A Different Approach To Becoming and Remaining Debt-Free

Debt Advice Is Everywhere

A quick google search will show you just how much advice there is on getting out of debt and staying out of debt once you're there.

This probably says something about how few American adults can honestly say they don't owe anyone any money. Can you? Can you honestly say you don't owe any person or entity so much as a cent?

Thus, there is all of the advice out there, but most of it focuses on only one thing. 'Spend less'. In fact, if you listen to all the debt advice 'gurus', you shouldn't eat out, shouldn't go to the movies, shouldn't spend on anything but essentials.

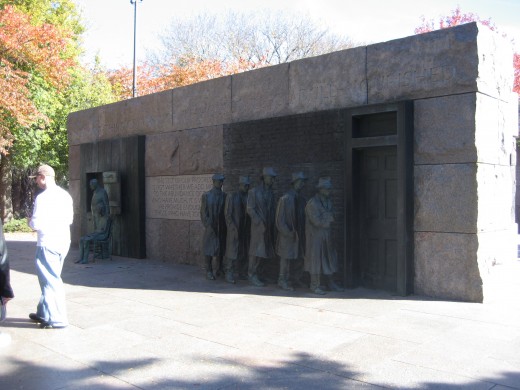

Many people, sadly, are in a situation where they have no choice. Debt burden is heavy in our society.

However, I am going to say right now. I don't owe any person or entity so much as a cent. And I go to the movies, and I went on a $6k vacation last year. I spend over a thousand a year on riding lessons.

The truth is that although spending less is part of being debt-free, it's not the only part.

Change Your Attitude

We're indoctrinated in this society to believe certain forms of debt are okay. The biggest form of debt we are taught is 'okay' is the mortgage.

If you go online and search for sites to tell you how much house you can afford, they'll give you the monthly payment for a house of value X. Or you can plug in, say, your rent and find out how much house you can afford that way.

What no bank is going to tell you is that this is how much house the bank thinks you can afford. Many of our current economic problems are caused by people buying more house than they can afford, generally because they listened to a mortgage salesman.

There is one other thing banks will never tell you. Say the house you are buying costs $100,000. A typical 30 year mortgage will cost you a bit under $800 a month. Not bad, right? But you aren't paying the bank $100,000.

You are paying the bank $220,000. Yup. Over those 30 years, the interest mounts up until it becomes more than the original principle. And in many urban areas, $100,000 won't get you a walk-in closet.

Yet, even most debt advisors will call a mortgage 'good' debt. Why? Because the assumption is that 30 years from now the house will be worth more than that $220,000. Which it might. Unless there's another recession, another burst bubble. This is how people end up owing more than the property is worth - a so-called 'underwater' mortgage.

What are your options? First of all, you can rent. The common wisdom is that renting your primary home is throwing money down the toilet, but if you look at those mortgages...and what real estate prices are doing, it suddenly seems more attractive.

Second of all, you can work towards buying a home cash. It might seem completely impossible (and in areas where single family homes start at half a million it usually is), but I know people who have done it. If your work is geographically independent and you don't mind moving, you can find places where properties can be had cheaply. This is especially true if you're good at DIY and can take on a house that has been neglected and put it back together over time.

Manage Your Credit Cards

The biggest category of debt is 'consumer debt'. That, for most people, means credit cards.

Managing credit cards means taking a long hard look at yourself. Some people can carry credit cards and still only spend what they need. I carry them because I have had my pocket picked before and prefer not to lug around too much cash. But I pay off the balance every month, without fail.

On the other hand, I know somebody who, no matter what she tells herself or others tell her is simply incapable of grasping that her credit limit is not money she has. Guess what...she's always in debt.

If you fall into group two, then seriously consider cutting up your credit cards and using a debit card instead. Or put the credit card away and bring it out only for occasions when vendors expect credit cards, such as buying airline tickets or renting a car. Keep it in a drawer where you can't easily access it. If you are going somewhere you know you will be tempted to spend a lot of money, consider withdrawing a budget in cash and not taking your cards.

