Online Currency Trading

What is the attraction? Why Leverage of Course

There is one single reason that forex trading is so popular. It isn't the twenty four hour accessibility to the forex markets and the ability to do a forex trade at whatever hour of the day you want. Nor is it the fast paced adrenaline inducing trading that the forex traders in the international banks partake in every day. Nor is it the thrill of currency trading on the world’s largest and most liquid market. What is it then that draws people to this sport? In one word it is leverage.

The forex market is a very exciting place to be if you are a smart and capable trader. With an average daily turnover of over four and a half trillion dollars, the forex market is larger than all the other financial markets combined. While stock traders and investors in bonds and money funds are subject to the ever changing state of the economy, forex traders can make money in all market conditions, whether a boom or whether a bust, for the forex trader it's just another great opportunity to make a profit. But this isn't the real reason why so many hopeful investors try to make it there, but foreign exchange leverage is.

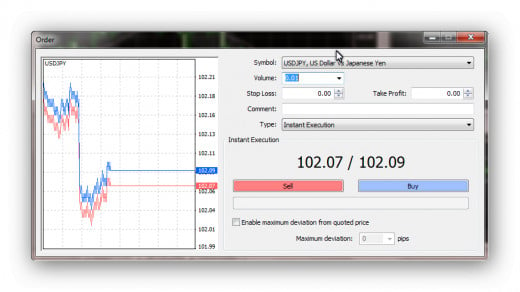

Leveraged Trade - Rates Window

How Does Leverage Work?

This is how leverage works. Usually when an investor makes a trade, he has a set amount of money in his account, let's say $1000. He then buys an asset, stocks, bonds, commodities or currencies for $1000. However, with some stock brokers, the investor has the opportunity to buy more stock than his initial investment by using leverage. By using the stock as collateral, the stockbroker will then loan the investor the remainder. The current laws require that the investor must put up at least half of the investment. So, if the investor has $1000 he can buy stocks worth $2000. That is all very good, but it's hardly something that has everyone clamouring to trade in financial assets.

Suppose on the other hand, that this investor took his $1000 and opened an online foreign exchange account. Now we are talking. Unlike stocks and bonds, forex trading is not regulated by a governing body, which luckily for the professional or the amateur trader there are no limits as to how much leverage can be used. Let's say the investor uses his $1000 which is in his online foreign exchange account and buys one or more currency pairs. The forex broker who is not subject to any laws, will then offer the investor a loan up to several hundred times the value of the funds the investor has in his brokers account. This essentially means that the investor can leverage his account by 1:100, 1:200 or even up to 1:400. Now it’s easy to do the sums, an investor who has an initial deposit of $1,000 can now trade up to $100,000 and maybe even more.

Trade Example

Trading Currencies

Have you ever considered trading currencies online?

Trading Floor

Trading Fundamentals

It's easy to see why foreign exchange trading is so tempting and why more and more people are signing up to open online foreign exchange accounts and downloading an online trading platform. In order to trade with leverage, you need to have collateral to borrow money from your foreign exchange broker. Trading is done in 'lots'. One 'lot' is $100,000, so if you your broker offerws a leverage of 100:1 you need to use $1,000 of your capital to trade $100,000. You can trade parts of a 'lot'. So say you decide to trade 0.01 of a 'lot' you are trading $10,000 and at 100:1 you only need to use $100 of your capital. This is what is known as 'leverage'.

It's important to understand that leverage isn't calculated on funds in your account, but on the total equity of your account. This includes all currently open trades. Let's say you have an online account with a maximum of 1:100 of leverage. This means that you can trade for 100 times your equity. In the first trade that will mean you can only trade 100 times your initial deposit, but if the trade goes your way and your outstanding trades appreciate in value, then your account equity will also increase even though your account balance stays the same. Because your equity has increased you are know able to leverage your trade even more. Trading this way is of course more than highly speculative.

