How to Live Well on Less Than You Think

Living Well on Less

In a world where consumerism screams from every ad and social media feed, it's easy to fall into the trap of thinking happiness requires a fat wallet.

As of 2025, with inflation lingering and economic uncertainties on the rise, more adults are discovering the art of thriving on less.

Here are 9 ideas to help you live your best life on less money than you think.

Idea 1: Track Every Penny – Knowledge is Power

The foundation of living well on less starts with awareness. Many people underestimate how much they spend on autopilot—those daily lattes or impulse buys add up fast, not to mention eating out routinely in order to keep up with a fast-paced modern lifestyle.

Once tracked, create a simple budget: allocate 50% to needs, 30% to wants, and 20% to savings. This isn't restriction; it's empowerment. One study from the Financial Health Network shows that trackers save 10-15% more annually. Suddenly, you're not just surviving—you're strategizing like a financial ninja.

Idea 2: Embrace Minimalism – Less Stuff, More Life

Minimalism isn't about living in a bare room; it's about curating what truly adds value. Audit your possessions: if it hasn't sparked joy in a year (thanks, Marie Kondo), sell it on eBay or Facebook Marketplace. The average American household has over 300,000 items—most unused.

By decluttering, you cut storage costs, reduce cleaning time, and free mental space. Redirect that energy to experiences, like a picnic in the park instead of a shopping spree. Research from Joshua Becker's Becoming Minimalist shows minimalists report higher life satisfaction.

Living with less means more room for what matters: relationships, hobbies, and adventures.

Idea 3: Master Home Cooking – Fuel Your Body and Wallet

Eating out is a budget killer—U.S. households spend about $3,000 yearly on it.

Flip the script by cooking at home. Start with meal prepping: batch-cook staples like rice, beans, and veggies on Sundays. Plan your meals and eat leftovers.

A Harvard study links home cooking to better nutrition and lower obesity rates. Bonus: it builds skills and family bonds over shared dinners.

