E-file Your Federal Income Tax Return for Free This Year

Tax season can almost seem like a second Christmas for many people, or at least a way to pay what they still owe on last Christmas. If you are like the majority of American taxpayers, you probably paid too much in taxes last year and are entitled to receive a refund from the IRS. If you are like me, you don’t have the patience to wait for the IRS to mail out a check. You want it now! Who could blame you? The way the government is spending money lately, they may not want to mail it any time soon. E-filing and electronic refund has become the most popular way to file taxes, but how much does it cost? Let’s look at a few income tax e-file programs that are completely free.

Free File

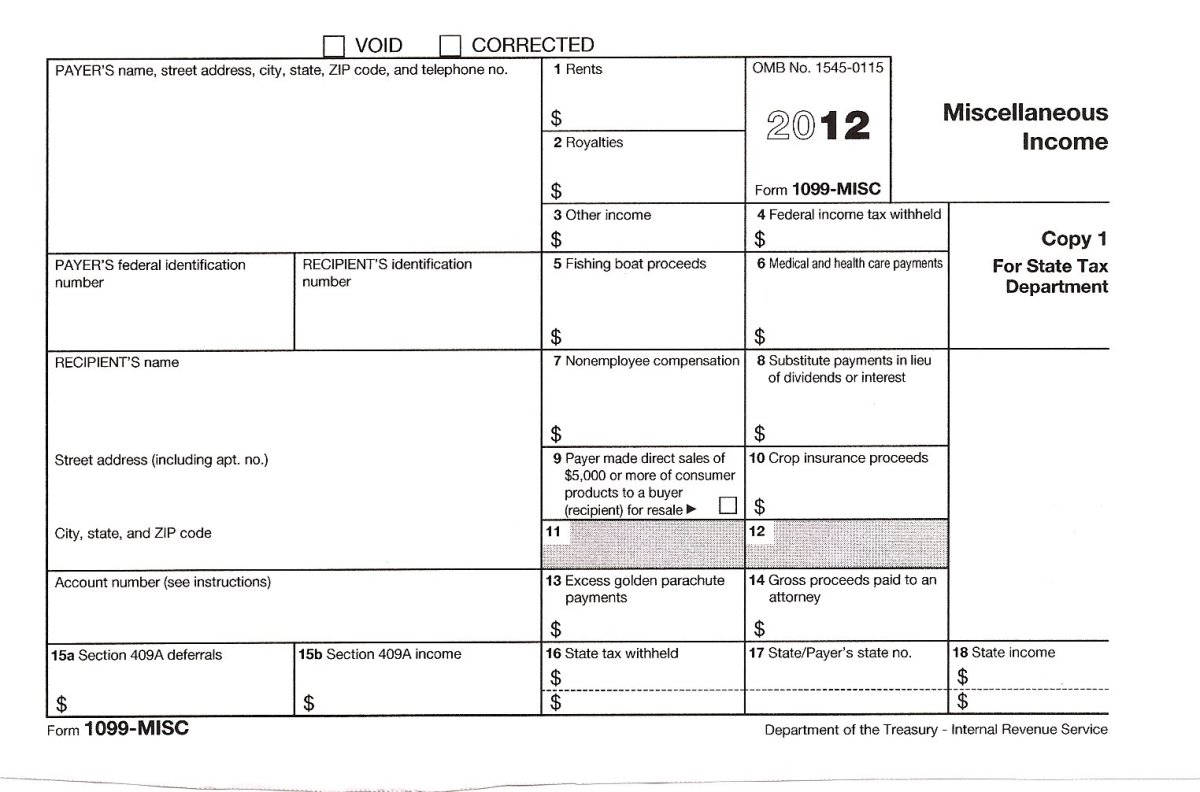

Free File is a free income tax filing solution directly from the IRS. Several commercial tax software companies have partnered with the IRS to offer their tax preparation software through what is known as the Free File Alliance. The only way to access these free programs is by going to IRS.gov.

