M-Pesa: Convenient Mobile Money Transfer

What is M-Pesa?

Ever thought of paying your electricity bill, shopping with your phone or even paying your kids school fees using your phone? Now that's M-Pesa for you. According to Wikipedia, M-Pesa stands for Mobile money, M stands for Mobile while Pesa is a Swahili word for money. Though this system has been used elsewhere to transfer money using smart phones, M-Pesa is more than a paperless money transfer, it is a modern way of doing business popular with micro finance sector. Using your mobile device, you can transact business in the comfort of your home. M-Pesa offers you the opportunity to transfer money, make deposits, withdraw money and pay utility bills. This could be the future PayPal very soon.

M-Pesa - How to Register Free

Using M-Pesa is a way to save time and enable you to avoid ques in banks and other point of sales. To register for M-Pesa service you need a passport or national identification document and a Safaricom or Vodacom line. Referred to as the most advanced mobile payment, M-Pesa is brainchild of the largest Mobile operator in East Africa, Safaricom and Vodacom and the service is very popular in Kenya and Tanzania. Registration can be done at any M-Pesa outlet, their customer service centre or any of their branches in the regions mentioned below.

Banking Using M-Pesa:

Several banks have in the recent past partnered with M-Pesa to enable their customers to bank, withdraw, transfer and pay bills using their mobiles and this real time transaction has seen a phenomenal growth of M-Pesa paperless money transfer service. You do not have to walk around with hard cash any more. Simply get your SIM card M-Pesa enabled and you can do shopping or dine out and pay via M-Pesa. It is also a way of attending to emergencies without having to borrow money, you simply withdraw cash from your bank account and send. Simple!

M-Pesa Benefits:

This service is not only limited to Kenya and Tanzania but has gone international and people in the Diaspora are using M-Pesa to send money back home. This has opened more investment opportunities spanning from real estate, saving in local banks, riding on exchange rates among many.

Locally, accessing your money has never been this simple and there are M-Pesa agents even in the remotest areas as long as there is good network coverage by both Safaricom and Vodacom. Days are long gone when sending money used to take days or weeks and banks used to operate for seven hours a day. You can buy airtime anytime as long as you have enough balance in your M-Pesa account.

You are in control of your finances and you save a lot in terms of travel costs. Remember the cost per transaction is one of the cheapest in the world hence value for money.

Where to Find M-Pesa Markets:

Being the leader in money transfer in the market, you can access or send money to any other network and the beneficiary will be able to access the funds in seconds. on the other hand M-Pesa redemption centers are everywhere and the customer service is superb.

The major M-Pesa markets include and not limited to Kenya, Tanzania, Afghanistan, South Africa, India and Egypt. Most of these countries the partnership has seen the rise in similar services by other mobile operators and by the turn of the century, paperless money transfer will be the next mode of doing business.

To make it world brand, M-Pesa will soon partner with Manchester United Football club in the UK to brand their T-shirts on all their away matches in the Barclay's Premier League.

M-Pesa Security:

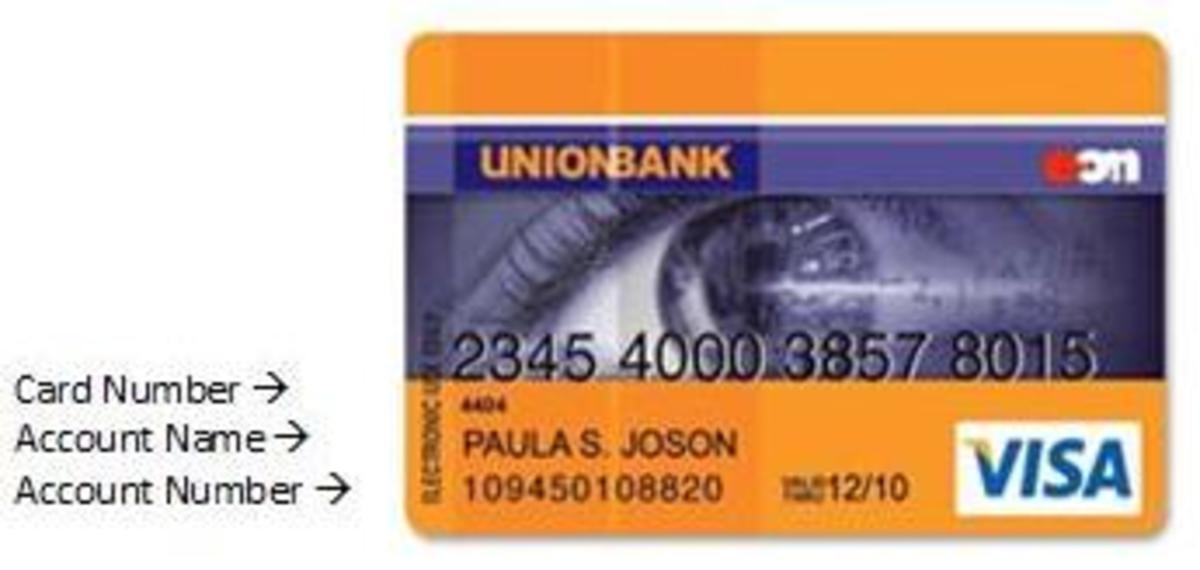

You do not need to have a smart phone to use the M-Pesa banking solution, a simple phone and sim card is all you need to do your Mobile Pesa transactions and your security is guaranteed through a PIN number just like an ATM card; no one has access to your account PIN unless you give it out.

- How to Make Moneygram Mobile Money Transfer

How to Make Moneygram Mobile Money Transfer In the recent years the number of people transfer their money to their abroad friends and families is increasing, which asks them have to ask help from a bank which can offer them international money... - Different Money Transfer Methods

We all love how good it feels when we get money back from our tax return, a mail-in rebate, a friend who pays us back, or a crisp bill in a birthday card. As much as we love getting money, we don’t always pay attention to the many methods we can... - www.WesternUnion.com - Money Transfer Western Union ...

Sending money to family and friends around the world is simplified with the services that this company provides to consumers. They offer money transfer services that allows you to send funds to loved ones quick. The company strives to make a... - Mobile Money Transfer Spreading From Africa To Europ...

Mobile money transfer is a type of mobile banking where that can be used to shop for grocery, pay bills and transfer money by use of mobile phones. Particularly in Africa, mobile money transfer has become the means through which small businesses and