How to Lose Money in the Stock Market

Lets make a ton of cash in the stock market

Everybody is making a ton of money in the stock market, youtube geniuses just say you need to like, subscribe and give them money for their trading programs, news letter and services and you will be good to go.

All you have to do is “Buy low and sell high” as the hallowed genius from a past era stated.

What a simple concept.

Who couldn’t do such a thing?

Well most of us actually, it turns out buying low and selling high can be a very difficult thing. You see if making money in the stock market was that easy, everybody would do it. You, your grandma and your paperboy (do those still exist?) would be smoking cuban cigars, lit with $100 bills.

The fact is, in a free market system, such as the stock market “Easy money” rarely exists, and if it does it is quickly gobbled up by the masses.

Remember these things?

Do you remember fidget spinners?

Back in the old days (2017-2018) when we could still wander around shopping malls without worrying about being killed by Corona virus and what not, a popular thing, basically a silly little hand toy came on to the scene, and everybody started to sell them, toy stores, music stores, game stores. Everyone had a fidget spinner, they sold ones that lit up, ones made out of interesting space age material. There were a lot of them.

But then everyone who wanted one, had already got one.

All these merchants still had a bunch of them, fresh from China no doubt and what were they supposed to do with them?

The easy money was gone, and the sales started. $5 for 2, $1 each, free with additional purchase. Everybody wanted to get rid of them then!

There was a crash and everyone tried to get rid of their fidget spinners at once. That was the end of fidget spinners, they now just spin in our memories or sit around in our basements somewhere.

So what does this odd tale have to do with the stock market?

Everything.

What happened with the fidget spinners, is what happens when you try to follow the “Easy money.” on wall street.

When you want to make money on the stock market, the first lesson you need to learn is how to not LOSE money on the stock market.

Here are several of the best ways to lose money on the stock market

“Not losing money is 90% of the way to making money”

— Rich E. Cunningham

Thinking other people are in the "Know"

Should I buy this?

Should I sell this?

Is the market going up? is the market going down?

One of the first things you have to realize, right off the bat is..

Nobody knows anything in the stock market!

So called "Experts" and professionals are confident that they know what is going to happen, and what's going to happen in the market.

They don’t. Nobody does. Not really. The market is not beatable, not long term. Not forever, not by everybody. Sometimes people get lucky, most people don't.

Welcome to the stock market.

You need to stop listening to the talking heads at CNBC, and fear mongering websites and make your own choices.

People make predictions all the time, then when they are found to be wrong they just disappear back into the darkness, and move on with their lives.

don't know anything either. But at least I admit it and I took the time to write an article about it that you could enjoy.

"Nobody knows what's going to happen and if they did they wouldn't tell you."

— Rich E. CunninghamNot knowing what you are buying

Would you buy a car without test driving it?

Would you buy a house without looking at it?

Most people would say no. So why do so many people buy stocks and other investment products without knowing what they actually do?

Weird ETFS

There are many weird ETFs out there, people keep buying them and losing money. I don't know why.

(ETFs incase you don’t know are exchange traded funds.)

Most of them index different part of the stock market, for instance say you think oil companies are really going to do well, but you don’t know which ones.

You could buy an ETF made out of oil companies, for a small fee that is usually charged over time on your holdings.

That way you could benefit (Or be punished) by how oil companies did as a group, even if an individual oil stock might do poorly.

Some ETFs can even cover the entire market, or do other weird things.

Heres a question for you...

Would you buy an investment, that has always lost money, has been made to lose money, and the creators tell you that you will lose money?

If you clicked on Yes, you should not be investing.

Yes it was a trap.

Many ETFS, ones that model commodity prices for instance, the leveraged ones especially have been set up to always lose money.

If you look at the charts. This is where capital comes to die.

I won't name which ETFS specifically because I don’t want to be sued.

But before you try to use an ETF to say… play the price of oil, or natural gas.

Maybe you should look at what they actually do. The companies that run them make money, will you? (No you won't)

Buying bad stocks who plan to screw you over.

You know how like, as a kid you had to learn that not everybody is your friend?

Stocks are like that as well.