The current eligibility requirement for using Free File is having an adjusted gross income of $58,000 or less. In addition, each partnering company has their own requirements for eligibility, so a user may only qualify to use certain companies. Each Free File company is also required to provide customer support to the taxpayer through their company website.

With Free File, electronic refunds are generally processed in about three weeks. There is also an online tool to check the status of refunds. It’s easy to get started. Just go to IRS.gov, choose a company from the list of providers and start filling out your tax information.

FreeTaxUSA

FreeTaxUSA is a web-based application for doing federal and state income taxes. A taxpayer can file a federal return for free, or get a few extra features for a small fee. As a web application, it is convenient to use because you can access your account from any computer without the hassle of having to download and install anything. FreeTaxUSA also offers free customer support for their clients.

If you want to get a jump on your taxes, but think you may have to do an amended return, you may want to opt for their Deluxe Edition tax preparation package which is $5.95. Then you will be able to do unlimited amendments. Otherwise, the free edition should be fine for most filers.

FreeTaxUSA claims that most customers can see returns within 8 days after filing for an electronic return and within three weeks for a mailed check from the IRS. Taxpayers can also login to their TaxFreeUSA account to get the status of their income tax return. To get started, visit TaxFreeUSA.com and register an account.

TaxACT

TaxACT is one of the oldest income tax e-file providers in the country. They have been around since 1998 and have helped pioneer the e-filing experience. TaxACT boasts the most complete free income tax filing solution in America. Taxpayers have the option of completing their income tax return through a web-based interface, or by downloading or ordering the TaxACT software and installing on their computer and filing from home.

Filers are limited to one free e-file and additional federal returns are $7.95 each. TaxACT also offers some very comprehensive customer support and is committed to filing income taxes for their clients as fast as possible. As with the previously mentioned company, they claim that most returns can be received within 8 days of filing.

TaxACT has an Answer Center for personalized guidance, streamlined navigation and more tools aimed at saving the taxpayer time when preparing their taxes. Getting started is a s easy as going to TaxACT.com, opening an account and filling out the appropriate information online.

Turbo Tax

Turbo Tax offers free federal income tax filing for returns that are not complex, and can be completed by the average user without any problem. If you are looking to itemize deductions, or have some interesting tax calculations, then the Turbo Tax Free Edition may not be for you. The Free Edition also does not cover tax schedules C, D, E, and F which may be required for those who have investment interests.

Turbo Tax claims that most clients receiving a refund will see their return within 8 days if they choose direct deposit. They even offer an option to have your refund deposited to a reloadable Visa prepaid debit card that can be used wherever Visa is accepted.

Technical support is provided via live chat or by other users within the Turbo Tax community available through their website. If you are unsure if your tax situation is right for the Free Edition, you can still begin a return and the program will alert you if an upgrade would be required to complete the return. To get started with Turbo Tax visit turbotax.intuit.com, then select the Free Edition.

Links for Free E-Filing

- Free File | Free Tax Preparation from the IRS

Let Free File do the hard work for you with brand-name software or online Fillable Forms. You can prepare and e-file your federal return for free. Participating software companies make their products available through the IRS. - FreeTaxUSA FREE Tax Filing, Online Return Preparation, E-file Income Taxes

100% Free Tax Filing. Efile your tax return directly to the IRS. Prepare federal and state income taxes online. Yearly tax preparation software. - TaxACT | Free Tax Preparation Software, File Taxes Online, Free E-filing

TaxACT prepares, prints and e-files your income taxes for FREE. Free Federal Edition handles simple & complex returns, includes free-efiling. - TurboTax Tax Preparation Software, FREE Tax Filing, Efile Taxes, Income Tax Returns

TurboTax is the #1-rated, best-selling tax software. Free Edition includes free IRS efile. Easily prepare your tax return and file income taxes online. Choose Easy.