What is Frugal Living?

The Beauty of Learning "No" Early

Ah yes, living below your means. We have all heard this exciting phrase so many times throughout our lives. To some, it is the only sensible way of life and the suggestion is often greeted with a smile, polite nod, and a cheerful, detailed testimonial of success. However, more often than not, the remark is followed by a groan, an expletive, or stark silence of quiet dissolution.

For me, my life has been made up of living within or below my means, or rather the means of my family. I was raised that way. Being close to my grandparents meant frugality, coupons, and dollar stores. And believe me, I am not complaining!

Sure, when I was five years old I wanted that Barbie Jeep. That pink, expensive, motorized, assemblage of plastic was marvelous to me. All of my friends had one - but I did not. That Barbie Jeep, or rather lack of that Barbie Jeep, is symbolic in that I received less as a child, materially speaking of course, compared to many of the kids I grew up with.

The Coach Purse

Fast-forward to today, December 2013. As the holiday is upon us, and has been since October it seems, I decided to take a trip to the mall last weekend. Avoiding Black-Friday at all costs, I ventured to the mall Saturday instead. Still busy and full of angry, holiday shoppers, I browsed around in search of deals and enjoyed the ever-so entertaining dynamics of family-oriented holiday shopping. And to no surprise to me, I witnessed a situation I will call "Operation: demand and stomp".

A young girl, I would say roughly fifteen or sixteen of age, was shopping with who appeared to be her mother. The duo was in a nice department-store looking at high-end, designer purses. The girl found a nifty-looking purse, if I do say-so myself, and handed it to her mother while asking if she could have it. As I was also in the purse section, I could see that it was a Coach purse. It was rather large in size and had a security tag on it to prevent theft because of its dollar value.

After examining the purse, price more specifically, the mother told the daughter to pick out something not as expensive. Here is when the story gets more exciting. The girl said something to the effect of, "I want this! Ashley has this purse! I want one too!" And, to my bewilderment, stomped her foot. Now, before I go any further, let me say this. I see young children stomp their feet in anger frequently. Children are unaware of many realities of life such as budgeting, finance, responsibilities, and the ever famous answer, "no". This teenage girl's behavior closely resembled that of many toddlers I encounter. After a back and fourth argument between mother and daughter, the mother finally gave in and told her daughter that she could have the purse.

This type of situation is quite common with young people today and I see it with strangers as well as people close to me. Looking back at my childhood, I remember asking for items and being told "no". Sometimes I fought back, of course, but I would still be told that I could not have it. At the time I'm sure my little heart was angry and my blood was boiling. However, hindsight places a quiet smile upon my face - I'm thankful for the many "no"s I have received in my life. Because when that "yes" does by chance present itself, you are that much more appreciative.

Top Causes of Debt

Oftentimes it is difficult to face debt, to realize just how far under you are and taking the steps needed to address it. When you're thousands, even hundreds of thousands of dollars in debt, it is no longer a game, no longer a pointing-fingers situation.

Below is a list of the top 10 most common causes of debt:

1. Low Income: This should be no surprise. If you do not make much money, it is nearly impossible to accumulate savings and extraordinarily as easy to amass debt.

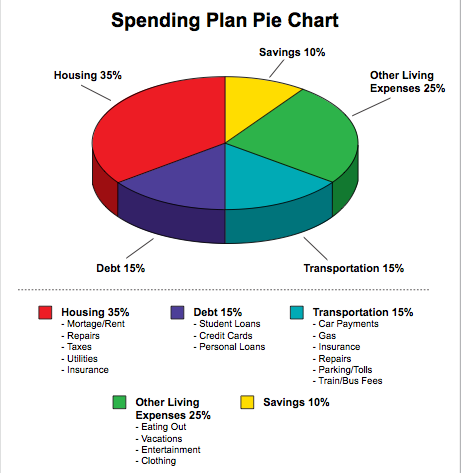

2. Bad Budgeting: Money management is typically an elective course in high school, where students only decide to take it if they are going into business in college. Courses dealing with money and resource management should be included into all curriculum the same as the common core classes, such as math and science. Budgeting is knowing exactly how much money you net, the amount of bills you owe, and how to allocate your funds appropriately and punctually.

