How to Build Financial Discipline When Living Paycheck to Paycheck

Paycheck to paycheck existence is more common than many realize. A LendingClub report found that 52–64% of Americans are in this cycle, struggling to make ends meet between paychecks. To the north, the problem is even more pronounced, with 85% of Canadians reporting the same financial squeeze. And it’s not just North America—31% of workers in China also face this challenge. Clearly, managing money on a tight budget is a reality for millions worldwide

Living paycheck to paycheck is exhausting. The money comes in, bills go out, and by the time the month ends, there’s barely anything left to show for it. Many people think the solution is simply earning more. But in reality, the foundation of financial freedom is discipline. Even with a limited income, small changes in habits can create stability and open the door to long-term security.

Here’s how to start building financial discipline, even when money feels tight.

1. Know Where Every Dollar Goes

You can’t control what you don’t measure. For one month, write down every expense—whether it’s rent, a snack, or a streaming subscription. You’ll likely be surprised by how much slips away on small, forgettable purchases. Awareness is the first step toward discipline.

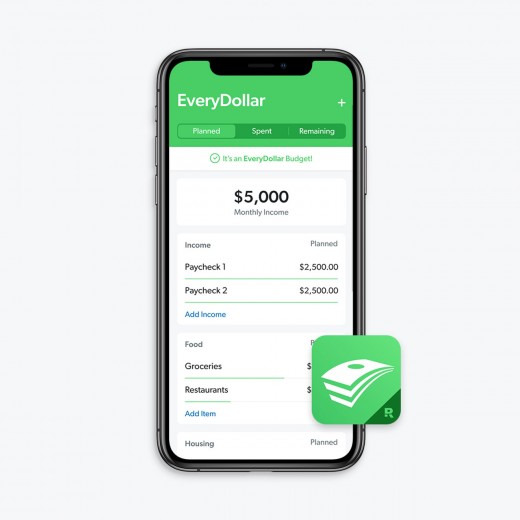

Tip: Use free budgeting apps or even a notebook to track expenses daily.

Start with a spending log. For 30 days, record every single purchase. You can use a notebook, a spreadsheet, or a free budgeting app like Mint or YNAB. The method doesn’t matter, what matters is consistency.

The expenses should be placed in categories for optimal tracking. For instance, essentials such as rent, groceries and gas. Non-essentials could be takeout, entertainment and designer items.

This process will likely reveal spending habits you didn’t realize you had. Maybe your $6 daily coffee habit costs you $180 a month. Or you’re paying for three streaming services you barely use.

Once you know where your money is going, you can start to redirect it with intention. Trim small leaks, cancel unused subscriptions, and look for swaps that don’t feel like sacrifice.

2. Separate Needs From Wants

When money is limited, prioritize essentials first: rent, utilities, food, and transport. Wants—like eating out, new clothes, or gadgets—should only come after the basics are covered. A helpful rule: If you wouldn’t be willing to borrow money for it, maybe it isn’t a priority right now.

It can get tough to keep from splurging and a lot of it comes down to age, income and assets that have been built up. If you are 25, you have a long way to go in life. So you’ll want to focus on the needs and help fund a retirement and home purchase plan. At the same time, a 45 year old may have gotten a lot more out of life by way of experiences and he can afford to do some indulgence. Again, it would vary on a case by case basis. Human beings are different in their tastes and quirks, but its always good to identify your needs. These needs are typically universal in nature.

3. Create a Bare-Bones Budget

Budgeting doesn’t have to be complicated. Try a simple breakdown:

- 70% for needs (housing, food, transport)

- 20% for debt repayment/savings

- 10% for wants

If your income is very tight, adjust the numbers. But always give at least a small percentage to savings or debt reduction. That habit is key to breaking the cycle.

4. Build Micro-Savings Habits

By focusing on small, consistent actions, individuals can steadily accumulate savings over time, creating a strong financial cushion. The key is to set clear, achievable goals, whether it is saving for an emergency fund, a vacation, or future investments, and break these targets into manageable daily or weekly savings. Starting with tiny amounts such as one or five dollars can make the process less intimidating and easier to stick to. Automating transfers from your checking account to a dedicated savings account removes the temptation to skip deposits and helps establish a routine.

