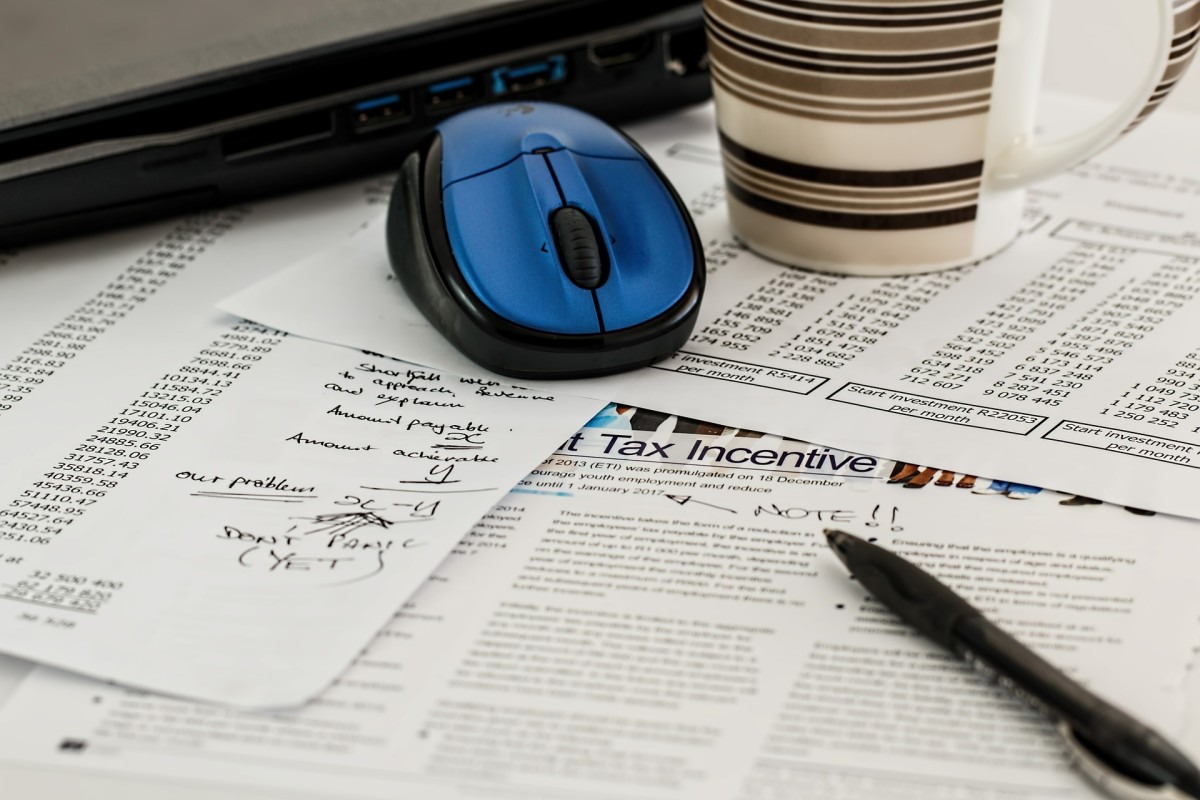

Keeping Good Tax Records Ensures Maximum Tax Credits and Deductions

Why Keep Good Records?

I network with other small business owners, and what I see is this: everyone filing for extensions; everyone getting their records to their accountants at the last possible second; people practically shutting down their businesses for weeks on end; and people still paying too much in taxes year after year because they are not able to plan.

On the other hand, for me, tax time is trivial. Most years the person who does my accounts has everything the first business day of January, and it takes her only an hour or so to do my taxes, and it takes me less than half an hour to get everything prepared. In addition, because I have time and the ability to plan, I am able to reduce my tax burden and keep more money for myself, and I have never once been audited.

Now, doesn't that sound like a better way to work? And it's quite simple to set up!

How Do I Keep Good Tax Records?

If you are just starting your own business, such as writing articles for the Internet, keeping accurate tax records can be very confusing. (And yes, if you write articles for the internet, according to the United States Internal Revenue Service, you own your own business. This is not my opinion; this is settled tax law.)

So, with that in mind, here are some guidelines.

Contrary to popular belief, your tax accountant does not want to see a shoebox full of receipts; she or he wants either a notebook or a spreadsheet with all your expenses neatly recorded. (You can use tax software or accounting software for this, too, if you wish.) It's if you get audited that the IRS will want to see a shoebox full of receipts!

