Payoneer; Trouncer to PayPal?

Paypal vs Payoneer

When it come to hiring, one may opt to hire staff from all around the world. However, how to circumnavigate about in paying them becomes a problem that as an outsourcer, one encounters.

It's time to payout, and you need to pay your freelance programmers in India, your graphic designers in Japan, the translators in Germany, and other affiliates employees and vendors around the world. Like most companies, you end up hassling with various time consuming and costly payout methods such as wire transfers and checks. Once you deal with that, you find that one of your affiliates in Russia cannot receive payments to their eWallets and wire transfers in India are a costly affair and face constant delays. And just when you are about to blow your top off, lost check complaints feature now and then.

Now you are up with bile, so you need a solution to these never ending headaches that keep arising to work well done. There are various solutions that have emerged to take care of such situations, and we will deal with them and how to chose the right, suitable and convenient one for your business.

Payoneer

The finance setup was founded in 2005 by Yuval Tal as an online payment and international money transfer service that also provide it's very own branded Prepaid Credit cards.

Opting to work with Payoneer is a viable option of transferring funds. Once you join their services, one is issued a debit card that allows the user to withdraw any amount of funds held by them in their Payoneer account from any ATM. It is irrespective of their location. However, it is available to some preferred partners.

They have partnered with oDesk), Elance and freelance.com to provide a medium of sending and receiving payments.The setup brings with it some form of fees for the partners, withdrawal from ATMs and loading onto their card. It is, therefore, an ideal mode or those with a large number of employees.

Paypal

An American worldwide payments system established in 1998, Paypal is a subsidiary of eBay back in 2002. It was developed initially as Confinity back in December 1998. Paypal is one of the most popular online payment platforms in the world today.

PayPal is suitable for worldwide use, especially in the Asian market. However, it gets limited in a few countries such as Russia or Ukraine. If holding an account, you happen to transact with a family member or friend, the costs is minimal for you. Thus, you get to transact cheaply. The cost of using PayPal within the US is cheap, but as one extends to the international community the cost rises. This also dependant with the location of the payee.

An advantage happens to be for those transacting heavily with several people at the same time which bring the overall cost to a reduction.

Which is best option?

The brief indication above outline some of the ideal online payment system.

But how should one decide to go for Payoneer or PayPal? What are the pros and cons when it comes to these payment Processes?

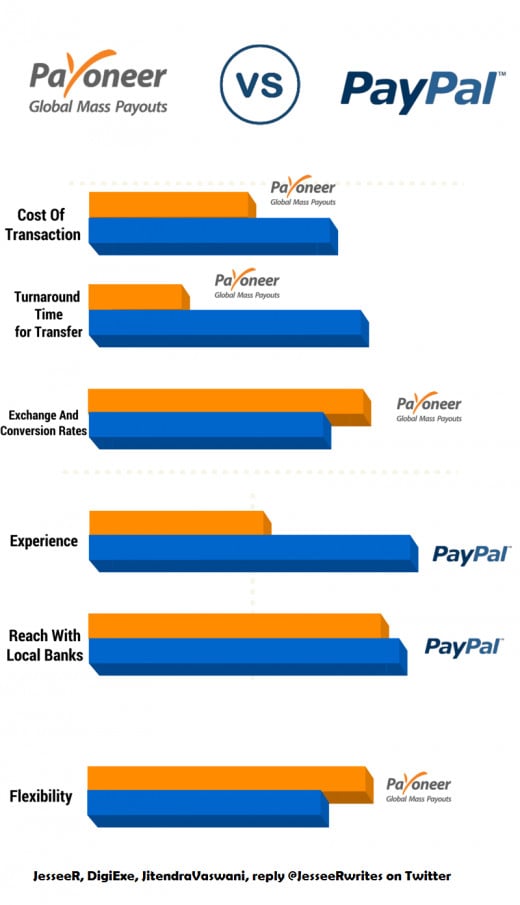

- Profitability

The costliest average charges per transaction are $14.88 while the cheapest are $1.55. The variance is inclined to the more expensive side i.e. loss of valuable money is almost inevitable.

With Payoneer, you save an average of $5 per transaction of $100 that is. With PayPal this is not the case as Payoneer offers:

Higher Conversion Rates

Higher Exchange Rates

PayPal charges a straight fee of $5 per $100 and then there is the added transaction costs that result in massive money-erosion.

With Payoneer the entire cost before the money is in your account is almost $3. Huge Savings!

- Smoothness

It is a tedious process of withdrawing money from a bank for a PayPal user. The whole process is lengthy and a tad too complicated. Thus not an ideal platform

With Payoneer, such hurdles are eliminated while offering users to withdraw money from local banks in a simple, straightforward and convenient manner.

Whereas one is only allowed to withdraw a maximum of $10,000 from your PayPal account, no such restrictions are imposed on Payoneer. The only limitation is on the card with up to a daily limit of $2,500 on the ATMs.

That’s not all. A lengthy amount of time of 3-5 days is taken to receive a transaction on PayPal; a 24-hour guarantee is given for using Payoneer. It is efficient as on would need a speedy payment system to ensure reliability and optimization of output from their workers.

• Benefits

When one signs up with Payoneer, one is issued a US account number that acts as your banking credentials. It is an efficient strategy for international personnel who wish to transact in the US.

What this means is that you is provided for. For your American clients who wish to pay via local banking then you are directly covered. No need to worry.

one can, therefore, say that one's range of coverage is expanded to many parts of the world

Earlier on I had indicated that as with Payoneer, the culminating process is a streak of just under 24 hours. It cannot be said the same for PayPal users.

Where I am concerned, I can say Payoneer is a more convenient and suitable means that make it a compelling choice for any freelancer. If asked which one to use, I would go for Payoneer. Why?

Well, the sign-up is free for both! As a marketer, my options are varied and to clients they may be inclined to choose either of the two. Truth be told that PayPal is still the premier choice for many despite both being popular. However, a shift is seen as to the uptake of newer and more advantageous services such as Payoneer with more people coming to terms with the added benefits given.

Which would you prefer?

Now that we have covered the to, which would work best for you?

Payoneer

PayPal

In conclusion

To conclude, I will come forward and say that I am inclined towards using Payoneer more. As per my research, it is more profitable and creates a more sustainable monetary framework for me.

If you ask me, there are certain added benefits with Payoneer, which make it a compelling choice for any freelancer. If asked which one to use, I would choose Payoneer.