World Financial Crisis in a Nutshell - The Intertwined Debt Threat

The Debt crisis is Europe is threatening to engulf the world with many Asian countries, and even China, showing signs of being affected by falling production and exports.

What's it all about? How can we understand what is happening?

This article aims to summarise the main information needed to understand the financial crisis that lies at the heart of the problem.

Fundamentally the crisis is about debt and a country's capacity to meet the debt repayments and to borrow money to keep financially viable.

The debt linkages between countries means that most nations on earth are at risk from a 'domino' effect triggerd by a default in debt repayments.

Total Debt - Nutshell

Europe is engulfed in the eurozone crisis with stalling growth, mounting debt and widespread market uncertainty.

The links through the eurozone and network of debt and borrowings means that all countries are intertwined and are at risk of being strangled by the tendrils of the vines of debt liabilities linking the countries together.

Already Greece, Portugal and Ireland have been forced to get bail-outs to avoid loan defaults, and this has put financial pressures on the other eurozone countries that are required to meet the bail-out arrangements.

Italy is approaching a crisis of unaffordable borrowing costs, but its economy is too large to be bailed out.

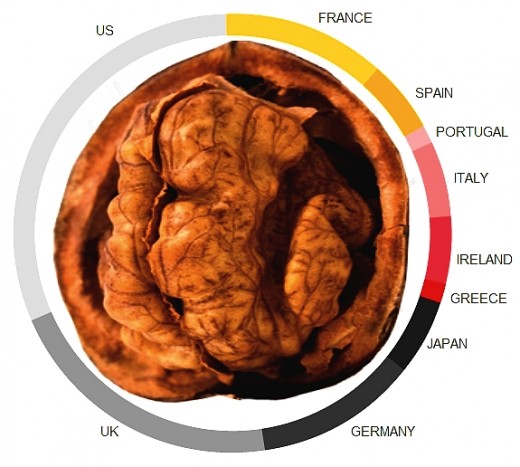

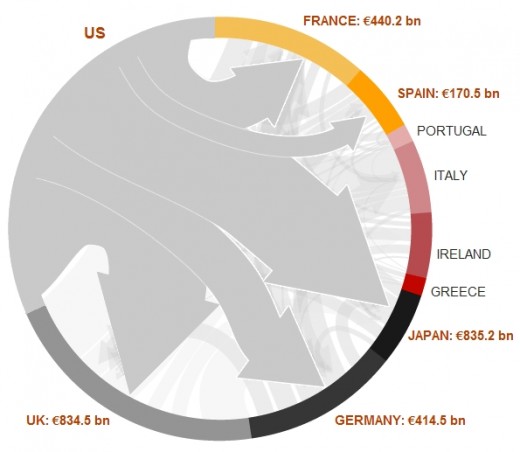

The nutshell image opposite, shows the gross foreign, or external debt for the major european countries as well as US, UK and Japan.

The colours used provide a rough guide to how much trouble each economy is in, the darker and brighter the colours the greater the risk.

The data is derived from a BBC report.

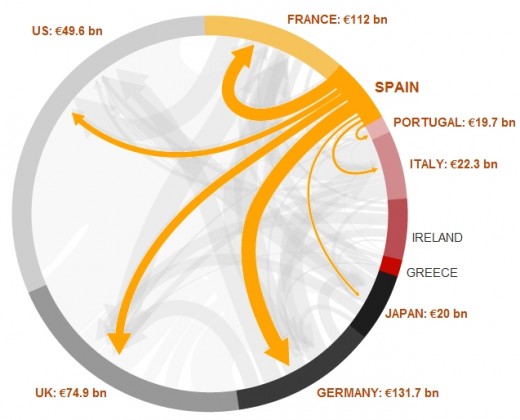

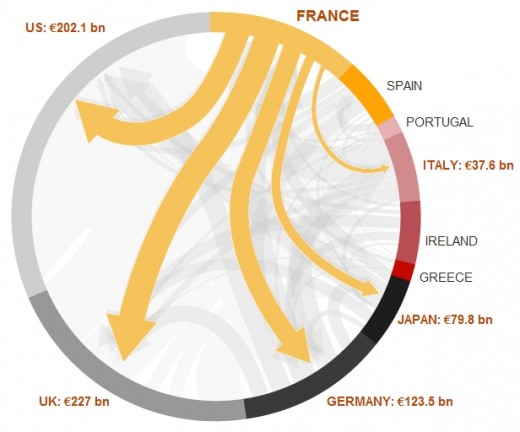

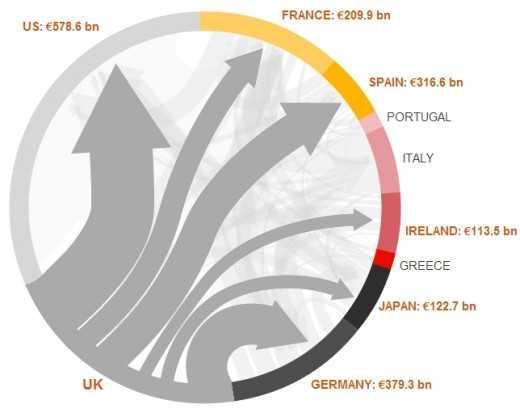

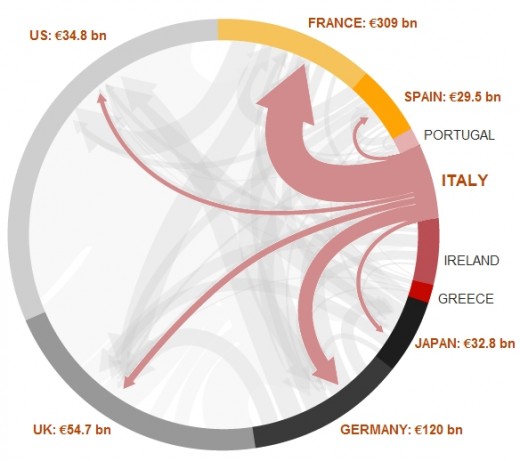

The series of images opposite show how the debt is linked between countries.

