Your Tax Refund is an Epic Fail

As we usher out the old year and embrace the new, many are now starting to receive 1099s, W2s, and other tax related documents in order to file their 2015 taxes. This can be a dreaded time of year for those of you sifting through shoeboxes of faded receipts, or a time of child like expectation for others filing and expecting to receive a refund.

If you are anticipating a refund, you probably already have the funds earmarked and mentally spent by the time your money actually hits your account. Pay attention to print and commercial advertisements and you’ll see many companies (especially car dealers) targeting the select group of you, who have excess money to blow this time of year.

Those who are pretty financially responsible might just use their refunds to knock out some credit card debt or pay bills. Others will hit the malls and grab more things they can’t afford while adding to their preexisting credit card debt. Financially responsible or not, if you are entitled to a tax refund, you have financially failed.

There are no free lunches. Don’t think the government is that generous to actually give you something for nothing.

What does a tax refund really mean?

I literally cringe every time I hear someone excited about “tax time” and ecstatic to receive a tax refund and here’s why. Receiving a tax refund quite simply means that you have overpaid the government in the form of taxes. It means, you’ve thought your money better suited with Uncle Same for one year than in your pocket. Like any smart business or corporation, the government then capitalized on your loan and invested that money in order to make them more money. Their thanks to you? No interest or return on your investment, just the return of the money you overpaid back to you. How nice of them right? You pretty much loaned the government money, interest free for one year, and are patiently and excitedly waiting as they merely give you your own money back.

Let’s look at the breakdown. If you are expecting a tax refund for let’s say $3,000 this year, then you have essentially overpaid Uncle Sam a whopping $250 per month last year! How could your life or year have been different with $250 more dollars added to your paycheck each month? You could have paid off some debt, if we’re going back to our financially responsible example, or even invested it yourself and made yourself some money. Had you blown it all, you still would have been better suited to have the money in your possession because you would have at least enjoyed it.

Here’s what I suggest now: If you are expecting a refund this year because you weren’t privy to this information, then be smart about it. Since it’s not actually “free” money, make it count! Treat yourself to something of course by spending let’s say 10-20% of your refund, and then use the remainder to pay off some debt. It might not feel good to do so initially, but trust me; you’ll thank me later.

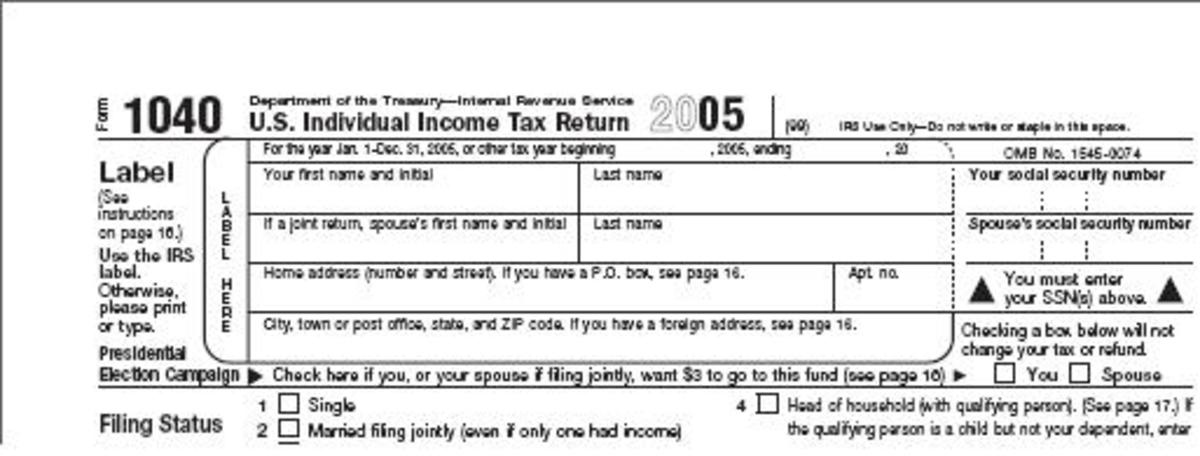

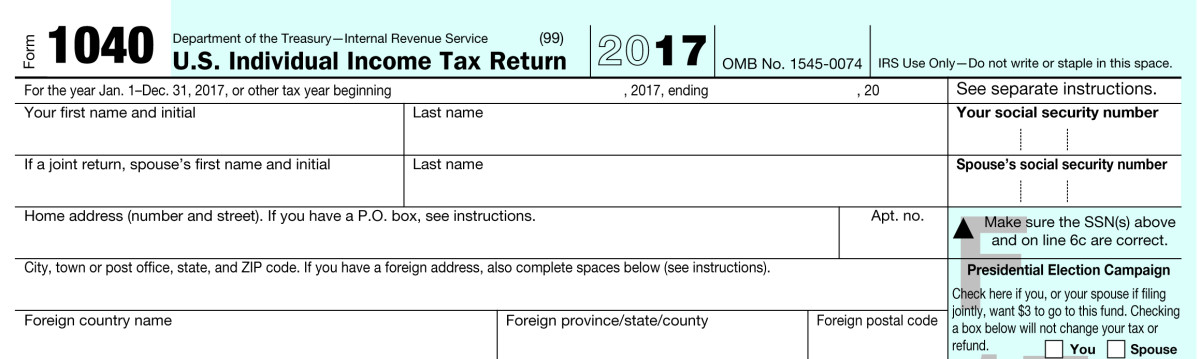

Your next to do: Contact HR at your job and inform them that you’d like to make some changes. You’ll want to make those changes on form W4. HR should be well versed in the form, but just in case they aren’t, your W4 is the necessary form, which stipulates how much federal, and local taxes (if it applies) are withheld from your paycheck. In order to adjust your form, you’ll want to add exemptions to make sure your money is spread out to you throughout the year and not held and given back in the form of a refund. Don’t go exemption crazy! You don’t want a refund back, but you also don’t want to owe Uncle Sam any money either because you went exemption crazy. Feel free to use this handy W4 calculator for guidance, or you can contact me and I’d be more than happy to help you.

In the example of the $3,000 refund, I look at it this way. Intuitively, you know you can live and survive without the $250 per month and you probably didn’t even miss it. Once you make your W4 adjustments, and the money is added back to your paycheck each month, take the $250 excess and stash it away into a savings account or other financial vehicle. That would be the financially responsible thing to do, of course.

© 2016 Jamilah McCluney