Your Everyday Guide on How to Manage Debt

Introduction

Many people across the country have to grapple with the issue of debts at one point or the other in their lifetime. This is traceable to the fact that financial transactions take place on a day to day basis with the attendant commitment that results when final payment is not made for goods purchased or services received.

In the same vein, fund or service providers needs to be kept happy by adhering to the terms of the business or financial transaction. Debt requires all the attention necessary because it is not just a finance issue but also a lifestyle indicator and it cuts into every facet of life.

For best effect, many proponents of financial literacy have advocated for the inclusion of debt management modules in high school curricula so that people can begin to learn this vital survival skill from an early age. Suicides, depression and loss of family are some of the downsides of a debt crisis and it certainly requires all the attention it gets in daily human discourse.

How The Debt Crisis Occurs

A debt crisis can occur on account of any of these factors but there are other random reasons that can lead to the same scenario.

Job Loss

Job loss is a common reason for a debt crisis and it is an overwhelming issue when a person loses a means of livelihood. Job loss can result from a variety of reasons but what can precipitate a debt crisis is when the circumstances remain for a long time and there is a resultant failure to meet personal financial obligations.

Living Beyond Your Means

A lifestyle that is beyond personal means is an open invitation to a debt crisis. There needs to be a balance between what is earned and what gets spent on a monthly basis. To incur debts on non-productive ventures or just to fuel a trifling lifestyle is dangerous and fraught with risk. When things go wrong or there is a loss of income, the debts incurred become unmanageable.

Financial Indiscipline

The craze of credit card acquisitions can fuel financial indiscipline and this leads to a debt crisis whenever there is a sad turn of events. Incurring debts on store accounts because of a fashion craze is irresponsible if your finances are in deficit on a monthly basis.

Business Failure

A business failure can plunge an individual into a debt crisis and this is due to the fact that some business plans do fail in reality or on account of unforeseen events. Either way, having debts to settle when there is no income is a severe crisis that can be damning for many people.

When is Debt Best Managed?

The Pre- Debt Scenario

Most persons are wrongly opinionated when it comes to the issue of debt as they hold on to the belief that debt management only needs to be considered when you are in repayment difficulty. Debt management cuts into a huge slice of corporate finance attention as whole departments are sometimes dedicated to this sphere in the corporate world. For individuals, it does not demand less attention either, as many lives have been ruined because of poor debt management.

Whenever the decision to incur a debt is being considered, it is necessary that the management should also clearly be given its pride of place. Such issues as ability to repay, state of personal finances as well as the compelling need for the debt needs to be carefully analyzed.

The Post-Debt Scenario

When there is an existing debt, two issues need to be attended to and that revolves around interest payment and the principal repayment. When the debt is serviced through interest payment, it is not considered to be a problem debt at this stage. However, failure to pay interest and principal in the long-run will lead to personal credit rating downgrade or loss of good standing with the credit bureau and subsequent blacklisting.

Most people lose out on their credit rating when they fail to service their debts and this probably underscores the need for proper evaluation before taking on a debt. Keeping the terms of debt servicing will save you from further debt crisis and keeping you afloat above the associated quagmire. On a rational ground, it is advisable to avoid getting blacklisted as the cost of getting back into the good books of the credit bureau might be overwhelming for some.

Factors in Debt Management

Ability to Repay

Primarily, it is instructive that debt should be avoided if there is no clear-cut ability to meet repayment terms. This consideration is of importance as many people find themselves in a buying binge even when they know they have little or no ability to sustain such spending pattern. This becomes more worrisome in an age when credit is easily accessed through credit cards, overdrafts and shopping payment plans.

A person with no stable source of income for example might be able to maintain a bank account from piece jobs or contract appointments and when bank marketers see stable accounts with little or no debt attached, they are likely to mount pressure with repetitive calls that push their credit card offerings among other products. It takes a strong willpower to turn down such offers knowing that your present finances cannot sustain new debt commitments.