Most debt advisors will tell you to immediately cancel and cut up all credit cards, because they are evil. However, what a credit card really is is a tool for paying for things. It's a potentially dangerous tool, because it does have a sharp edge you can cut yourself on, but if you think of it as 'a way not to carry cash' rather than 'a way to have more money', then it becomes just a tool. For that matter, without a credit card you may not be able to rent a car, buy airline tickets or book a hotel reservation. In this day and age one is almost an essential tool.

Consider Yourself A Business

Businesses have to make a profit in order to survive. When running a business, you need to make sure that the money that comes in exceeds the money that goes out. On top of that, you also need to consider cash flow.

A cash flow problem is when the bill arrives before the money to pay it. If you've ever felt you have 'too much month left when your money runs out'...you have cash flow problems.

There are a lot of companies right now touting virtual wallets designed and intended to help households avoid cash flow problems. I haven't tried any of these, but they may well work well for some people.

One of the simplest ways to 'act like a business' is to fill out a profit/loss statement. That sounds intimidating, but it's really not.

Grab your spreadsheet of choice and last month's bank statement and credit card statement.

In column one, put all of your regular income. Don't include birthday gifts, hobby income or the like. Just what you can count on getting in for that month.

In column two, list all of your essential, routine expenses. Include your rent, commuter costs and food costs. Don't include clothing (it's essential, but not routine), eating out, alcohol, etc.

If your regular income is not automatically taxed, take a third off of it. (Yes, that's an ow. For those who don't know, self-employed people have to pay their own payroll taxes as well, including the employer portion).

Sum the two columns, then subtract column two from column one. You should have a positive number - if you don't, then it's time to shop your resume. That positive number is your profit. Otherwise known as your disposable income.

Out of that money you have to pay for everything not routine and essential. This is where the average debt advisor would cut in with 'if it's not routine and essential, you shouldn't be getting it'.

I call that bull. It's like sticking to a strict diet with absolutely no sugary foods. Sooner or later you will break down, binge and spend more calories (money) than you've saved. Instead, it's time to work out that healthy diet. Bear in mind. There is no good debt. Don't let anyone tell you otherwise (student loans might be an exception, but only because almost nobody can actually go to school without taking one out these days).

Prioritize Your Profit

So, now you know exactly how much profit you're making a month. It's time to work out how to spend it. I'm going to give priorities that, again, are different from the debt advice you read elsewhere...well, similar, but different.

1. A me thing. Before you spend anything else, buy ONE me thing a month. Go out to your favorite restaurant. Take in a movie. Buy a new book or a video game. Uh, isn't that backwards? Not at all. By promising yourself that one little luxury, you make sticking to a money diet easier, just like saying 'I can have one can of soda a week' makes it easier to stick to a weight loss diet.

2. Non-routine essentials. If you need clothes, that's the next thing. If your kids need clothes, that's even more the next thing. If you need a computer because you're working from home, that's a non-routine essential. Car maintenance also falls into this category because you don't have to do it every single month.

Now, take what's left and split it four ways equally:

1. Spending down existing debt. (If you have any. If not, that's one less way to split your money). Always buy down credit card debt first as it has the least favorable terms. Then student loans. Then other consumer loans (car, major appliance, etc). Finally, start working on that mortgage.

2. Saving for future needs. If you have kids, this means college. If you don't, it means retirement. Make a special savings account for this money and put it in there. Then don't touch it.

3. The emergency fund. This goes into a second savings account, but one you can access instantly. Remember those non-routine expenses? Go to the emergency fund first and only pay out of your paycheck if its exhausted. After a while, that new computer? You don't even notice it. New tires? No trouble.

4. The fun fund. This is the third savings account. This is for things you want, but can't afford. It's for that $10k vacation. For the new computer just to play video games on. For that thing you always wanted to do.

Don't stint the fun fund. It's tempting...especially if your profit is only, say, $50 a month (meaning some months you may be putting less than a buck into each account)...to go 'well, the adult thing to do is...' Don't do it. That way lies guilt, stress, and depression. Living debt free does not mean giving up on everything.

I'll be honest and say I'm no good at doing this. I tend just to toss everything into the one account and hope. (Yeah. Do as I say, not as I do). But it's something I'm thinking about as a definite, distinct possibility for the future. The important thing, though, is to save, but not to tighten your belt so much you never have any fun. Even if your me thing is only a $2 latte...always get your me thing.