- Buy a cheap notebook and log your income

- Itemize your bills with their due dates

- Organize when and how much you can pay towards your bills - tackle the largest debts first to avoid high interest rates

3. Divorce

4. Depending on Credit Cards: Simply, do not pay more than you have. Do not use credit if you do not have a sustainable, reliable way to pay off the debt. And remember that interest can bury you before you realize it.

5. Gambling: Do not get sucked into this track. Be responsible and know when to stop.

6. Illness: If you can pay medical bills in cash, oftentimes you can negotiate a discount. Insurance companies also have an appeals process to cover certain things that were originally the responsibility of the individual. Always ask questions and check your options.

7. Little or No Savings: While having a cushion is everyone's desire, it is not always feasible depending on your income. But every little bit helps. Start a coin jar, and don't take anything out of it!

8. Lack of Financial Communication: Money is an important issue that must be an open topic between parents and children, and spouses. Talking about financial issues and goals can provide a strong network of support. If you're trying to stop relying on a credit card as much, discuss this with your spouse or a family member. Let them inform and encourage you.

9. Spending Future Money: Don't spend money until you have it. Don't count on bonuses or raises, and don't buy large ticket items thinking your upcoming tax return will cover it. It is best to wait to spend money.

10. Not Knowing the Basic of Personal Finances: Study up on the basic of finances if you're not sure how to budget or handle money - this is especially true if you're fresh out of college, and starting your first real job. Don't let that new salary trick you into thinking you're financially indestructible. Budget from the beginning!

Source: http://www.mybanktracker.com/news/2010/07/19/top-10-debt/

But Can We Really Change Our Spending Habits?

Like many facets of our personalities, our willingness to spend money is unique to all of us. We each have different values and while one item may be extremely important to me, another person may have no use for it. Ingrained in each of us is a blueprint, a remarkably exclusive outline of what defines us and what we consider significant. What shapes our values stems from: our childhood, our friends, our significant others, our financial situations, and our culture.

Conversely, our values are what shapes what kind of friends we associate with, who we choose to date, and the type of culture you accept as your own. What is more important to you? A brand new car, or traveling around the world? Would you rather have the latest smart phone or a new mountain bike? How about this one - would you rather hold an inanimate object in your hand for one hour or go white-water rafting for one hour? Specifically, do you value materials or experiences?

Our society, in the US at least, has evolved into a consumerist merry-go-round, where individuals want more, more, more. But when are we going to say enough? When are we going to be satisfied with the size of our televisions? Ever? Really, how large can a television become before we start a new trend by reversing the size until eventually your home television is completely portable that you can, "Take it anywhere! Car, bus, train! No matter where you want to go, your television is going with you!" - This, my friends, is not completely far-fetched. We are a society driven by continuous improvement. Marketing professionals will lead you to believe that your current blender is just not enough, it simply is not the latest and greatest! They will talk you into buying the new, deluxe version that "finely chops your garlic, onion, and tomato at the exact. same. time." So then you buy the new deluxe version and eight months later that same marketer rips on your current food processor and tells you to go buy another one. The cycle will never, ever end.

But what it if did? What if we decided not to go buy that new cell phone? Or we decide that, "You know, my television is just fine. I'm going to take my kids to the park." What if we all slowly started to not buy what they're selling? Our culture, our society is functioning and supporting itself because we consume, throw out, consume, throw out. We are in the middle of a giant, never-ending cycle of buy, buy, buy.

What we can all do is consume what is necessary, recycle, and reuse. Our country needs to economically sustain itself in healthier, more natural ways. Our landfills are overflowing, our air is becoming more polluted each day, and our food is growing out of petri dishes. Our society is afraid to buy used, and afraid to keep what they already have when The Jones went and bought the new version yesterday. Eventually, we are going to completely wipe ourselves out of anything natural and wholesome in exchange for plastic - for manufactured goods. We, as a society, need to come together and create healthier, more sensible ways of preserving our economy.

Are You Frugal?

What is your go-to way save money?

Happy Simple Living

- How to Live Simply

Eliza is all about living a simpler life and being extremely happy in the process. From promoting peace, uncluttered environments, debt-free lifestyles, and giving back, Eliza's blog will help inspire anyone to appreciate simplicity all around us.

How to Live Frugally and Simply to Save Money and the Environment

© 2012 M Carnahan

![These Companies Will Send You Free Stickers [#05] These Companies Will Send You Free Stickers [#05]](https://images.saymedia-content.com/.image/t_share/MTczODA2NTA0NDkzOTgzMzcx/stickers-free.png)