Staying On A Budget

Budget Low, Aim High

I know it’s hard to budget but often times I think we forget that there are some things in life that we can live without if we want to achieve our financial goals. Say you want that new Louis Vuitton that would look oh so good on your arm or those come hither pumps from Gucci well you might just have cut out this in order to get that. As a single woman I have learned to live without some of the conveniences that other singles or families might need (or think they need). But here I’ve listed 8 tips others I know or I, myself, have done to help keep a little jingle in our pockets.

Budgeting

Ugh! No one wants to sit down and do it but it’s got to be done. For those of you that are allergic (it’s in your head) to the concept this is all you have to do:

Make a list of all of your monthly expenses (car note, insurance, groceries, gas, electric bill….etc.) Not extras like money for shopping. I’m talking the bare minimum essentials.

Subtract how much you make every month from that. And see how much you have left. Voile! You have just budgeted. Now was that so hard?

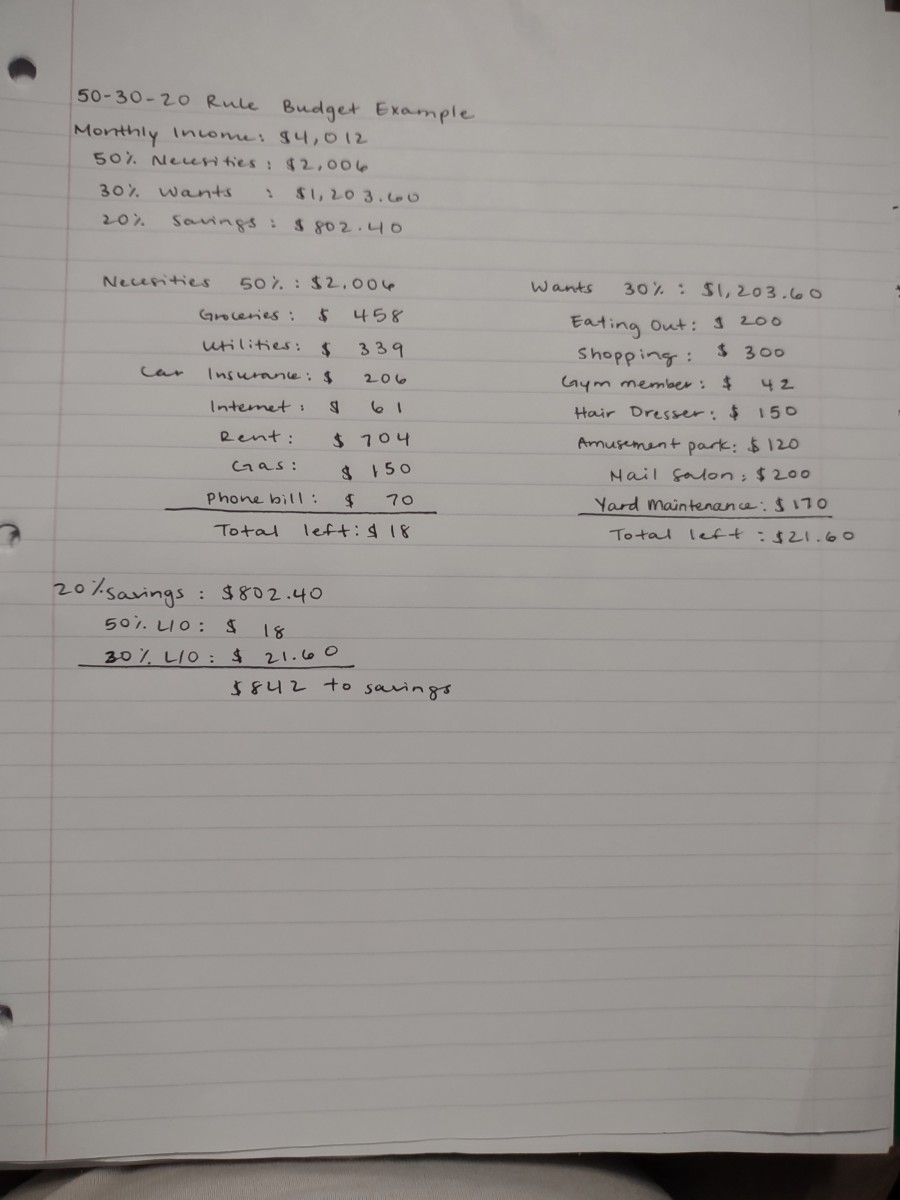

How I Budget: Let’s say for example I made $1200/mo. Well I would subtract my expenses against $1180 versus the full $1200. The aim here is to budget low. So if my expenses totaled to $1160 then that left me $20 in my mind. And that was the number I focused on as having left over. Even though in reality I had $40 left over. I was happy knowing that I had at least $10 extra to give myself as “fun” money and the other $10 is the “savings”. Which in actuality, $30 was being saved in my account. It sounds confusing and silly but you have to pretend that extra money doesn’t exist or you will spend it. I was perfectly content as long as I had food in my belly and a roof over my head. To me the $10 fun money felt like a bonus! You have to always think of the big picture. Pretty soon that $30 you really have left over adds up and becomes something larger.

Visual Example:

Earn $1200/mo, but budget low with $1180/mo.

$1180 “pretend” pay - $1160 for expenses = $20 left over to split for you and your savings.

$20 left - $10 to have “fun” cash = $10 savings but in reality you have $30 ($1200/mo - $1160 expenses - $10 fun cash= $30 your true savings)

Clear as mud? Like I said if you can ignore your true savings you will be able to save that money and not spend it. Of course, everyone's budget will vary but I just wanted to give a basic example.