Without a shadow of doubt, it is easier to take on debt when you have stable income sources although this is not a blank cheque for new debt acquisition. Debt needs to be tied to tangible variables and your ability to repay is just one of them.

Personal Financial State

What is your personal financial health? Is it good enough? Determining your personal financial health is a critical index that must be critically x-rayed before taking on new debt. An entrepreneur or worker with net inflow of R10, 000 monthly as against net outflows of R12, 000 is already in a R2000 deficit so, there is need of personal financial health review when considering new debt.

It is unhealthy to consider new debts that will not add to your net inflow when you are presently in a net deficit in your monthly cash flow analysis. New debt is normally considered by corporates when they are looking for a means to reduce short-term debts with longer term alternatives, or when investing in a new source of inflow or product line. For individuals, it is safer to approach new debt with the corporate mindset in order to remain financially healthy.

New Debt Opportunities and Threats

Every new debt comes with its threats and opportunities. New debts can add to your monthly outflows by way of interest and computed repayments whenever you sign up for them. There is an over-arching need to make sure that both sides of the coin are critically situated when looking at debt prospects. It is also of importance to realize that taking on new debt might be necessary for some individuals if they are to come out of their financial quagmire.

New debts without doubts offer a specter of new opportunities and can be a life-saver under many circumstances if they are properly evaluated and channeled into productive uses.

Dealing with A Debt Crisis

There are different scenarios when it comes to the debt crisis and how it arises. The most common scenario includes;

1. Failure to pay on primary commitments like mortgage, credit card outgoings, rentals, etc.

2. When your debt outstrips your post tax income

3. When you lose your source of income and become unable to meet your financial commitments

4. for entrepreneurs, when their business fails and they become insolvent or go bankrupt

In the event of some or all of the above, failure to meet minimal debt service obligations is bound to lead to a debt crisis and this can be avoided with debt management skills.

How to Manage a Debt Crisis

Every crisis can be managed with the applicable skills and this includes debt as well. On a daily basis, individuals and families have to make financial decisions as they go about their lives. When faced with a debt crisis that does not involve loss of income, the following can be considered:

Live By the Budget

In simple terms, a budget states out what you expect to earn and spend over a period of time. When you identify the source of income, how much you expect and what you spend money on, it is the beginning of the long journey to financial discipline.

To make it easier for you to manage your debt, putting a tab on your income and spending can be the first step to personal financial sanity. There are a couple of financial planning templates online that you can use if you do not have a personal financial planner.

Consider Downsizing

Downsizing is closely used when describing a scenario when organizations have to reduce their workforce. In personal debt management, it is wise to also consider reducing expenditure or cost of living. For example, moving from an upscale mansion can help shave off property rates, maintenance costs and associated expenses from your budget.

Look for Areas of Savings

Lifestyle changes are crucial when managing debt and it is better to avoid playing the ostrich here. In reality, the more savings you can make on daily expenses, the better it will be for you to reduce your outlay and pay your debts. For people on costly insurance policies, consider alternate policies that cost less. If you are driving a fuel guzzling automobile, consider trading it in for a cheaper option.

Take a Look at Cost of Debts

Managing debt requires close scrutiny of outflows and what can be done about them. If you are using costly credit cards, consider migrating to low priced versions if it is impossible to negotiate a term loan and migrate the debt away from a credit card.

Consider Cheaper Personal Loans

Using corporate finance approach, it is possible to negotiate new debts to replace existing ones provided the terms are more favorable. This can only be feasible when you are not blacklisted or in the bad books of the credit bureau. Knowing this, it is really worthwhile, if you are able to substantially reduce the pressure on your outflows on this basis and free up resources for other pressing needs.

Check Grants and Support

You need to find out if there are grants and support that you can take advantage of when managing a debt crisis. Some rates and utilities can be settled with a substantial write-off if you have accumulated arrears. Making enquiries on what is possible here is advisable as you need all the help possible as long as it is legal.