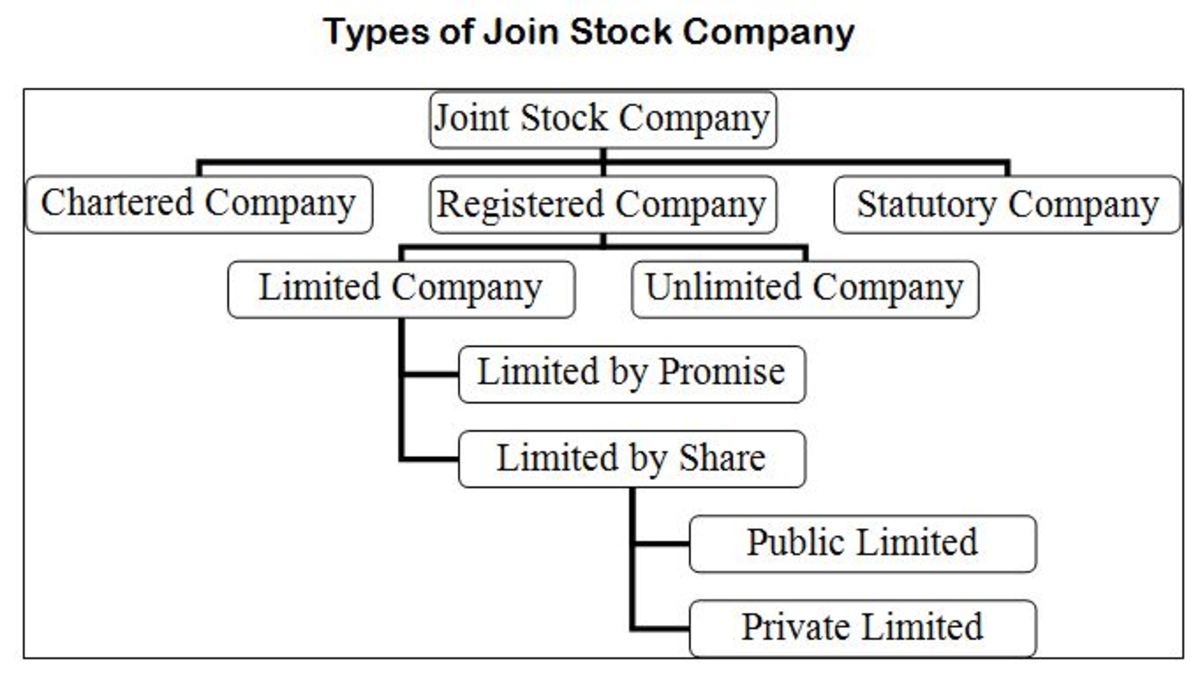

Wait, What is a stock exactly?

What is a stock?

That is a little beyond the scope of this article. But a stock is a piece of a company that is sold for money.

The company is “Suppose” to use that money to grow and develop the business, over time the company is supposed to reward its stock owners, for their foresight and wisdom, with dividends.

Most stocks have been perverted so they only reward CEOs, management and founders.

Since stocks are a way of making money for the business, it is not unexpected that they would use their stocks to generate money.

At the time of this writing, there is a global pandemic (May 2020) that is destroying the world.

Airlines for instance are completely shut down as our foolish governments figure out how to save our lives.

Airlines need money. They will probably take out loans, and get government assistance.

But how could any reasonable person not expect them to tap into the capital market as well?

I know I would if I was running one!

The businesses will make more shares with their magic wand, and sell them on the market.Diluting your ownership and perceived value of your shares.Over time this could held the business survive, and be a good move.But short term it hurts you.

Listening to others conclusions, not their evidence.

Do you listen to people on facebook, twitter, youtube and what have you? (Hubpages are cool, you can listen to us.)

The problem with that is, they aren't playing with your money are they?

They could be very well right about some hot stock tip they told you about.

But rarely do they tell you when you should buy, when you should sell etc.

The smarter way to look at it is to look at the evidence they offer about the tip.

“Why is this company going to do well?” you should ask. Then you make your own conclusions.

I often read articles online about stocks. www.fool.com is a great resource.

But I always consider what they say, what their biases are.

If I agree with them. Its a nice way to start looking at an investment, but don’t let it be the end all to be all.

