How to Get Out of Debt

In one of my most popular articles to date, I discussed quick money making ideas to help get one out of a financial tailspin. But what if the tailspin has actually turned into a financial crash and you find yourself wallowing in debt you don’t know how you’ll pay back?

In this followup article, I discuss three ways to get out of debt. With a strategy in place, the anxiety that accompanies debt can be lifted as an active plan helps you feel more in control of the situation.

1. Cut Your Bills Where Possible

In my previous article, I touched briefly on some ways to lower your monthly bills, but a second look consistently brought up the same list of bills that should be examined for reduction.

Cell Phone - According to ABC News, "J.D. Power and Associates says that U.S. families spend an average of $139 a month on cell phones — $1,668 a year — up from $127 a month in 2009. And the Bureau of Labor Statistics says that household spending on cellphone services rose by more than 4.5 percent in 2011 and has gone up more than 20 percent since 2006."

One recommendation from the article, "Let free websites figure it out for you. At Savelovegive.com you log in with your carrier account information, giving the site access to your previous bills. The site analyzes the bills, looking at usage and charges. It then compares your plan to other available plans, offering you ways to adjust your current plan and save."

Cable - According to Donna Rosato,Time.com, "The average monthly cable TV bill is rising 6% a year. It’s projected to hit $123 a month next year and top $200 by 2020 , , ," Rosato offers some suggestions on how to play hardball with your cable company. She recommends downsizing your channel package and lower your monthly rates noting that Time Warner and Cox Communications now offer starter packages for less channels.

If you're going to play hardball with your company, Rosato says, "Call the cancellation department to talk with a retention specialist trained to hang on to customers."

And finally, here's an option she talks about that I see a lot of friends and family turning to - an a la cart option which includes services such as Netflix, Hulu and Amazon Prime. To save monthly on your monthly viewing, see more suggestion in the full article here.

Energy Bills - Meghan Rabbitt, Forbes.com offers her favorite money saving hacks for slashing high winter bills in an article found here.

Besides the obvious, like wintering your home, Rabbitt offers tips on swapping out old light bulbs for LED versions and turning off your PC monitor to save energy. "A waste of about 50 watts per device", says Rabbitt is, "about $50 each per year."

Rabbit goes on to discuss water savings and even eliminating waste with cooking appliances. Her "hacks" are sure to give you some idea on how to cut monthly energy bill costs.

Car Insurance - on the Kelley Blue Book site, we find 10 Ways to Save Money on Auto Insurance. Some of these are very obvious like drive less and drive safe, but other suggestions may help when considering your car insurance premiums. Comparing auto insurance carriers is probably the biggest money saving option here. Companies are highly competitive and most will give you a quote after filling out an online form. It takes some time, but just accepting the same company you or your family have used for years might be costing you money.

2. Roll a Debt Snowball

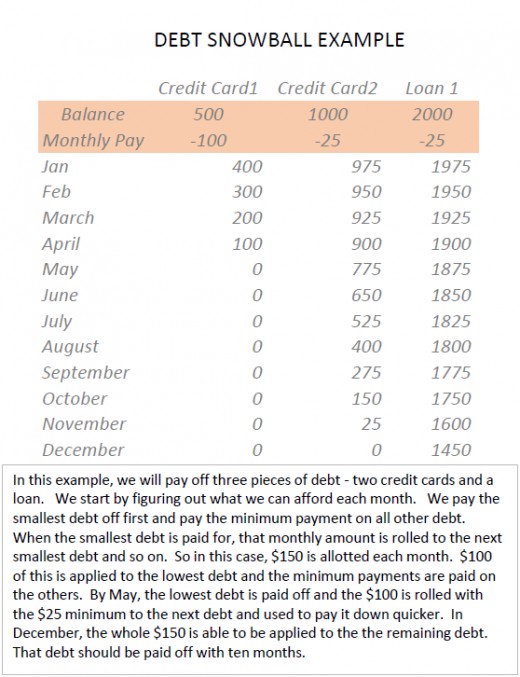

Roll a debt snowball, Dave Ramsey, author of Financial Peace, says when he shares this rule of debt reduction. According to Ramsey, “The principle is to stop everything except minimum payments and focus on one thing at a time. Otherwise, nothing gets accomplished because all your effort is diluted.”

