- HubPages»

- Personal Finance»

- Tax & Taxes»

- Income Tax

Will I Get a Tax Credit Under Obamacare?

President Obama's Signature on the Affordable Care Act

Requirements to Receive Tax Credits under Obamacare

Starting in 2014, millions of people will get tax credits to purchase individual health insurance under Obamacare ("Affordable Care Act"). Will I get an individual health insurance tax credit?

Individuals will need to meet three requirements to receive the health insurance tax credits:

- Purchase individual health insurance from a state-based marketplace;

- Individuals and families must meet certain income requirements; and

- No access to affordable health insurance through an employer or other government program.

Eligible individuals will receive tax credits limiting the cost of their health insurance to 2% to 9.5% of their household income. The percentage will be set on a sliding scale, and will increase as the household's income increases.

Purchase Health Insurance from a State-Based Marketplace

Individuals will be eligible for the tax credits only if they purchase their health insurance from a state-based health insurance marketplace.

Thus, individuals who receive health insurance from their employer are not eligible.

Under the Affordable Care Act, every state is required to operate a health insurance marketplace by October 1, 2013 for insurance going into effect on January 1, 2014.

Individuals and Families Must Meet Certain Income Requirements

Only individuals and families with incomes between 138 and 400 percent of the federal poverty level (FPL) will be eligible for individual health insurance tax credits. This includes individuals with incomes up to $45,960 and families of four people with incomes up to $94,200. Families with more people can have even higher incomes.

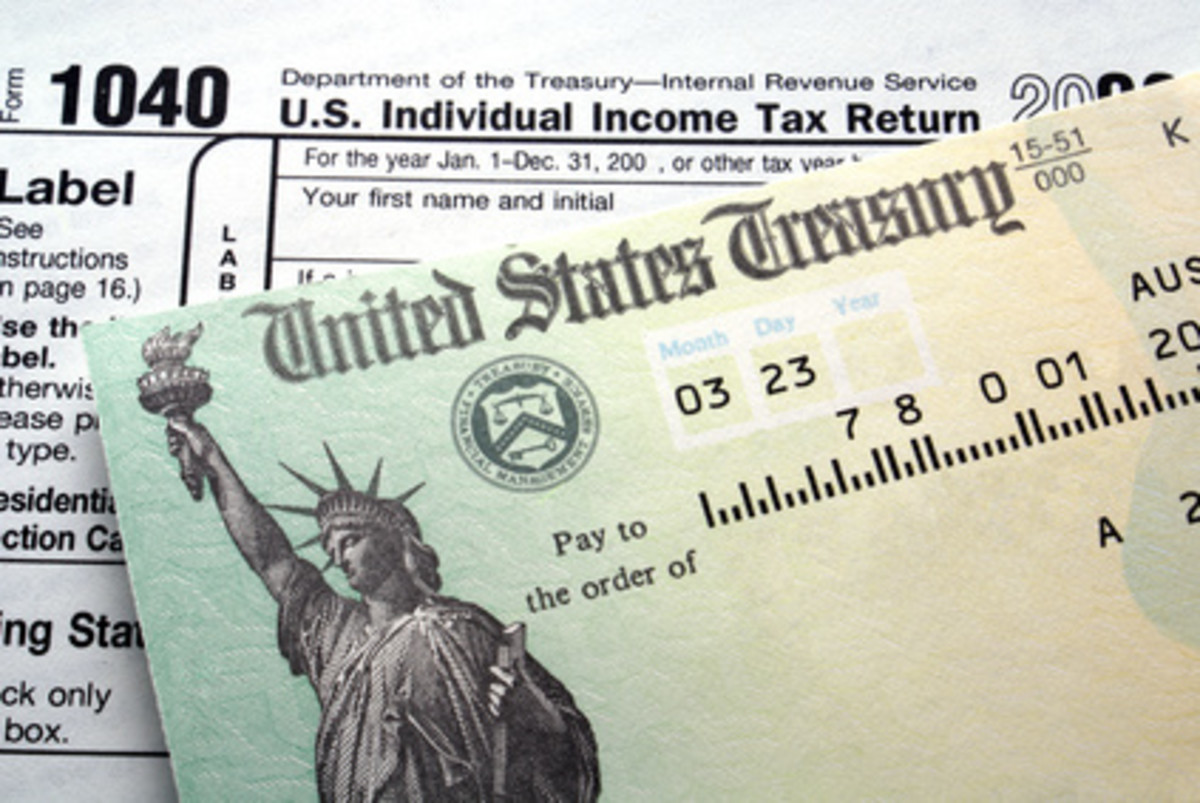

The definition of income for the purpose of determining the health insurance tax credit is "modified adjusted gross income" (MAGI). MAGI is defined as the sum of a household's adjusted gross income (AGI) plus any tax-exempt interest income. AGI is familiar to anyone who has filed a federal income tax return, where it appears on line 37 of Form 1040, line 21 of Form 1040A or line 4 of Form 1040EZ. Tax-exempt interest income appears on line 8b of both Form 1040 and 1040A.

To determine eligibility, calculate MAGI and see if it's less than 400% of the federal poverty level (FPL) for the size of your household. For 2013, the federal poverty level guidelines are as follows:

2013 Federal Poverty Level (FPL) Guidelines

Household Size

| 100% of FPL

| 400% of FPL

|

|---|---|---|

1

| $11,490

| $45,960

|

2

| $15,510

| $62,040

|

3

| $19,530

| $78,120

|

4

| $23,550

| $94,200

|

5

| $27,570

| $110,280

|

6

| $31,590

| $126,360

|

7

| $35,610

| $142,440

|

8

| $39,630

| $158,520

|

For households with more than eight people, add $4,020 for each additional person. Different federal poverty levels apply to the high-cost states of Alaska and Hawaii. The federal poverty levels will be adjusted annually to account for the effect of inflation.

To estimate the size of the tax credit, eligible individuals can use an online tax credit calculator. The actual tax credits and health insurance premiums will be determined by the health insurance marketplaces when they go live on October 1, 2013.

No Access to Alternative Affordable Health Insurance

The third requirement for individuals to get a health insurance tax credit is to have no access to affordable health insurance through an employer or other government program. Thus, the many individuals who receive health insurance from employers or another government program such as Medicaid or Medicare will not be eligible.

This requirement reflects one of the overriding goals of the Affordable Care Act: to increase the percentage of Americans with access to the healthcare system. People with access to affordable health insurance are ineligible for the tax credits since they already have affordable access to the healthcare system through another means.

Other Information about Obamacare

- Application for Health Insurance under Affordable Care Act

The latest draft of the application for health insurance under the Affordable Care Act is 21 pages long. Its instructions are 61 pages long. Keeping organized will be key to completing it.

- Directory of Health Benefit Exchanges

The Affordable Care Act requires the creation of an online health benefit exchange in each state. The exchanges must be able to enroll consumers by October 1, 2013 for coverage starting January 1, 2014.

- Health Benefit Exchanges

48.6 million Americans had no health insurance in 2011. Millions of others suffer from "job lock" because they fear losing their health insurance if they leave their current jobs. These Americans will soon have a new option for health insurance.

- Health Insurance Exchanges and the Affordable Care Act

Starting in 2014, state-based health insurance exchanges will make it easier for individuals and small businesses to buy affordable health insurance.