How to Learn About Credit and Credit Scores: A Young Adults Guide to Credit

What is Credit?

The definition of credit that I found online is "your reputation as a borrower". Once you begin building credit, you will have a credit score (for me this started at ,18 when I got my student loans). Your credit score is calculated by different factors, but what has the most impact is if you pay your bills, and whether you pay them on time.

Everything I didn't Know

- Credit determines a lot of important factors in your life.

- There are multiple credit bureaus that report to one major company.

- There are different types of credit scores.

So this might be obvious to some people, but if no one teaches you about this early on in life, you're out of luck. In my case, no one taught me anything about credit. The only thing I was taught is that you need a credit card in order to build it. I began making a ton of mistakes, before I even know I was making them!

What are Credit Bureaus?

Credit bureaus are company's that collect and distribute information on consumers. So any time you apply for credit (financing a new phone, car, house, etc.), make or miss a payment, or anything along the lines of finance, they are keeping track of this information. This information is used to calculate your score, and then used to determine whether you're extended more credit.

The 3 Major Credit Bureau's

Experian

| TransUnion

| Equifax

|

|---|

These are the three major bureaus that report. There smaller ones that report too, but these are generally the ones you will see.

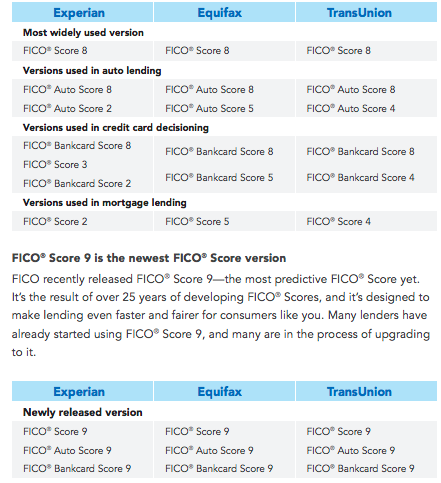

What is FICO?

The 3 major credit bureaus report to a larger company, the most used known as "FICO", which stands for the Fair Isaac Company. This company uses all the data that credit bureaus report, and creates your score based on that information. These scores help lenders determine whether you get approved, and what terms/interest rates to give you. FICO isn't the only company that does this predictive analysis, there is also one called VantageScore. But FICO is used by 90% of the U.S.

FICO Scores

How Your Score is Calculated

How Your Score is Calculated in Detail

Payment History (35%)

| Amount of Debt (30%)

| Length of Credit History (15%)

| New Credit (10%)

| Credit Mix (10%)

|

|---|---|---|---|---|

Whether you've made payments, and if you've made them on time. Payments considered from:

| The amount of credit you're using, and how much you owe.

| How long your accounts have been established.

| The amount of new accounts you've applied for or opened. Opening several accounts in a short amount of time hurts your credit.

| Different types of credit accounts being used or reported.

|

Credit cards, retail accounts, installment accounts, finance company accounts, mortgage loans.

| Total amounts owed on all accounts.

| The age of your oldest account.

| Number of new accounts.

| Different kinds of credit accounts.

|

Details on late or missed payments: how late, how recent, how many, how much owed.

| The number of accounts with a balance.

| The age of specific accounts (credit cards, auto loans, mortgage, etc.)

| How many recent credit requests you've made.

| Credit cards, retail accounts, mortgage, auto loan, etc.

|

Credit utilization ratio (how much of your available credit you're using)

| Whether or not you're "rate shopping". (when applying for loans, if they fall under a certain time period, it counts as one hard inquiry)

| |||

Remaining amount owed on installment accounts.

| ||||

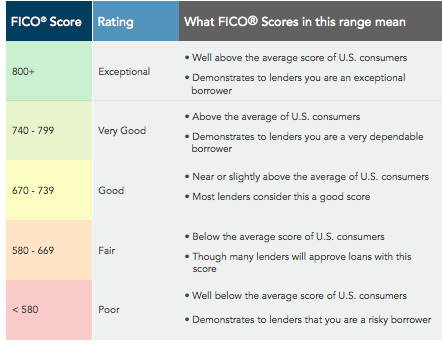

FICO Score Ranges and Rating

Credit Karma and Credit Sesame

Credit Karma and Credit Sesame are the two company's I first used to check my credit score, I also use my Capital One credit card app. When I first started it out with these two accounts, I didn't know anything about FICO scores, the different credit bureaus, or how your score is calculated. I learned all of this by researching on the internet. I read a lot of the conversations threads on both sites. So both of these sites (and other sites) are just estimates of your score. These sites give you a general idea of what range you're in and what you can do to help your score. You have to pay in order to get your actual FICO score, or you can get a free credit report once a year.

My Tips to You

- If and when you decide to open a credit card, do not spend the whole balance. Keep your utilization low.

- Make your payments on time. If you can't contact whoever it is that you owe money to.

- Keep track of your credit score.

- Learn as much as you can about credit.

I highly suggest reading and learning as much as you can before opening accounts. The more you know the more successful you will be before you start building credit. All of the things that I have since learned, I wish I knew before I opened credit cards. Below I will link some very useful sites for you, that will help you learn what you need to know.

Useful Websites

- Annual Credit Report.com - Home Page

- Free Credit Score and Credit Report Analysis | Credit Sesame

Get your free credit score and credit report analysis with no credit card or trial required. Use it to find the best credit cards, mortgage rates and loans. - Log in - Free Credit Score & Free Credit Reports With Monitoring | Credit Karma | Credit Karma

Get your free credit score and credit report without any hidden fees. No credit card is ever required. - Credit Basics Demystifying Credit Scoring & Credit Reports | myFICO

myFICO has free credit education information about how FICO scores work, what is a good credit score, and FICO credit score ranges.