Idea 4: Rethink Transportation – Move Smart, Not Expensive

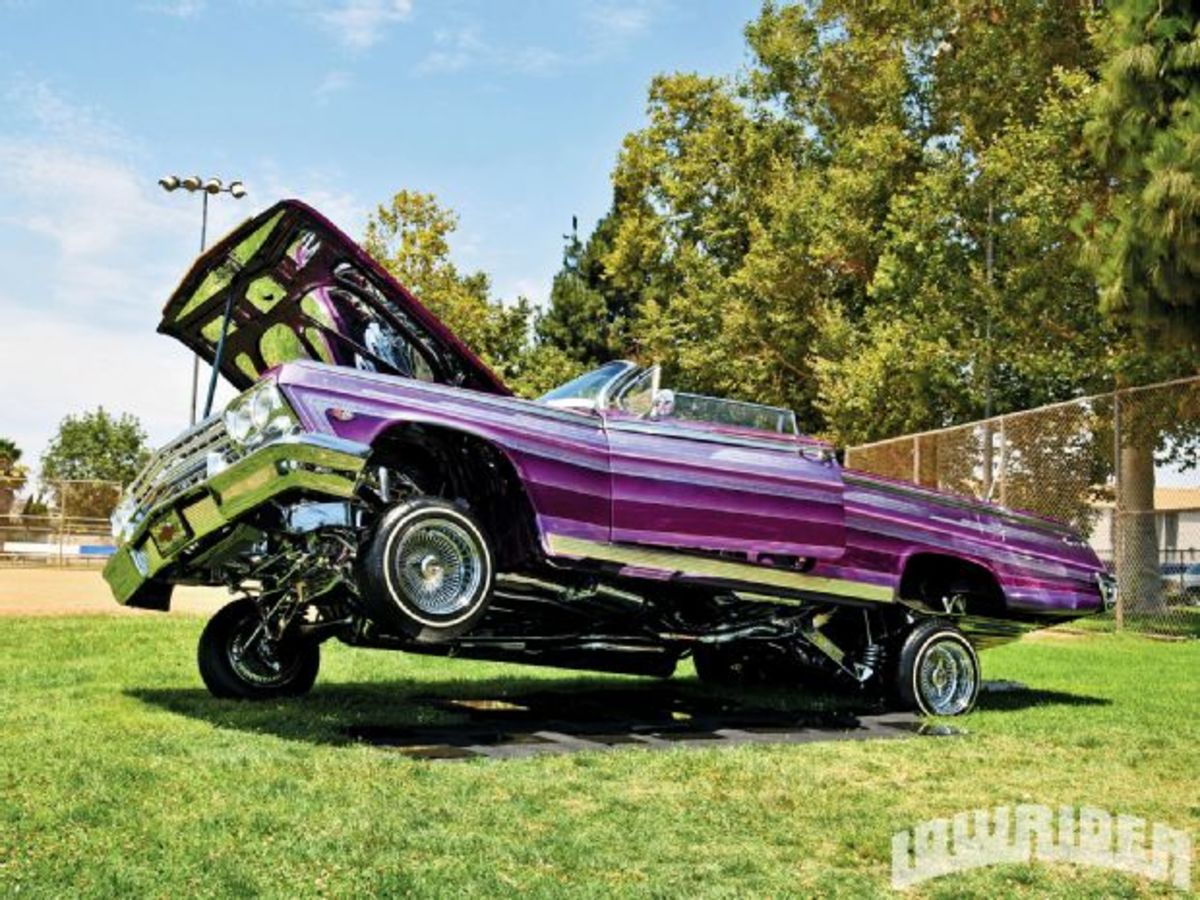

Cars are money pits: gas, insurance, maintenance— it averages $10,000 a year per vehicle.

Opt for alternatives like biking, walking, or public transit. In cities, services like Citi Bike or Uber Pool cut costs dramatically. If you must drive, carpool or use apps like Turo for occasional rentals. Electric bikes are a game-changer, costing pennies to charge and saving on gym fees through built-in exercise. The American Public Transportation Association reports riders save $10,000 annually. This shift not only pads your wallet but boosts health and reduces environmental impact—win-win for living well.

Idea 6: Hunt for Free Entertainment – Joy Without the Price Tag

Entertainment doesn't require pricey tickets or streaming subscriptions. Libraries offer free books, audiobooks, and even events. Apps like Meetup connect you to free local hikes, game nights, or workshops.

Host potlucks instead of restaurant outings—friends bring dishes, you provide the space. Nature is the ultimate freebie: parks, beaches, and trails for zero cost. A Nielsen report shows Americans spend $2,500 yearly on entertainment, much of it unnecessary. By prioritizing free or low-cost options, you cultivate creativity and community, proving fun thrives on ingenuity, not income.

Idea 7: Negotiate and Shop Savvy – Stretch Every Dollar

Bills aren't set in stone—negotiate them. Call your cable provider or insurer; loyalty often earns discounts.

Shop secondhand via thrift stores, Craigslist, or apps like ThredUp for clothes and gadgets at 70% off. Use price-comparison tools like Honey or CamelCamelCamel for deals.

Bulk-buy non-perishables from warehouse clubs, but only what you'll use. A Consumer Reports survey found negotiators save $300+ yearly on services. This proactive approach turns passive spending into a game, where every win builds your financial muscle.

Idea 8: Focus on Preventive Health – Avoid Costly Crises

Health expenses can derail any budget, but prevention is cheap. Prioritize sleep, exercise, and a balanced diet—free or low-cost habits. Walk 10,000 steps daily instead of a gym membership; apps like MyFitnessPal track nutrition gratis.

Regular check-ups catch issues early, saving thousands in treatments. The CDC notes preventive care reduces chronic disease risks by 30%. Mental health matters too: free meditation apps like Insight Timer combat stress without therapy bills. By investing in wellness now, you're not just saving money—you're extending your quality of life.

Idea 9: Build Side Income – Earn More Without Quitting Your Job

Living on less pairs perfectly with earning a bit more on the side. Freelance skills like writing, graphic design, or tutoring via platforms like Upwork or Fiverr.

Rent out a spare room on Airbnb or sell handmade goods on Etsy. Even gig apps like DoorDash offer flexible hours. Aim for $500 extra monthly—it compounds quickly.

A Side Hustle Nation report shows 45% of Americans have one, averaging $1,000/month. This isn't about grinding; it's diversifying income for security and freedom.

In conclusion, living well on less isn't deprivation—it's liberation from the endless chase for more. By tracking spending, embracing minimalism, cooking smart, rethinking transport, DIY-ing, seeking free fun, negotiating deals, prioritizing health, and adding side income, you can craft a fulfilling life on a surprisingly slim budget. These strategies, backed by data and real experiences, prove that abundance comes from mindset, not money. Start small: pick one idea today and build from there. You'll discover not just financial ease, but deeper satisfaction. After all, the richest life is one lived intentionally, not expensively.

More From This Author

- How Couples Can Live on One Salary and Thrive

Whether your family experienced a layoff or is choosing to have a stay-at-home parent, you can learn to thrive as a couple on one income. - Does Microsoft Rewards Actually Give You Money?

Learn how to earn points with Microsoft Rewards and cash out for gift cards. - Does Yupp AI Actually Pay You Money for Questions?

AI companies are rabid for data, and that can be to your benefit.

© 2025 Kat Theisen