Cutting Costs: Fixed Expenses and Spending

In order to reach your financial goals, you need a budget. A budget is a written guide of your fixed expenses and your planned spending. A budget also incorporates planned savings and debt reduction. In order to create a budget, you need to know what your fixed expenses are and where you spend.

Types of Budgets

There are two basic types of budgets, and the one that will better suit you will depend on how often you get paid, how steady your income is and how consistent your expenses are. The most common type of budget is a monthly budget. It works well for anyone who has regular income and expenses. The second type of budget is an annual budget. It is better suited for those who work on commissions, own construction companies, are farmers, ranchers or the self employed. The basics for creating either type are similar.

Fixed Expenses and Spending

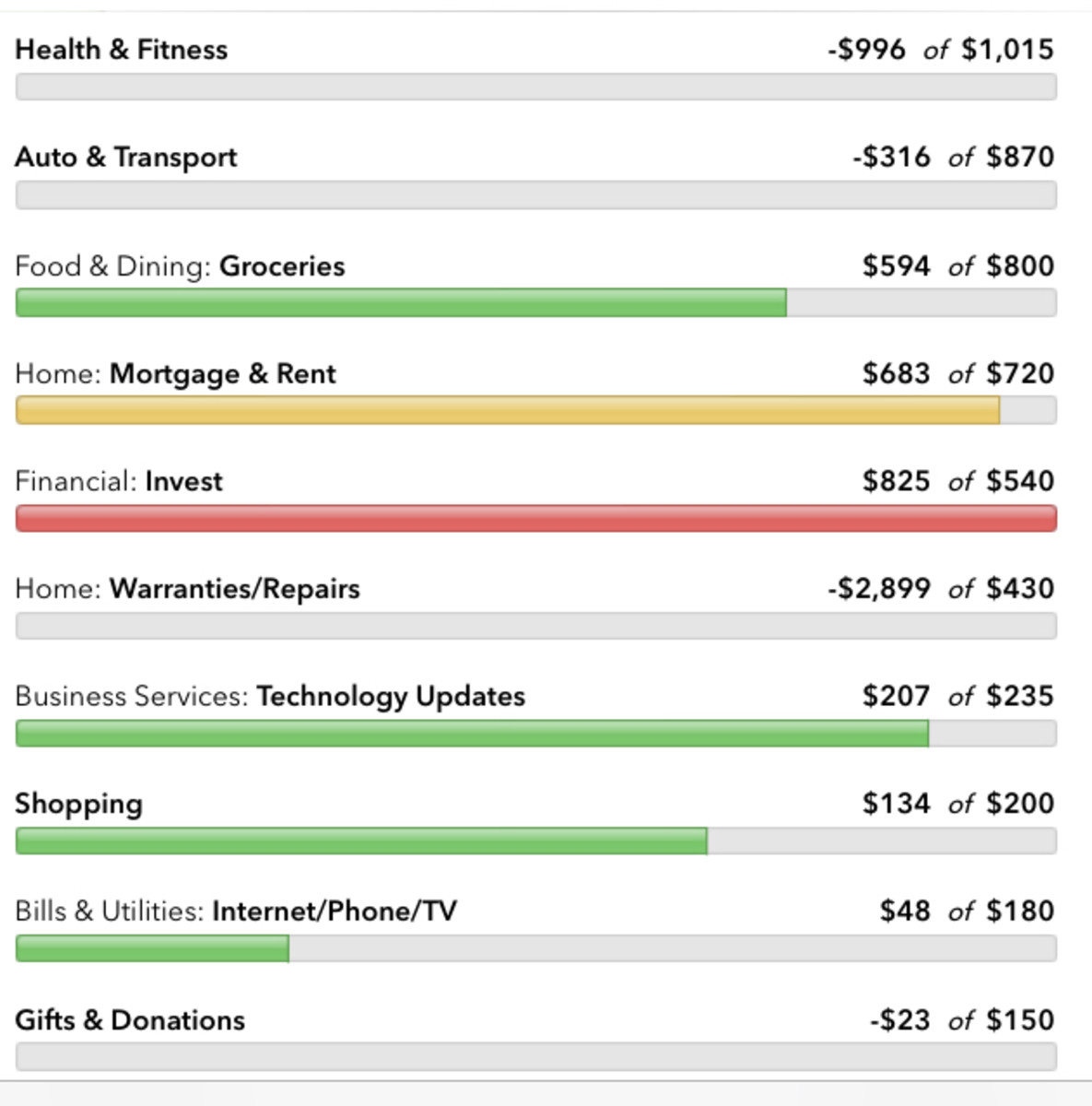

First, calculate your total fixed expenses. These are all the expenses that remain the same from month to month and over which you have very little control. The rent or mortgage, the auto loan, student loans, some utilities, insurance, taxes, work related travel expenses are all fixed expenses. Include bills that need to be paid monthly, quarterly, and annually.

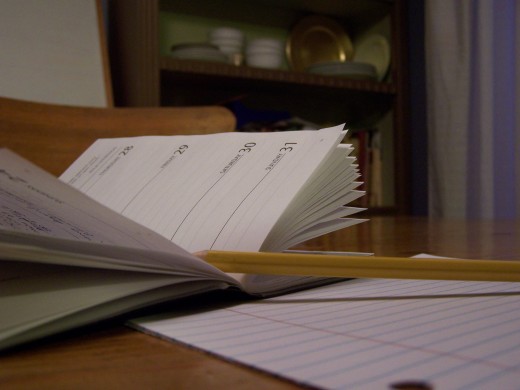

Next, calculate your spending. Spending is any expenses that do not fall into the fixed expenses category. To do this accurately, look back over your past checking, debit and credit card statements, to see what you are spending on, or carry a notebook with you for the period of a month, and record all expenses. Record the trips to the vending machine and the grocery store, the stops for coffee and the morning paper. Estimate how much you spend on clothing and lawn care each year. Finding every single expense is important to making wise decisions.

While you are making your budget, look ahead at the expenses coming up that you don’t always have, such as replacing the tires on your vehicle. This expense can be added into an annual budget, or divided by the number of months until you will need it, to begin saving for the item in a monthly budget.

Once you know how much you spend, compare it to your income. Are you spending more than you make, or less? Do you have as much disposable income as you thought you did?

When using an annual budget, it can be difficult not to spend the money not in use. To solve this problem, Howard Dayton, of Crown Financial Ministries, suggests putting all of your income into a savings account, and having the portion you need transferred each month into your checking account. This method is also good for building up your savings, when using a monthly budget.

(c) Copyright text and photo Christa Dovel 2010