewhere, the store, bank, or company will know the check is fraud because your ID doesn't match, thus, they will not take it. This will save you from having your money stolen.

Be Smart

Be sure to write down fees and automatic withdrawal amounts in your check register immediately so that you always know how much you actually have in the bank. Then you can go get that massage or go to the gym knowing your account will not be overdrawn when you pay for them.

Pay attention when an ATM gives you an amount for using the machine. This will be taken out of your account when your money is taken. ATM fees are one of the biggest reasons for overdrawn accounts because most people don't realize that the ATM will charge them. Also, keep in mind that your bank may also put a fee on your account for using an 'out of network' ATM. Be sure to ask your bank if they charge these fees before you assume they don't.

Fees

Banks have fees for just about everything. Each bank is different in the amounts and types of fees charged, so check with you bank for their fee policies. Fees are applied to your account immediately but you do not usually see them until you receive your bank statement. Therefore, you should always be aware of what fees your bank will charge you and record them immediately so that you do not attempt to use the money in some other way.

Fees are usually done in the following manner (NOTE: these are only examples and do not cover the entire list of what banks may charge since every bank is different):

- ATM fees-many banks charge ATM fees just for using their ATM (that is usually noted at the time of the transaction), but in addition to that fee, many banks will charge an additional fee if the ATM you used was not in their network.

- Savings and checking fees-Many banks charge service fees for their various accounts. Some of those fees can be waived if you do specific things such as keep a minimum balance in the account or use direct deposit.

- Withdrawal fees-overdraft fees-These are charged by the bank for too many withdrawals, withdrawals that are done too soon, or withdrawals that overdrafts your account (means you have tried to use more money than you have in your account). These fees can add up very quickly and often do not show up right away which means you could be overdrawn in your account because of a fee and not be aware of it. Always check with you bank to see what fees they charge, when they charge them, and how much they will charge..

- Non-use fees-if you have an agreement with the bank that your account will be used at least once monthly (be sure to read the fine print when opening an account because that is often one of the stipulations) and you haven't used your account (maybe you want the interest to add up or you are waiting for some type of paycheck, the bank may charge you a non-use fee. These fees happen without notification and often drain your account before you knew they were being charged.

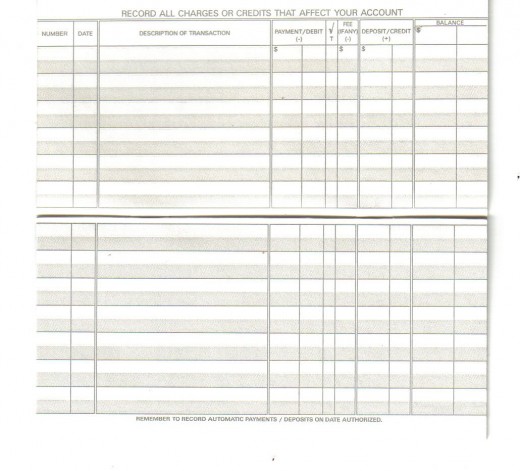

Keep accurate records of your transactions so you don't over-drawer your account

How It Works

Banks usually handle the money in your account in different ways depending on the type of bank you use and the amount of money you have in the bank.

- When you open a checking or savings account, you put money into that account. The bank then uses that money by adding it to other accounts and then loaning it out or investing it. When they invest the money or loan it out, they make money with it. Because a portion of what they made was due to the use of your money, they pay you interest on that money based on amount, length of time they have it, etc. Banks do not always use your money depending on what type of account you have.

- Now you have an account with an amount of money that you have deposited. Check with your bank to see when that money will be available for you to use. Some allow the funds to be used right away and some do not based on their rules of handling funds.

- ATM or debit cards-these are cards that are attached to your bank account and allow you to pay for things or get money out of your account electronically. You should have some type of record that you use to record your withdrawals so that you can track your money and know how much is left. ATM withdrawals are usually removed from your account immediately--be aware of all ATM fees and record them at the time of the transaction. When a debit card has a credit card symbol on it, it means the card can be used as a credit card (but the rules of a debit card will remain the same). When you use the card as a credit card, it means you won't have to put in a pin number. Because of this, you might want to have the bank put a restriction on the card in case it is stolen.

- Checks-checks are written to make payments based on your account balance. Check amounts do not get taken out of your account right away because it usually takes a few days for the check to be presented to your bank for payment. Unless the company uses electronic transfer programs which allows the company to present your check for payment electronically. That means it may be taken out immediately. Never count on the money withdrawal being late. That could spell disaster for your account, and you.

Your Correct Balance

If you use on-line banking or ATM's to check your balance be aware that some of your transactions may not have been processed at the time you checked. That means that even if the bank says you have $XXX amount in the account, that may not be correct if you have conducted transactions that have not yet been recorded. Recording and tracking your transactions yourself is the only way to know your correct balance.

By writing down everything you do that might affect your account (for example if you use an ATM to withdraw money) you can 'keep track' of your money. Overdrafts (overdrawing your account) rarely happen if you 'track' everything you do. Be sure to keep a running balance at all times.

You should be aware that gas and convience stores (to name a few) can, by law, put a hold on up to one hundred dollars from your debit card to protect themselves should your account not have enough money. This means that money is not available to you until your transaction clears the bank. Credit cards are better for these transactions.

Definitions

Now that some of the charges are clear to you, let me explain what some of the words banks use mean:

- Overdraft-an overdraft (also known as overdrawn or insufficient funds) is when you try to remove more money than you have available in the account. It may be by writing a check, using an ATM, transferring money, or going to the bank to take money out. Overdrafts will cause fees to be charged to your account. (debit). Be careful because companies who received payment from you when your account can not cover the payment, will also charge fees.

- Credit-a credit is an addition to your account-credits might be deposits or corrections. A credit means that your account will increase by that amount.

- Debit-a debit is a subtraction from your account-debits might be fees, checks written, ATM withdrawals, or transfers. A debit means that your account will decrease by that amount.

- Deposit-a deposit is an amount of money that is put into your account and could be by check, cash, or transfer. A deposit increases your account by that amount. (credit)

- Withdrawal-a withdrawal is a removal of funds from your account through automatic payments that you have authorized, transfers, checks you have written, or cash that you have removed. A withdrawal will decrease you account by that amount. (debit)

- Interest-interest is when your checking account or savings account earns money based on rates and amounts. Interest is usually added to an account as a credit; unless it is being charged on a loan in which case it will be added to your balance owed.

- Running balance-a running balance means that you do something with your account (for example deposit money) and then calculate what your balance will be when that item is processed by the bank. This balance is usually different from the bank's balance because items may not have been processed by the bank prior to your checking. Keep this in mind when using your debit/credit card.

This content is accurate and true to the best of the author’s knowledge and is not meant to substitute for formal and individualized advice from a qualified professional.

© 2011 Cheryl Simonds