Review of Core ETFs from iShares

The iShares “core” series of exchange traded funds is a powerful new investment tool for individual investors. By buying as few as three ETFs within this series, investors can build a well-diversified portfolio with exposure to U.S. stocks, international stocks and U.S. bonds. Designed for buy-and-hold individual investors, the “core” series of ETFs have ultra-low costs and are tax efficient.

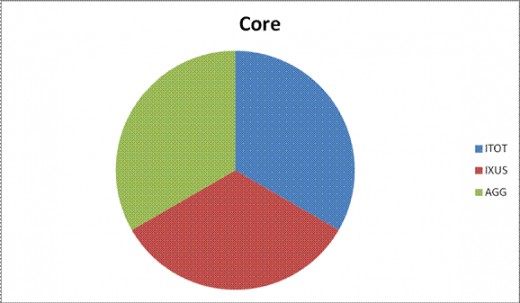

Core ETF Portfolio

The iShares “core” series of ETFs is perfect for investors who use a “core and explore” strategy where most of their portfolio is invested in core assets that are designed to track broad market indexes while the remainder of their portfolio is invested in non-core assets that seek market-beating opportunities.

The first step in using the iShares “core” series of ETFs is to create a core portfolio of just three ETFs:

1. iShares Core S&P Total U.S. Stock Market ETF (ticker symbol “ITOT”);

2. iShares Core MSCI Total International Stock ETF (ticker symbol “IXUS”); and

3. iShares Core Total U.S. Bond Market ETF (ticker symbol “AGG”).

The ITOT ETF is designed to track the investment performance of the S&P’s Composite 1500. These 1500 stocks include the 500 stocks in the large-cap S&P 500, along with 400 mid-cap stocks and 600 small-cap stocks. ITOT has a very low expense ratio of just 0.07%. Its 30-day SEC yield is now 1.81%.

The IXUS ETF is designed to give investors access to 99% of the international stock market by using MSCI indexes. This new ETF will start trading on October 22, 2012, and will have a low expense ratio of 0.16%.

The AGG ETF is designed to track the investment performance of the total U.S. investment grade bond market as defined by the Barclays U.S. Aggregate Bond Index. The expense ratio has recently been lowered from 0.20% to a very low 0.08%. The 30-day SEC yield of the AGG ETF is currently 1.52%.

An individual investor using a “core and explore” strategy could, for example, invest 25% of his portfolio into each of the ITOT, IXUS and AGG exchange traded funds. He’d then have 75% of his assets invested in a core portfolio tracking a combination of U.S. stocks, international stocks and U.S. bonds. This core portion of his portfolio would enjoy very low expense ratios averaging about 0.10%.

Customizing the Core ETF Portfolio

The next step in using the “core” series of ETFs is to customize the core ETF portfolio using 7 other ETFs:

1. iShares Core MSCI EAFE ETF (ticker symbol “IEFA”);

2. iShares Core MSCI Emerging Markets ETF (ticker symbol “IEMG”);

3. iShares Core S&P Small-Cap ETF (ticker symbol “IJR”);

4. iShares Core S&P Mid-Cap ETF (ticker symbol “IJH”);

5. iShares Core S&P 500 ETF (ticker symbol “IVV”);

6. iShares Core Short-Term U.S. Bond ETF (ticker symbol “ISTB”); and

7. iShares Core Long-Term U.S. Bond ETF (ticker symbol “ILTB”).

The individual investor who invested 75% of his portfolio in a core portfolio of ITOT, IXUS and AGG can invest some or all of the remainder of his portfolio in any or all of these 7 other ETFs. For example, if he thinks small-cap stocks and long-term bonds will do well in the current economic environment, he could invest 10% of his portfolio in IJR and an additional 10% of his portfolio in ILTB.

Other Opportunities

The last step in using the “core” series of ETFs is to invest the remainder of the portfolio in other investments designed to capture specific opportunities. These other investments can include other ETFs, mutual funds, stocks, bonds or other investments. For example, the investor who puts 75% of his portfolio into the 3 core ETFs and 20% into IJR and ILTB could invest the last 5% in Apple stock if he believes Apple will continue to beat the market. Since most of the portfolio is invested in the customized core, the risk due to this additional investment is relatively small.

Conclusion

The iShares “core” series of ETFs from BlackRock Inc. is a powerful new tool for individual investors. Investors using this tool can easily build a simple, tax efficient, low cost and well diversified portfolio. For more information about the iShares “core” exchange traded funds, visit www.ishares.com.