The arrows highlight the debt owed by one country to banks in other countries.

The arrows extend from the debtor to the creditor and the width of the arrow is generally proportional to the amount of money owed as of the end of June 2011.

Spain - Spain's major problem is bailed-out Portugal with billions of euros in debt. Spain also has large debits with France and Germany.

France - is the second biggest economy in Europe and is exposed with debts to some of the crisis countries. The banks in France hold large debts with Greece, Italy and Spain.

UK - The UK has huge overseas debts but this is offset by its strong assets and its strong banking industry.

Germany - Europe's largest and most robust economy has low risk, but it is exposed to Irish, Greek. Portuguese and Spanish debt.

US - Although the US's has debts which almost equals its annual GDP, it has retained a low overall risk. US has a reasonably robust economy, despite the downgrading of its credit rating and its inability to cut expenditure.

Most of the US debt lies in Asia - primarily China and Japan, Europe has the second largest percentage of US debt. A financial melt-down in the eurozone will profoundly affect the US banking system.

Italy - has a huge debt, but it is a large and wealthiy country compared with Greece and Portugal. Nevertheless Italy poses the greatest risk because its too large to be bailed out. France is heavily exposed to Italian debt.

Debt Status

The table below summarises the debt of countries in Europe with those of the UK, Japan and US.

The size of the debt is truly alarming, especially in terms of the size of the debt in relation to that of the Gross Domestic Product, which defines the capacity of countries to pay off their debts.

As the debt crisis gets worse the cost of borrowings to meet the debt repayments increase because the risk of default increases and the credit rating declines. The catastrophic risk is that a country will default on its loan repayments,

Debt Status

Country

| Foreign debt

| GDP

| Foreign debt per person

| Foreign debt to GDP

| Govt debt to GDP

| Risk Status

|

|---|---|---|---|---|---|---|

FRANCE

| $7.68 tn

| $2.43 tn

| $66,508

| 235%

| 87%

| MEDIUM

|

US

| $19.94 tn

| $14.61 tn

| $35,156

| 101%

| 100%

| LOW

|

SPAIN

| $3.47 tn

| $0.95 tn

| $41,366

| 284%

| 67%

| MEDIUM

|

PORTUGAL

| $0.73 tn

| $0.27 tn

| $38,081

| 251%

| 106%

| HIGH

|

ITALY

| $3.66 tn

| $1.62 tn

| $32,875

| 163%

| 121%

| HIGH

|

IRELAND

| $3.11 tn

| $0.27 tn

| $390,969

| 1093%

| 109%

| HIGH

|

GREECE

| $0.73 tn

| $0.27 tn

| $38,073

| 252%

| 166%

| HIGH

|

JAPAN

| $3.66 tn

| $5.55 tn

| $15,934

| 50%

| 233%

| LOW

|

GERMANY

| $7.68 tn

| $3.24 tn

| $50,659

| 176%

| 83%

| LOW

|

UK

| $13.35 tn

| $2.30 tn

| $117,580

| 436%

| 81%

| LOW

|

Growth in Gross National Product

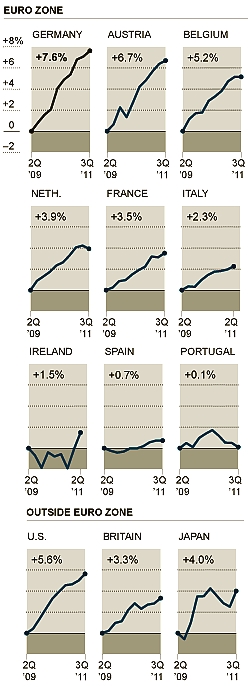

It now clear that the fledgling financial recovery that began in 2009 after the 2007-2008 recession has faltered and slowed, and a recession looms. New fears have arisen concerning the confidence in the banking system. The European agreements on bailouts and other decisions have failed to calm the markets. Italy and Spain have suddenly been required to pay sharply higher interest rates that investors had imposed on countries like Ireland and Portugal.

The European Central Bank made the decision to buy large amounts of Spanish and Italian bonds. However by the beginning of September 2011, new fears developed that European banks were at risk from the debt crisis. Many economists believed that the responses of the Central bank were not forceful enough to stimulate growth.

As shown in the graph opposite, during the economy crisis period since 2009, Germany has been able to produce a remarkable recovery in its GDP. However the growth of other economies in the euro zone has been very slow, especially in the countries facing a debt crisis.

The charts show trends for the real gross national product in nine eurozone countries since the second quarter of 2009.

Also shown is the growth in the gross national product for the United States, Britain and Japan.

© 2011 Dr. John Anderson