Penny Stocks

God damn you people love penny stocks!

I never realized so many people are attracted to these awful things.

Penny stocks are terrible little companies that for some reason have stock on the market.

I haven't run the numbers but I bet 99% of these little companies end up eating up all the money they get, then collapsing. Maybe 1% does ok, and grows and expands.

Penny stocks are often violated, have low volume and are very seedy. Some of the financial statements look like the owner pumped them out on a microsoft word template on a weekend.

Penny stocks are a great way to lose 50% or more of your money in a single day. You might catch a winner, but you might win a lottery too, it doesn’t mean you should spend on your money on a lottery ticket.

The fact is, most penny stocks are unknown. Although there might be a good opportunity in there somewhere. You need to be extra careful because the small size means they attempt to do many shady things, that bigger companies would get caught on more often.

I would never recommend a penny stock to a beginner, or even a immediate investor.

If you are able to do a Significant amount of research, and know the business inside and out.. it might be worth it. But I doubt it.

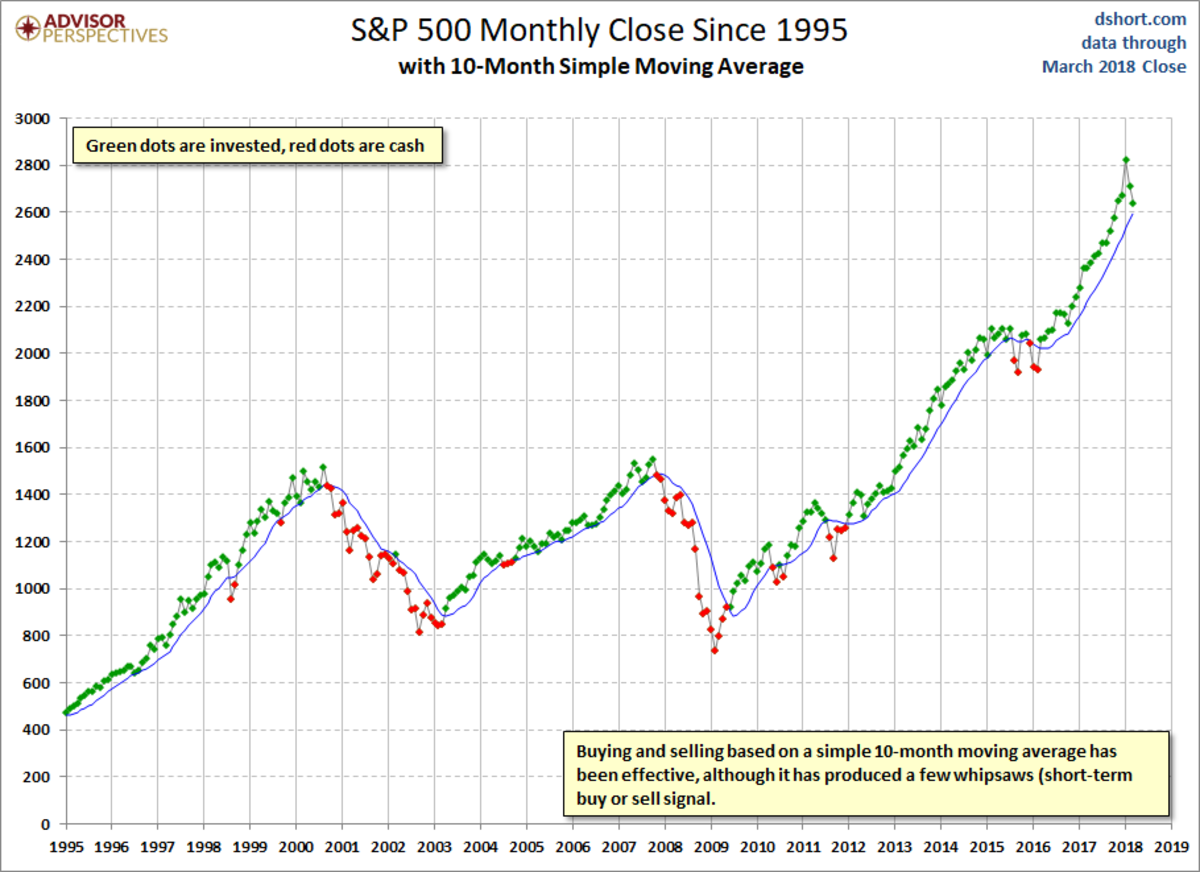

“Catching a falling knife”

Are you familiar with the term catching a falling knife? It is when a company stock falls hard, and dramatic.