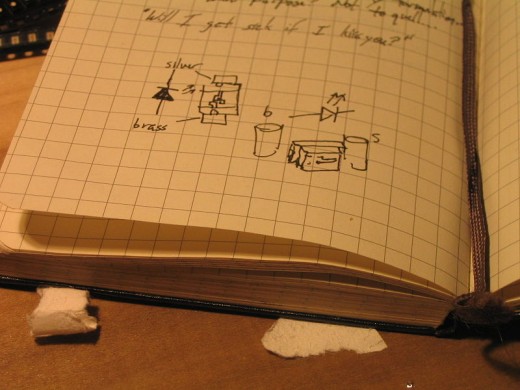

Good tax records start by being contemporaneous--that is, recorded on or about the day they occurred. It's simple enough: take five minutes each night and look through your receipts for that day. If a receipt is tax-deductible, write it down: place, amount, why it is tax-deductible (how did you use it in your business?).

If you travel for business, you can do the same with mileage. Each night when you get out of your car, note the number of miles driven, and how much of that mileage was for business purposes, where you started, and where you drove to. Cell phone apps make this easy!

What is Tax-Deductible?

Believe it or not, you don't have to know what is deductible: this is why you should hire a professional to do your taxes. The professional will be able to ferret out tax deductions that you would never find for yourself. Simply write down anything business-related (don't forget your business of writing articles!).

Some ideas for deductions are: rent or mortgage on the percentage of your property that is 100% devoted to business use, insurance and utilities for a home office; liability insurance if you meet with clients at your place of business; insurance for your business equipment, supplies used for your business, including books, computers, a separate cell phone or land line, etc. Again, don't worry about this too much, because your tax professional should find all these for you. Based on what you submit, your tax professional may ask you for additional records based on her or his experience with people in your same situation.

OK, I recorded everything . . .

So now can I throw away my receipts? No!

Your tax preparer does not need to see your receipts unless there is something she or he doesn't understand. However, if you undergo an audit, the IRS will require them. Generally, you should keep receipts for seven years. If space is an issue, consider buying a scanner and scanning them, or having a reputable scanning company scan them (that is a deductible business expense).

Whether you keep paper or electronic records, make sure that you have a backup in a different physical location! A fire or a flood can destroy your records and leave you with a huge nightmare (and perhaps a huge tax liability). If you think that's not a problem, well, my water heater leaked for ten minutes once, causing over twenty-two thousand dollars in damage, and had I not had backups, my life, which suddenly became incredibly complicated, would have been much worse. Fortunately, my tax records were all in good shape, even if my floors, furniture, and other items were not!

As of 2011

W-9 Form - for each supplier or contractor that you intend to deduct $600 or more, you will need to require them to give you an IRS Form W-9. This is because the IRS, for 2011, has declared that for deductions $600 and over, you will need to issue a Form 1099. If you do not get that form W-9 first, the supplier will not want to give it to you once they have finished their part. Get the W-9 first!

This includes not only people working for you, and contractors, but also suppliers: office supply stores, home remodeling stores, DIY stores . . . basically any place you spend more than $600. Otherwise, if you do not issue the Form 1099 (and you won't be able to without a Form W-9), you will not be able to deduct your expenses over $600. Get the form W-9 early in the year; you never know when you will have unexpected expenses!

For More Help

Believe it or not, the first place you should check is with the I.R.S.! Most people are terrified of talking to them, but their job is to be there to help you, first and foremost. I talk to them sometimes ten or fifteen times a year (other times I don't talk to them for years on end), and even their website has helpful videos and explanations for even the most nervous and inexperienced business owner. Don't worry, you're not going to get into trouble for asking a question!

Most communities have free tax help at the library or senior center, and of course there are plenty of resources at your library. So take heart, keep good records, and enjoy peace of mind!

Legal Disclaimer

I am not a lawyer, nor a certified public accountant. Each person's tax situation is different, and tax law is subject to change at any time. Please consult a qualified tax professional about your individual situation. I will not be responsible for any errors on your tax return.

This article is accurate and true to the best of the author’s knowledge. Content is for informational or entertainment purposes only and does not substitute for personal counsel or professional advice in business, financial, legal, or technical matters.

© 2011 classicalgeek