Consider Utilizing Your Savings to Offset Debt

Interest charged on debt is higher than what you get paid as interest on your savings account balances. On this score, it is by every means the preferred option if you have some money on your savings account, to settle your debts and reduce the interest you have to pay.

Some people consider this alternative as out of bounds because of emergency cash funding that might arise from time to time. If your financial standing is not terrible, you can always get once-off overdrafts to settle nagging problems when they arise.

Have You Considered Remortgage?

Contemporary mortgage realities make it possible to shift your mortgage to cheaper deals when you get a chance to do so. Having a decent equity in your home makes this attractive to lenders and it is a surefire way to manage debt.

Other debt management proponents have suggested moving your credit card loans and other debts into your mortgage if it is comparatively cheaper. Why this looks like a good way out, it can lead to loss of your home if you are unable to maintain a steady income flow to service the mortgage.

Debt Bursting

Solutions to Curb Debt

The practical steps to take when faced with a debt crisis if the above does not work for you include:

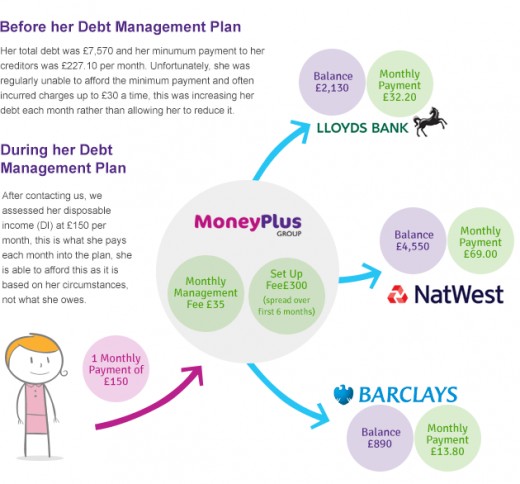

Lender Consultation

Most people shy away from their lenders when faced with default on repayments. When dealing with institutional lenders, this is an opening that can be explored. It can give you a chance to get a moratorium or even get migrated to lower service plans. You will never know what is possible until you try. So, never run away from your lender, engage and let them know what might be responsible for a forthcoming default or a short-term squeeze.

Look Out for Scholarships and Education Subsidies

Many people are oblivious of the fact that there are a number of scholarship plans that can be utilized for the education of their wards and dependents. A debt crisis provides veritable grounds to search out these options that can help you cut down on your monthly outlay.

Scrutinize Your Card Rates

Depending on your credit card provider, some people have complained of rate jacks that they were not consulted on before implementation. Some increases have been recorded to be as high as ten percent and this no doubt imposes further burdens on a person already in a debt crisis. You can reject such rate hikes and pursue other remedies that are out there in the finance marketplace.

Consolidate Your Loans

To consolidate your loans might require getting a secured loan in order to bring your debts under a single roof. This will mean that your home becomes the means to secure the loans you are granted on this score. The flip side is that you can lose your home if you fail to meet the repayment terms. However, it is a good option if you are able to maintain a stable income despite your debt crisis.

Option to Sell and Rent

Rent back options go hand in hand with the sale of your underlying asset and this can be your car or a home. When your home is sold under this plan, you get substantial payout while a proportion can be ploughed into your rental for a foreseeable period. This can be attractive if you have lost the ability for gainful employment or income generation.

One good fallback position here is that you are able to structure your finances, scale down your expenses and settle your debt with the payout you get here. The safeguard to explore is to ensure that you weigh the pros and cons so that you do not expose yourself to the short end of the stick.

Get Help with Debt –Counseling

Institutional lenders provide debt counseling services to their customers and you can take advantage of this and other options so that you get full exposure to the possible options that are available. There are also several resources online that you can explore so as to equip yourself for the tough job of wading through a debt crisis. The services you get here are mostly free and you do not have to worry about paying for the services.