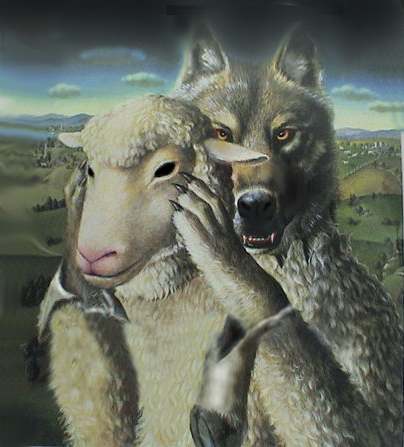

Don't let a fiduciary near your family's trust!

Let me hold that money for you!

Welcome to the latest installment of the unbelievable saga of my husband's family trust. Or, how we have come to mistrust everyone associated with this family's trust.

Previously, on “All My Greedy Children,” my sister-in-law (SIL) underhandedly usurped the family trust, installed herself as executor, and put all the assets in her name. When Hubby caught wind of this plan he sprang into action. Several lawyers and a mediation later, our side was victorious. Well, kind of. At least it seemed that way – for about five minutes.

We were able to oust SIL from any position of authority on the trust. But she had a very, very clever attorney and she is also very spiteful. The resulting Settlement Agreement pretty much left Hubby holding the bag on his mom's care – with no hope of even a dime in compensation or even reimbursement -- while his sister skated away with not a care in the world. Plus a nice little payoff for her trouble, thank you very much!

That was two agonizingly long years ago. Fast-forward to today.

You would think that having SIL out of the picture would make our lives easier. True, except for one small (okay, not small at all) fact. SIL was replaced by the fiduciary from hell. What metaphors/sayings apply to this situation?

Out of the frying pan into the fire

No good deed goes unpunished

SSDD (same “stuff” different day)

I am writing this hub to share our experience. It’s a cautionary tale of sorts.

If I can save even one person from ending up in this horrible situation, it will be worth it.

Black's Law Dictionary Definition

Black's Law Dictionary describes a fiduciary relationship as "one founded on trust or confidence reposed by one person in the integrity and fidelity of another." A fiduciary has a duty to act primarily for the client's benefit in matters connected with the undertaking and not for the fiduciary's own personal interest. Scrupulous good faith and candor are always required.

...taking advantage of the forgetfulness or negligence of the client are totally prohibited by a fiduciary.

The utmost good faith is required in all their dealings. Simply put, fiduciaries must exhibit the highest form of trust, fidelity and confidence, and are expected to act in the best interest of their clients at all times.

It is generally believed that fiduciaries perform their trades for reasons other than money and feel a sense of responsibility that goes beyond simply making a living.

To paraphrase Supreme Court Justice Brandeis: "It is an occupation which is pursued largely for others and not merely for oneself. It is an occupation in which the amount of financial return is not the accepted measure of success."

What is a "fiduciary" anyway?

A fiduciary is a paid professional whose job is to “administer” the trust. To start with, a trust is a legal document that sounds like a swell idea. And for some families, it is. If you are contemplating putting your family's assets into a trust, make sure you have a really, really good lawyer write the trust document. Or you (and/or your beneficiaries) could be in for a whole heap of unintended consequences.

Now about that fiduciary person. On the plus side, having a “neutral” third party in charge of the family funds does serve a useful purpose. It’s amazing how otherwise harmonious families can implode when money enters the picture. The idea of a paid fiduciary is to save the siblings from squabbling. More to the point, it’s to remove temptation from the sibling put in charge of the trust. That's the concept, anyway.

Anyway, back to the story.

So here we are with our family trust. It’s not very big. Not what you'd call an "estate." Hardly worth fighting over. Really.

One day everything’s fine. The next day my sister-in-law is stealing money out of it with only a light slap on the wrist. And before we know it – boom! We have a fiduciary in our lives!!!

Every day we look at each other and ask, "How did we get to this point? And what in the world did we do to deserve this torture?"