If the trade goes south and the value of your outstanding trades decrease, you may be subject to a 'margin call' from your broker. Since your account equity is now less than what is needed to maintain the leverage, the broker may require you to deposit additional funds to keep your trade open. So, while leverage can reap enormous profits, it can also make you lose your initial investment very fast. You can never lose more than the money in your account though. That means you get all the opportunity for leveraged profits, but only risk losing the non-leveraged amount in your account. Now that’s not a bad deal.

Of course being a clever trader you could also employ stop losses on every trade you do. You can indicate the rate at which you want your broker to close out the deal in order to minimize your loss if the deal is going pear shaped and you are not around to close out the deal yourself.

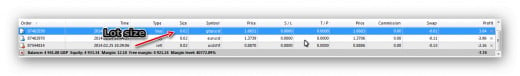

If you are a beginner at online trading, it's best to experiment with leverage using a demo account, with your broker and download a trading platform from one of the many regulated online brokers. You can also try trading with leverage using a mini account where the minimum deposit can be as low as $20. With $20 you can trade as much as $2000. I personally have an account with several brokers and usually trade for an hour a day with some success. Above is a series of trade which I did on one of my demo accounts. Each trade used 0.02 of a 'lot'.

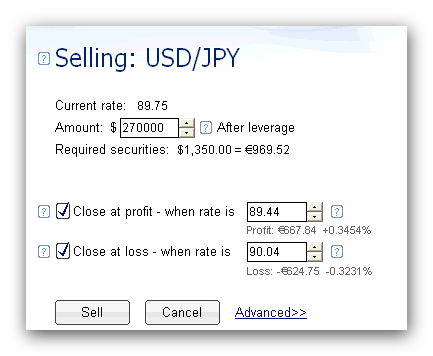

Trading Ticket

Trading Ticket

This is the window that appears after clicking on the buy or sell button in the rates window. This window shows the rate at which I dealt. In this case 89.75. Which side I dealt on. In this case it's a sell of dollars against yen. It shows the amount of the deal after leverage ($270,000), the amount taken from my account was $1350.00. It also gives me the opportunity to set up a stop loss or/and a stop profit rate. As you can see here I set up a stop loss of 90.04, a loss of $624.75. I also for this articles purposes ticked the stop profit button at a rate of 89.44. I would not normally do this as I would like as much profit as I can get. However, if you cannot keep an eye on the market a stop profit is good for preventing the profit from dwindling away because of a downturn in the rate and you are not there to close out the position.

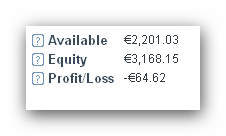

Profit/Loss Indicator

Real Time Profit/Loss/Equity Indicator

This window shows how your deal is performing and what is happening to your equity. In my case I am $64.62 down on the deal and I have an equity of $3,168.15. As the profit/loss figure changes so does the equity position. So if I went into profit of $20 my equity balance would increase by $84.62.

Candle Stick Chart

I find that using the candlestick chart is far more efficient than using a line chart for tracking a currencies movement over a period of time and in real time. As you can see the general trend of the USD/JPY currency pair has been down. At 15.25 the rate was 90.20 and at around 19.35 it is at 89.78. So the dollar has fallen some 42 pips in 4 hours. I took this snapshot at 19.40 and as you can see for the last hour the rate has not done much and has been fluctuating in a 10 pip range. Not a good time to do a deal as I didn't really know where the rate was going. This chart tells us that the USD/JPN rate tried to move above 90.20 twice but didn't make it. Also it tried to move below 89.70 several times and didn't make it. If you read candlestick charts carefully they can tell you a lot.

Finally

The plus500 trading platform is easy to use for the beginner; it’s easy on the eye and fairly intuitive. Give it a try to if you don’t feel comfortable with it, Google the term ‘forex trades’ and you will get a list of most of the online trading platforms. Good luck, I’m sure that like many people you will very quickly get hooked on forex trading online.