The Six P’s of Learning Forex Trading

Passion

You know who Einstein and Mozart were, right? Sure you do, everyone does. Mozart created beautiful music and Einstein explained meaningful theory in a way that changed the way we see the world forever. What was it about them that made them stand out from everyone else? They were both incredibly brilliant and talented prodigies – but what it really came down to is that they were passionate about what they did and put 100% of themselves into their work. They put all their eggs into one basket and they never looked back.

Now, I am not claiming that you can become the Mozart or Einstein of Forex (because, let’s be honest, Forex is probably not going to change the world), but what I am saying is that this same momentum can lead you to the kind of success with Forex that could change your world. Mozart understood music on a deeper level than the average person, and Einstein understood physics and the mysteries of the universe beyond the abilities most of us ordinary people, you could take this passion and focus it on the key areas necessary to master Forex trading and understand it from the inside out.

Preparation

There are some key things that you must do to learn to become a Forex trader. You need to learn the “language” of Forex, like how to use a trading platform such as MT4, understanding the basics of reading charts, knowing the difference between pips and currency, identifying levels of support and resistance, etc. But, if you’re reading this article, you’ve probably already learned the basics of Forex. So, what comes next in your road to preparation and building the framework necessary to achieve success?

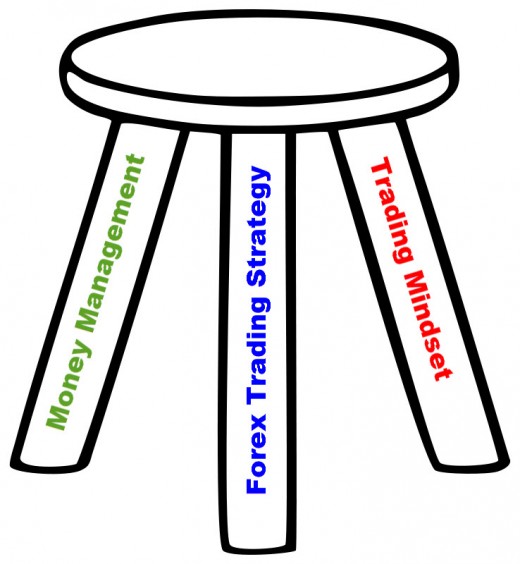

It's important to understand that there are three integral components to the ‘three-legged stool of Forex Trading’: your trading strategy, your money management system and your trading mindset (your attitude towards the market). Knock one of these ‘legs’ out of the ‘3 legged Forex stool’ and you will find yourself on the floor picking up the pieces and wondering what went wrong.

Psychology

For most traders, this is the biggest hurtle to overcome. When it comes to trading, anyone can learn a certain series of steps and if followed faithfully – they can make money over time. You don’t have to be incredibly intelligent, you don’t have to be the stereotypical aggressive stockbroker-type, you don’t have to be part of a certain class of society or speak a certain language or hold fancy degrees in finance or economics; almost anyone can learn to trade.

Yet, almost everyone fails, and one of the main reasons they fail is because they don’t learn to control their emotions and realize that it isn’t you against the market, it’s you against you. The market is going to do what it’s going to do, you can’t control that. All that you can control is how you react to it. You must be able to temper your emotions and not treat trading like gambling, and you must learn to understand it as a probabilities game.

Mark Douglas mentions how you can take two traders, give them the same set of rules and they will produce totally different results. You wouldn't even believe they were trading the same system. It all comes to their mental integrity, and ability to stick by the rules under pressure. Nobody is perfect, even the best traders will ‘color outside the lines’ from time to time, and need some good psychological mentoring to regain their focus. Becoming part of a responsible trading community can be a huge asset to your trading career because you will always have that other trader there to 'check' you - or even bounce ideas off.

Protection

It’s not all about the pips! First things first, don’t set your stop-loss based on pips. Determine the amount of money you are willing to risk, and determine where you would like your stop-loss to be placed based on your best judgment. So, in other words, your stop-loss should be placed at a point in the chart where if the trade should move against you to this point – you would consider it invalidated and you would want to cut your losses and exit the trade.

Once you have decided these two things, you can use a stop-loss calculator tool to determine what lot size to use.

Tip: if you don't know how to calculate lot sizing correctly - you can use an online calculator such as the one BabyPips provides...

Babypips Lot Size Calculation Tool

You need to protect your capital by understanding proper money management, and this is one part of it. The other important key to protecting capital is to always use a positive risk/reward system. This is probably the most important concept that you need to understand in order to succeed in Forex.

Even if you master learning to read the price action in the charts, and you execute all of your plans perfectly, you’re still going to have losing trades. The market is unpredictable because people are unpredictable and the market is a reflection of our decisions. If you have a positive risk reward system in place, you can lose more than half your trades, and still make money over time. For example, let’s say you decide that you are comfortable risking $100 per trade. So, you set your lot size and your stop-loss so that if the trade moves against you and hit’s your stop-loss you only lose $100. If you made your target (take profit or exit point) at the $300 mark, even if you only average winning one out of three trades you are still ahead by $100. Lastly, don’t risk money that you can’t afford to lose. You should only risk money that you have left over after paying for all of your “necessities” in life.

Patience

Most people do not succeed at Forex right away. In fact, most people don’t succeed at Forex at all. They end up losing money and quitting before they truly build an understanding of how to succeed. Like any complex skill, it takes time to learn the language of Forex and you learn as much from your mistakes as you do from your winners. This is why we believe you should keep a trade journal that records more than just the numbers involved in your trades, but more importantly the conditions during the trade, your reasons for taking it, your actions and why you did what you did.

You should analyze the market; choose your best opportunity; decide on stop-loss, entry, and exit; and make your trade. If you don’t see any great opportunities, be patient – don’t make a trade! Once you make your decision, it’s important to learn to stick with it. The market does not move at a constant 45 degree angle up or down continuously; it is going to retrace, it is going to pause and consolidate, it’s going to behave erratically at times - you have to give your trade room to run its course. There are two ways to lose money, when price moves against you and hits your stop-loss, or when you chicken-out and get out of a trade early (such as during a retracement) instead of being patient and letting your take-profit get hit.

Price Action

Let me first state that there are many different approaches to trading the Forex market. The only one that I am going to touch on is true ‘Price Action’. Price Action is the art and skill of reading candles and price movements on a currency chart. It is actually learning to read the charts and interpret what is happening to price in real time, while looking for patterns and clues that tell you where price is likely to go based on what you are seeing. It does not use indicators.

We don’t even consider trading based on indicators a viable trading method, because most traders who are using indicators don’t really understand the process behind them. This is bad for two reasons, one because indicators are always “lagging” meaning that they are based on calculations of what price has already done and cannot be as accurate as reading the real-time signals that the present candles are giving you. Two, it’s bad, because they very regularly give you the wrong advice and if you don’t know how to read the chart yourself - you don’t know any better than to follow this bad advice.

The reality is, most people don't see success in their Forex trading until they've developed a good understanding of price action. Price action is the living, breathing, everlasting heart of the market. So if you want to be a master of the charts, you need to keep your finger on the market's pulse and react to it's moves accordingly. The only way to do this, is by having that ability to make trading decisions directly from the chart itself. Pull this off successfully, and you will be looking in the rearview mirror spotting all those traders who are bogged down with their lagging indicators.

Best of luck with your future trading success!