What’s good about fiduciaries?

You are asking the wrong person. I have not one positive thing to say about our experience. Maybe we just got a bad seed. It’s not like we had any choice in which fiduciary got inserted into our family trust in the position of executor, Power of Attorney (POA) financial and even second position POA medical. The attorneys involved in our mediation selected this woman. We had no say in the matter.

Which is really weird, I think. I mean, this is a huge and powerful position of trust (no pun intended). If I needed an accountant, a banker, an architect or other professional, I’d want to interview and hire the person myself.

I guess the analogy here is getting this fiduciary was like being assigned a public defender. Only we’re not the guilty parties in this scenario!

What can you expect from a fiduciary?

Obviously you expect your fiduciary to be good with money and to be prudent in making financial decisions.

Legally, the beneficiaries of s trust are entitled to an accounting upon reasonable, written notice. Once a year is customary. I mean, if you hired a professional to do a job, wouldn’t you expect to see some evidence? Some work product? Of course you would.

As an example, I can’t imagine a client hiring me to write a website for them, me then refusing to show them the website copy, but getting paid for it anyway. That simply makes no sense. Just like our non-relationship with our fiduciary.

I will spare you the long, drawn out details of all the attempts to contact this fiduciary to find out where my MIL’s money was/is and how much was/is left. Suffice to say the e-trail numbers several hundred attempts over this two-year period.

... more like....

How do you know your fiduciary is hiding something?

Well, aside from pointedly not responding to repeated phone calls, emails, requests or demands, there are three really good ways to tell when your fiduciary is hiding something.

1. He or she hires a lawyer. With YOUR money!

Think about it. Innocent people don’t hire lawyers. Guilty people hire lawyers.

Yes, this is exactly what happened in our case.

Our fiduciary hired an attorney to write us a letter informing us my MIL’s trust is almost out of money. Wow! And so quickly, too!

Since we have never seen an accounting of the trust assets, income in, expenditures out, or fees paid by the fiduciary to herself, we have no way of knowing if this is true or not.

2. He or she threatens to put your loved one in an assisted care facility.

This is a clear sign the fiduciary is no longer interested in managing your loved one’s affairs according to the terms of the trust. So much easier to get rid of your loved one and pocket what’s left of the trust in so-called “fees.”

3. He/she becomes not defensive, but downright aggressive when confronted.

In our case, we already knew there was a problem. No accounting in two years is a problem. So we hired an attorney (but only after the fiduciary had already lawyered up) to politely but firmly respond to the threats our fiduciary’s attorney was making to put MIL in a home. Our attorney rightly pointed out several flaws in the fiduciary’s plan and politely but firmly informed the attorney where she and her client could stick said plan.

Imagine our surprise when, instead of owning up to her negligence in following out the instructions of the trust and offering to rectify her mistakes forthwith, our fiduciary came back enraged! I mean loaded for bear. She immediately escalated the situation and is now threatening to get a court order to remove my MIL from her home and put her in a care facility. It’s pretty unbelievable, but it’s really happening.

What’s going to happen now?

Well, they say justice is blind. Our attorney says litigation is a crapshoot. Although it would appear we have not only right, but the law on our side, that’s no assurance we will prevail in court.

Something tells me this isn’t our fiduciary’s first rodeo. In fact, on a popular review website there are at least a dozen “clients” who tell pretty much the same sordid story as ours.

The obvious question is, how does she get away with it? How does she stay in business?

For our part, we’ve been waiting for karma to swing back our way for a long, long time.

We are hopeful that we will be able to get this charlatan off the trust and out of our lives (it’s like déjà vu all over again!).

All we want is for MIL to live out her remaining days at home, in peace, as per the terms of the trust.

She’s suffered enough with her daughter’s betrayal.

We haven’t even told her what’s going on with the fiduciary. It’s too awful and too complicated to explain to a frail 90-year-old widow.

Stay tuned for the next installment of the soap opera that is my life.

Thanks for reading. I feel better just getting this toxic tale off my chest! MM