The thing about budgeting is that when you know how much you have left over it makes you realize what you can and can not afford to splurge on. If I have only $75 extra in my budget after paying off all my bills and monthly expenses then that amount will trigger in my mind when I see that $80 jacket that I want. It will cause me to think twice about trying to get it. Just because you have the money doesn’t mean you have to spend it. It’s all a mind game and if you can beat it, you can get through it. And if I take $15-$25 out of that $75 for myself it leaves me with $50-$60 to save towards whatever my goal may be. Even if you can only save $20 towards your goal it’s still something. Don’t give up.

Now, if you don’t have anything left over then you should try cutting out expenses that you don’t need.

Start From Home

You can easily start from home by cutting some of your electricity out. Some of us are guilty of being on a charging laptop while watching TV. I know I am every now and then. Try little things like turning off your laptops for at least an hour or use them without having them connected to the charger. And flip those switches. Getting one of those power strips can be useful because with one flip of the switch you have managed to turn off everything at once. Trying putting some of your appliances on one power strip and when you leave to go to work just turn it off and nothing is juicing and draining you dry while you're at work. Also, give this a shot at night. If no one is using the living room hit that switch and turn off everything. This can surprisingly save you anywhere from $10-$30! And let's not forget those power saving bulbs. Though these are a bit more expensive they save you in the long run. I eventually replaced mine one by one until that's all I have in the house.

No. The Cable Company Won’t Be Offended

Do you really need the whole HBO package? No. They just play the same thing over and over any way. You can even cut out the cable all together. (GASP!) I know it might feel as though your oxygen supply has been cut but you will survive. Basic television does have some good shows, ya know? And get something like Netfilx, it’s cheaper and you can always find something you want to watch.

Be Smart Phone Users

I see ya on your smart phone but are you being smart about your bill? Cut down the minutes on your phone plan. Or switch your phone provider. Some of us want unlimited everything. If you find yourself not talking on the phone as much as you used to, get a plan with less minutes. You know you only text anyway. With most phone companies having mobile to mobile plans you should really consider this option. If your phone doesn’t offer mobile to mobile switch companies! And if you still have a land line get rid of it if you find yourself always on your cell phone more than it. Just because you've had your same number for 15 years doesn't mean you have to keep wasting your money on two phone bills because it's easier for everyone else. Keep in mind that you have a goal. "Everyone else" is not going to help you pay for it.