“If you liked the stock at $40, you will love it at $20”

As they say. I am a bit of a contrarian value investor, so I do enjoy looking at stocks that have been hurt temporarily by external factors.

But one should not just buy the stock because it has fallen an is cheap.

Many people for instance are buying the airline stocks, for a long term hold, as they have fallen a lot in value. If they pick the right stocks, this would be a good move. But it doesn’t mean it will be.

They are trying to catch a falling knife, and as the metaphor suggests you will most likely get cut.

Every time I have lost money on the stock market is when I went against the trend of a stock, because I thought there was value there. Every single time.

Incase you were wondering... The trend is the long term movement of the stock. Maybe the business has had a good quarter, but on the long term it has been losing money for the last 40 years. That would be considered a negative trend.

Not knowing difference between a trade and an investment

This is a good one, it is all about how long you are planning to hold a company.

I read an article once while I was on vacation in Europe, paid for by money I made in the stock market actually.

It was about the 50 year portfolio. 50 years ago the magazine had picked various stocks as a “Forever” portfolio and they looked back and saw how much money they had made.

Over the 50 years needless the say the portfolio did very well. The businesses that did best were businesses that were able to grow and develop. Canadian banks did very well from what I remember, as they grew with the economy.

What didn’t do so well were commodity based businesses. Vale, a large resource miner and oil companies were suffering from low commodity prices at the moment the article was written. Most of their shares were not worth more than a couple dollars more than they were 50 years ago.

Yes you got dividends. Over the 50 some years, the businesses had grown and developed and over the years their share prices had been worth a lot more. But at that moment the 50 year investment was meaningless.

So clearly some companies need to be traded, and some need to be long term holds.

Being stupid

Are you dumb or something? Haha just kidding, calm down.

I don’t mean that you are dumb if you lose money on the stock market. In Fact some of the smartest people in the entire world have lost a lot of money in the stock market. Experts whose profession is to make money in the stock market lose money in it all the time.

I mean you lose money, by making stupid choices.

What's a stupid choice? Well that's up for the market to decide.

But generally it's one of the things I talked about above. You should have a few things decided before you buy up an investment. (I know there are other things, where you make money by selling or what have you, but for the simplicity of this article let just say you are buying ok?)

Jesse Livermore, one of the world's greatest winners, (and losers) of the stock market had a good story about a woman at a party harassing him about a stock pick.

The reason he says stock tips don’t work is because, although they tell you what to buy, usually the tip person never tells you when you sell!

When he had his wife call the woman to tell her to sale, not wanting to make things awkward at the next fancy dinner party. The woman was still waiting to buy.

Before you buy a stock, ask yourself the following questions

- Why are you buying it?

- When and at what price are you going to sell it?

- When would you sell it for a loss?

- Are you able to follow what you have decided later, once emotion takes over?

- Is this a long term investment or a short term trade?

- Are you risking to much capital?

- Are you going to make enough money to make it worthwhile after fees?

- Are you being stupid?

Conclusion:

As you can see this easy money requires a lot of work, but there are few things that offer such large returns on money as the stock market.

I have been playing the market in one manner or the other since I was a teenager.

I have lost a lot of money, I have made a lot more money.

There are a million other ways you can also lose money in the stock market. But these are a good start.

It can be a fun and rewarding hobby, or the worst decision of your life.

That is up to you, and well the market to be honest.

If you are looking for a good book to read, I recommend stock market for dummies. The title is a little harsh as all Dummies books are but I have always found them useful and informative. I have personally read a earlier edition.

This article is accurate and true to the best of the author’s knowledge. Content is for informational or entertainment purposes only and does not substitute for personal counsel or professional advice in business, financial, legal, or technical matters.

© 2020 Rich E Cunningham