Foreclosure Timeline-Chase and other major banks-how long does it take to foreclose?

How long until I am foreclosed on? What is the foreclosure timeline?

Foreclosure timeline is based on two different types of documents and processes. One is called the "deed of trust" the other is called a "mortgage". It is confusing because most people refer to their home loan as a "mortgage". You will hear the term "mortgage payment".This refers to your loan payment.

Know if you actually have a "mortgage" or a "deed of trust". The easiest way to do this is to look at your original loan documents to see if you have something in there with either of these terms. As a side note- you will have a "grant deed"- this is not a deed of trust. A grant deed is the document that transfers title to you and is recorded with the county (usually).**

Foreclosure Timeline for a Deed of Trust

The exact timeline for foreclosure depends on the lender. It also will depend on the state the home is located in. The following information should be considered as the general timeline that all foreclosures will follow. Regulations can vary by state.

Also- due to the nature of the current housing market not all Lenders will follow the foreclosure timeline to the letter. Some lenders are more aggressive than others when initiating a foreclosure, and some are less. Much of it depends on many factors including-- how impacted your local area is, and how many foreclosures your Lender has on the books. There isn't a one-size-fits-all timeline.

Trustee Sale- if you have a Deed of Trust--

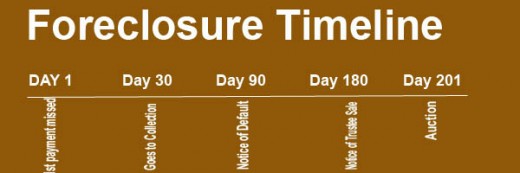

- Day 1 It's the first of the month and your payment is due. You miss your payment.

Notice of Default is filed with the county recorder. A notice of default is also known as an NOD. - Day 16-30 you have a late charge added to how much you owe. This is when the company that services your loan will try to contact you for payment. This will be the collections department.

- Day 45-60 Your "Servicer" will send out a "demand" or a "breach" of contract letter to you. At this point you may be given 30 days to pay what you owe, including the late charge.

- Day 90 NOD or "Notice of Default" is recorded in the county where the property is. It is also published in a local paper under "notices". This becomes public information and you may start getting contacted by all kinds of real estate agents, people who want to "buy" your house, people who can "help" for a fee. IGNORE them. Most of these "do gooders" are predators trying to capitalize on your situation. Many have gone to foreclosure seminars to learn how to take advantage of you. If the time comes for you to sell your house, YOU seek out an agent who is knowledgeable in the process (not your aunt Millie who just got her real estate license).

- You are now in the reinstatement period

- Day 180 NOS or "notice of Trustee sale". If you have not been able to make your payments and get caught up, The Lender will instruct the "Servicer" to record the NOS.

- Day 196 5 business days before the sale date- right to reinstate expires.

- Day 201 After 21 days have passed from the recording of the NOS a foreclosure sale can take place in a public auction on the county courthouse steps. Two things may happen at this point. Either a third party bidder will buy your property, or the Lender will take it back and hold it for sale- this is referred to an REO or Bank Owned Property.

How long in the foreclosure timeline until my house is sold at auction?

If you found this article interesting, you may like-

Lien strip in bankruptcy chapter 13 solutions- a true story how one couple saved their house, and erased $200k debt"What Ifs"

Remember- this is the way that the Lender can foreclose on your house. With the current status of things- this could change, as new laws are put into place perhaps to slow things down (this keeps the market from being flooded with foreclosed properties) When the market is saturated with homes for sale--further devaluing takes place in surrounding homes in the area. The main thing to know is "the what if" possibilities.Here are a few:

- What if my Lender is really aggressive- how long until I am out on the street?

- What if I call my Lender and try to work something out as soon as I am in trouble?

- What if I don't care and just want to walk away?

What are some other what ifs you can share with us?

Did you find this article helpful? If so please give it a thumbs below- with our thanks!

Do you have other questions? Ask them here. Either about the Foreclosure Timeline or any other Foreclosure problems OK? Remember-Tomorrow is a new day full of new possibilities!

**All information here is considered general guidelines only. It is not tax or legal advice. You need to see the proper authority for advice.

Foreclosure Help and Foreclosure Timeline will be updtaed as new information becomes available.