Brown Bagging It

No one will make fun of you if you bring your lunch. Okay, they might a little. But what are they in, kindergarten? You’re an adult, it’s okay to bring your lunch. Now I might advise you to not use your sturdy metal Star Wars lunch box but hey if you want to take it, take it. Just revel in the idea that you will be saving money and those yahoos laughing at you won’t. It sometimes is a pain in the butt to pack your lunch but I have found it worth it.

No Shopping On an Empty Checkbook

It is not wise when you are saving money to take a light stroll through the mall. It will only seduce you into buying something that you are not saving for. Or if you feel the urge for shopping, try going to dollar stores like the Dollar General or Dollar Tree. You walk in and buy up the place and you’ve only spent $25! You fill the need for shopping and you’ve saved yourself from overspending. Cha-ching!

Every now and then you may feel stir crazy and tire of buying baskets and plates from the Dollar Tree so it’s okay to go to a department store and buy a little something to keep you at bay from buying a big something but you must show some restraint! I repeat you must show some restraint! This is what you do. Go into the store with a spending price in mind. Find you a little trinket for that price and get outta there! Or try consignment stores. You never know what new or new to you treasures you might find in there. It might be something better than the Gucci’s you're saving for. Okay, I went to far. But you never know.

Make Yourself the Chef Tonight

You knew it was coming. If you can’t shop as much then you can’t eat out as much either. Come up with a doable budget to spend on groceries per pay check and stick to it. Have you checked the Sunday paper for coupons? They’re still in there. With all the stuff available online that good old tried and true method of saving still exists. And if you’re like me, you never have time to look for coupons or forget to bring them with you. But give it shot for the first few times that you go grocery shopping. The savings you have will probably get you in the habit of doing it more often. It’s kind of addicting. And plus by cooking your own meals you know exactly how it was prepared. Win, win!

In the midst of it all you might eat out every now and then to maintain some type of life but just by cutting back on how often or even what you are buying can save you money. Is it necessary to guzzle down two glasses of wine when one is really enough? Or is it necessary to buy a whole dinner plate when they have a cheaper appetizer version of what you’re eating? (Though it seems restaurants are catching on to this. Appetizers are becoming about as expensive as the meals.)

Leave That Auto in Park

Try catching the bus if you can. It’s an adventure in every ride. You just never know what you’re gonna get. But seriously, if you have some form of transit that you can use in your city or town give it a shot. With gas prices out there the way they continue to fluctuate you can always trust that a more cost efficient way to travel is by bussing it.

Beware of the Alien ATMs

You know what I’m talking about. Those pesky yet tempting ATMs that catch you off guard because you have found yourself low on cash. The ones that charge you an extra fee because they’re “special.” They send out a message that states just because you don’t bank with them you have to give more of yourself until you do. Who do these ATMs think they are? Well tell them they are no one to you and keep on moving. And these fees aren’t just cut and dry. It’s a fee from the ATM as well as the bank you’re banking with. You might be adding an extra 4-5 bucks on top of what you took out. Though it might get challenging, find your bank's ATM machine. And it might seem nerdy but finding each of the ATM locations near places that you frequent can be a good idea. If you do find yourself in a bind you know where to go for some quick cash without worries of extra fees.

Bottom line: Cut out any extra expenditures that are ultimately unnecessary to have. If you have a movie night every Sat. and it brings you and your family together. Do it. If you can cut somewhere else and keep that going, great. I’m not saying to live like a recluse but just watch where your money is going. Just taking a few extra steps can help you towards saving. I'm not saying this is a sure-fire way to save money. Most of these things have worked for me because I am single and only have to look out for myself. But hopefully most of these suggestions will be beneficial for most as well.

And for those of you that have other bright ideas, let us know what you're doing to save.