Double Your Take Home Pay, Correct Withholding

Jan. 04, 2011 5:20 pm cst, Updated August 08, 2014

Increase Your In-Pocket Money, for US Taxpayers

Credit cards are not for emergencies, but a way to get people pay a bank, for using their own money. Those who are well-off enough, not to "need" credit, and can pay off their balances each 21 days. They are in the minority.

This information offers an alternative to living on credit cards. What would you do if I could show you a way to increase your in-hand money each year interest free?

Maybe the reader can forgive me on showing the negative spin of using credit cards. This will hopefully allow you to consider paying yourself, with this way of withholding your income.

This advice, if taken, will increase weekly, or month take-home income.

- Are we talking a second job?

- Turning the children into the slave trade ?

- What do we have to do now?

What does a U.S. Taxpayer have to do?

It is important that each fiscal or tax year, is reviewed by the individual taxpayer to make sure that they are withholding around 90% of the their last years taxes, or estimated tax liability.

For first-time tax filers in the U.S., you get a break, because as a taxpayer, you are starting from scratch, not sure of what should be withheld from wages, tips and bonuses.

www.irs.gov

- IRS Withholding Calculator

1). Go to Individual 2). #5 item = withholding calculator 3). Complete (2011 rules are not all the way in place, so use caution in determining 2011 withholding.

Withholding

US citizens loan money interest free, while paying 21% interest through the year, this turns out to be a double loss, and twice the financial burden.

The IRS can fine taxpayers for over withholding. It is not the US Treasury who asks you to over withhold, it is just another one of those ideas that somehow became a common practice.

I have done the taxes of thousands of taxpayers, and almost each person who over withholds, is in credit card debt. The then come to these tax offices offering bank products; a loan of their projected IRS Refund. The higher the refund, the more the loan costs. These loans are up to 300% interest.

The optimal withholding should be 90% of your projected tax liability. In other words, my earnings last year were $17,000.00, after all my deductions and exemptions, my tax liability was around $545.00. I withheld $1,500.00, so I got a refund of around $900.00. I based my withholding on making $24,000.00. It did not happen, but I did withhold at least 90% of my previous years tax liability. If I would have known that I only owed $545.00 I would have been able to spread the $900.00 out over 52 weeks I would have had an extra $17.31. That may not seem like much to some people, but it could have been gas money, or extra needed for essentials.

Wealthy investors often do not withhold or pay their tax, fine, and liability until the very last minute, because they USE THEIR OWN MONEY! They are not paying interest, and they sure are not loaning their spending power to the US Treasury.

Those who are eligible for Earned Income Credit, can also get that extra on their paychecks each week, or however often they are paid.

US Taxpayers suffer in debt all year long, when they have the availability of the money they are over withholding interest free.

An over-simplified table for completing the W-4

For one single person

| Claim "1"

| exceptions for Individual income(s) over $93,950.00

|

For a married couple

| Claim "2"

| over 100,000 there are exceptions

|

How many people are in your household?

| Claim that amount of people

| over 100,000 there are exceptions

|

Over withholding to get a big tax refund at the end of the year, is giving a FREE LOAN to the US Treasury, Interest Free. Is the credit you live on to over compensate free?

US taxpayers loan money to the U.S. Treasury

Throughout the year, taxpayers are giving interest free loans to the US Treasury department. Then taxpayers/consumers paying 26+% interest through the year.

Many US Taxpayers who are over-withholding taxes on their income, are living on credit, and paying credit card interest.

This does not make sense.

Open a savings account, withhold the correct amount, and use your own money, interest free. No credit card needed. No 20+% interest payments for the rest of your life.

Tax Law Changes, Tax Forms, and Withholding

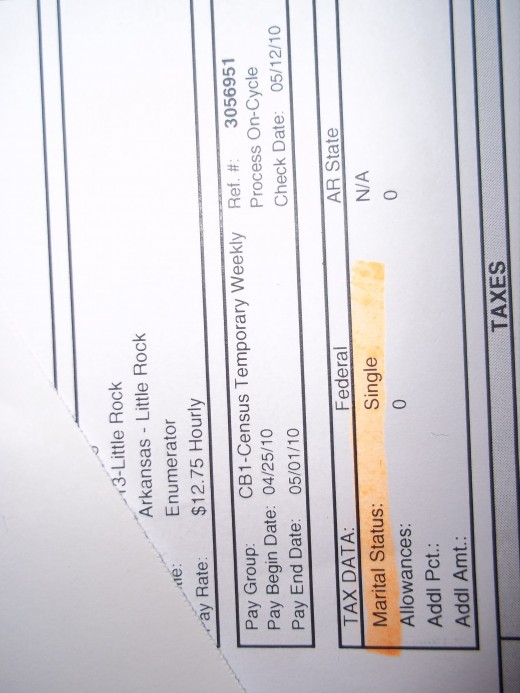

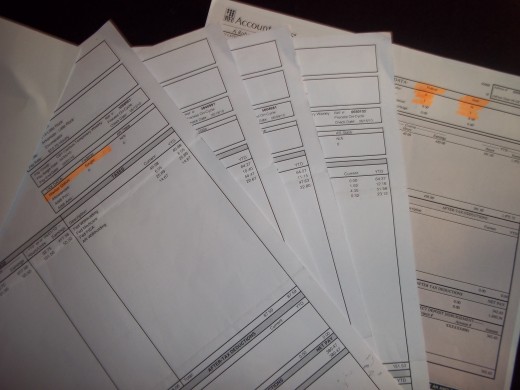

Click thumbnail to view full-size

Free IRS App - IRS2GO

CPA exam review

Tax Information

One final note...

During your income earning year, whether it is earned income or investment income, there are two important things to know and keep in mind.

-

If your income increases, decrease or you win a settlement or large sum of money, it is time to go back to the withholding calculator on the irs website, you can print off a new W-4 at anytime, and submit it to your employer so they can adjust your withholding up or down.

-

Bonuses and other lump sum settlements are usually taxed at 40%. If this happens, it is a good idea to adjust your withholding and withhold less taxes throughout the year, unless you have had a substantial increase in income, winnings, or any other taxable income. This will keep more money in your pocket, while covering your tax liability.

© 2011 Lori J Latimer

![Symantec Norton Security Premium – 10 Devices – 1 Year Subscription [PC/Mac/Mobile Key Card]](https://m.media-amazon.com/images/I/51+FgVavEzL._SL160_.jpg)