Tracking expenses with budgeting tools can reveal areas where unnecessary spending occurs, allowing you to cut back and redirect those funds into savings. Many apps now offer micro savings features, such as rounding up purchases to the nearest dollar and saving the change, which makes saving effortless. Over time, as your income increases or expenses decrease, gradually raising your savings amounts can further accelerate your progress. Staying disciplined and committed to the habit despite small amounts leads to significant wealth accumulation in the long run. Regularly reviewing your goals ensures your savings plan remains realistic and motivating. Ultimately, cultivating micro savings habits requires consistency and patience, but the positive impact on your financial future can be profound and lasting.

5. Tackle Debt With Discipline

High interest drains your paycheck and ignoring it won’t make it vanish (unless your banker suddenly moonlights as a magician—highly unlikely). Think of debt as an overeager puppy: if you don’t train it, it’ll chew through your peace of mind and wallet. Two tried-and-true tricks are the debt snowball (knock out the smallest debts first for quick wins) and the debt avalanche (target high-interest debts to save more money long term). Either way, pair it with a budget, skip the “just this once” splurges, and watch balances shrink. Freedom beats instant noodles at month’s end—every single time.

6. Practice Delayed Gratification

Impulse spending is the enemy of financial discipline. A simple trick: wait 24 hours before buying anything non-essential. Often, the urge will pass and your wallet will thank you.

This is very important since a small unplanned purchase has often snowballed into debt, regret and clutter. The thrill is temporary, but the ensuing ordeal can be hard to deal with. Mental peace should be valued and discipline is the key. That way, stress can be avoided and long-term financial security and freedom can be secured.

7. Look for Ways to Increase Income

Cutting costs has limits, but earning more has no ceiling. Consider part-time gigs, freelancing, or selling unused items. Even an extra $50–100 a month can accelerate debt repayment and savings.

When working a full-time job, a salary negotiation is important. The approach should be calm, respectful and strategic. There should be some time spent on research on industry pay ranges. This may involve informational interviews to gather requisite information. Then request a meeting rather than be demanding in which the value additions brought to the table can be highlighted through relevant examples.

The focus in a salary negotiation should be on collaboration and minimal confrontation. The position should be to assess how contributions have helped the company greatly rather than coming from just a personal need.

8. Shift Your Mindset

Discipline isn’t about deprivation, it’s about freedom. Every time you resist an impulse purchase or put money toward savings, you’re buying yourself peace of mind. Living paycheck to paycheck doesn’t have to be forever. With consistency, the cycle can be broken.

In the wild, animals must face challenges to survive. Humans need the same, psychologically. Avoiding challenges makes the brain hypersensitive. The recommended course of action is to take controlled risks by trying tasks that are slightly uncomfortable, step by step.

9. Build an Emergency Fund (Even a Tiny One)

Living paycheck to paycheck means one unexpected expense can throw your entire financial plan into chaos. A medical bill, car repair, or appliance breakdown often forces people to rely on credit cards or loans, creating more stress down the road. The solution is to build an emergency fund—even if it feels impossible at first. Start small: set aside just $5 or $10 a week, or commit the spare change from everyday purchases. Once you’ve saved $100–$500, you’ll already have a buffer against life’s surprises. Keep this money in a separate, easily accessible account so you’re not tempted to dip into it for non-emergencies. As your financial discipline grows, aim to expand the fund to cover three to six months of essential expenses. An emergency fund is like self-insurance—it buys you peace of mind, reduces stress, and keeps small setbacks from becoming financial disasters.

10. Surround Yourself With the Right Influences

Financial discipline doesn’t happen in a vacuum—it’s shaped by the people and environment around you. If your circle of friends constantly encourages overspending, it becomes harder to say no to nights out, impulse buys, or “keeping up” with their lifestyle. On the flip side, being around people who value savings, frugality, and smart money choices makes discipline feel natural. Start by curating your influences: follow personal finance blogs, podcasts, or YouTube channels that keep you motivated. Join online communities where members share budgeting wins and challenges—it helps to see that others are on the same journey. If possible, find an accountability partner, someone you can check in with monthly to review goals and progress. Even small conversations can strengthen resolve. Remember, discipline thrives in the right environment. By surrounding yourself with positive influences, you’ll stay focused, motivated, and more likely to achieve long-term financial stability.

Final Thoughts

Financial discipline isn’t built overnight. It’s the result of small, consistent choices—tracking spending, prioritizing needs, saving little by little, and resisting unnecessary purchases. Even if you’re living paycheck to paycheck today, discipline can create breathing room tomorrow.

Remember: discipline today is the seed of financial freedom tomorrow.