How to Become a Good Investor?

Introduction

If you ask me personally how can we earn more money and become wealthy in this life? And what are the ways through which we can achieve this? Then my simple answer would be to “start investing” your money to grow your money.

If you check in a deeper level we are investing something to gain something in life. For example, in a job, you invest your time and effort to earn money. In the same way, investors, invest money and earn more returns. Therefore, if you want to become rich and wealthy in life then start investing money.

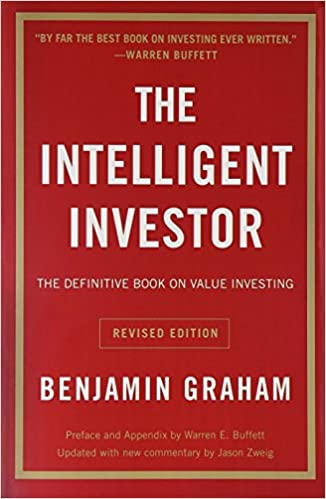

In this article, we are going to learn some lessons about investing mentioned in a book called “The Intelligent Investor” which is authored by Mr Benjamin Graham. By the way, the world’s best investor Mr Warren Buffett consider this book as the world’s best book on investment. So, let’s get started.

Aggressive Vs Defensive Investors

In the stock market industry, there are probably three kinds of investors. But to understand our first point we will talk about two basic types of investors. They are known as aggressive and defensive investors.

Aggressive investors are those investors who like to invest money on those stock, bonds etc from where he can expect high returns within a short time. Whereas defensive investors are those investors who like to invest in less risky stock and may even get medium returns instead of high returns.

Well, any layman will say it’s better to become an aggressive investor. The truth is although it looks more promising then defensive investors, in the long run, becoming a defensive investor is the best option. This is one important lesson which you can learn from this book. Remember in the stock market rule is high risk can also mean either high rewards or a high loss. Defensive investors are also known as passive investors.

Understand The Stock Market Concept

The stock market is a wonderful concept where you can start your business even by investing Rs. 500/-. Now let’s understand the stock market differently. Suppose you are the owner of one business and you have a friend called Mr Market. Your friend is very emotionally by nature. He can purchase your business or even like to sale his business.

But because he is emotional by nature, offers are based on his emotions. For example, when he is happy, he is ready to purchase your business by paying you more money. But when he is not happy he doesn’t want to give you even half of your price.

The stock market is also like this. Any business and deals on the stock market depend upon the mood of the market. But the good part is they never force you to sale or purchase any business. It entirely depends upon you and your requirement. So, always sale stock when you are getting more then what you have invested and vice-versa.

Divide Your Investment Portfolio In 50:50 Ratio

As per this concept, you shouldn’t invest everything you have in your pocket. For example, suppose you have $10,000/- then invest only $5000/- in stock and keep rest in cash. Never invest everything you have. In this way, you will have some amount of hard cash in hand. And when you earn some profit, withdraw your profit and reinvest the remaining one and continue this process.

Diversification And Large Companies

As per this rule, never invest all your money in a single company. You should diversify your investment plus don’t invest in a single type of business. Apart from this, you must mostly invest in large companies and never invest in many unknown companies.

Well, the second part is advised because the most investments are done after study and research but since most people don’t have that much time, therefore, it is advised to invest in the large well-established companies because we all know about them. So, will you like to invest in Apple’s shares or some holo company?

If you are interested to purchase this book, kindly click here and thanks in advance for purchasing the book. Get this book.

Conservatively Financed And Dividend History

These points tell us to invest in those companies which are financially strong and they have more number of assets than liabilities. They are making a good income year on year basis and have less debt. You need to check the dividend history of the company. They must be paying the divided from last 10 to 15 years. During your research, if you can find such companies then definitely you should invest in those.

Conclusion

These are some of the basic tips shared by Mr Benjamin Graham in his book. But if you want to understand more about investment then I will highly recommend you to read this book. This book contains many more amazing points about investment.

Start investing if possible get some online course on the stock market, self-study and then get a mentor who can guide you in the right direction. Without a mentor, it would be very difficult to understand the stock market.

This content is accurate and true to the best of the author’s knowledge and is not meant to substitute for formal and individualized advice from a qualified professional.

© 2020 Vikram Brahma