How Ramsey recommends you do this is by listing all your debts in order from smallest to largest not being concerned with interest rates or terms. He suggests you pay off your smallest debt first, paying only minimum on other debts. After paying off your smallest debt, you apply that monthly amount to the next debt in line until it’s paid off and so on. This way you see results!

I briefly explain the debt snowball below.

3. Create an Emergency Fund

Easier said than done - right? This is one of the aspects of freeing yourself from debt that is most important, because without an emergency fund, you are constantly either taking money from something else that needs paid or racking up credit card balances. With an emergency fund, the money is available in an emergency to pay for things as needed so that more debt is not incurred.

I'm all about lots of options and keeping it easy and that's why I was attracted to an article by Gary Foreman on US News & World Reports Website. According to Foreman, "... most Americans save just 2.5 percent of their disposable personal income, which can make preparing for financial emergencies difficult." He offers several tips on building an emergency fund.

My Favorite: use direct deposit. Set a certain amount of your income to be automatically deposited into your checking or savings account. Even socking away a small percentage can help you accumulate cash for a substantial emergency fund. You can read Foreman's entire article at the link listed below in references.

Other suggestions from different sources point to starting this fund with an income tax refund or saving your change. Whichever ways works best for you, get creative and stash an emergency fund to draw from in times of need instead of incurring more debt.

In Conclusion

Getting out of debt is not as simple as 1, 2, 3, but utilizing the three steps of reducing your bills, rolling a debt snowball and building an emergency fund can bring you one step closer to the fiscal autonomy.

Anonymous Credit Card Debt Poll

How much credit card debt do you hold?

Did you know?

The average household’s credit-card balance now stands at $6,802, up slightly from $6,628 in the first quarter, but still down from $8,431 at the end of 2008. By the end of the year, this figure is expected to exceed $7,000, reaching levels not seen since the end of 2010. U.S. consumers will be roughly $1,300 away from the credit card debt “tipping point,” where minimum payments become unsustainable and delinquencies skyrocket, the report says.

Source: http://www.marketwatch.com/story/american-credit-card-debt-hits-new-highs-2014-09-11

References

Behr, C. (n.d.). How to Survive on a Single Income - Six Quick Money Making Ideas. HubPages. Retrieved October 30, 2014, from http://carlajbehr.hubpages.com/hub/How-to-Survive-on-a-Single-Income-Quick-Money-Ideas

Foreman, G. (2014, June 13). Easy Saving Strategies to Build an Emergency Fund - US News. US News RSS. Retrieved October 30, 2014, from http://money.usnews.com/money/blogs/my-money/2013/06/13/easy-saving-strategies-to-build-an-emergency-fund

Lower your Auto Insurance Rates and Save Money on Auto Insurance - Decrease Auto Insurance Premiums - Kelley Blue Book. (n.d.). Kbb.com. Retrieved October 30, 2014, from http://www.kbb.com/car-advice/articles/10-ways-to-save-money-on-auto-insurance/

News, A. (2013, January 14). ‘Real Money’: Shrink Your Cellphone Bill by $1,000 and End ‘Wireless Waste’. ABC News. Retrieved October 30, 2014, from http://abcnews.go.com/blogs/business/2013/01/real-money-shrink-your-cell-phone-bill-by-1000-and-end-wireless-waste/

Rabbitt, M. (2014, October 20). Energy Experts Reveal Their Secrets For Slashing High Winter Bills. Forbes. Retrieved October 30, 2014, from http://www.forbes.com/sites/learnvest/2014/10/20/energy-experts-reveal-their-secrets-for-slashing-high-winter-bills/

Ramsey, D. (2009, August 1). Get Out Of Debt With The Debt Snowball Plan. daveramsey.com. Retrieved October 29, 2014, from http://www.daveramsey.com/article/get-out-of-debt-with-the-debt-snowball-plan/

Rosato, D. (2014, July 15). How to Break Up with your Cable Company. Time. Retrieved October 29, 2014, from http://time.com/money/2987833/comcast-cancel-ryan-block-time-warner-att-directv-cable-bill-save/

APA formatting by BibMe.org.