How can the Insurance Industry Survive in the Age of Cyber Risk?

Every week you might see breaking news related to cyber-attack. A recent report released by Reuters that Equifax’s 2017 data breach could be the most expensive attack in corporate antiquity- as of March 2018 the loss price was $439 million, with $125 million covered by cyber insurance. More so, in 2017, malicious interjected the business of a leading pharmaceutical company, moved to $275 million in cyber claims. And it’s not just about the private sector, even the City of Atlanta paid around $3million in recovery cost, after $56000 ransomware attack.

That’s the reason cyber insurance is trending these days because the insurance sector has an excellent record of solving problems where government regulation didn’t. However, obstacles occur for insurers when it comes to assessing the risks and providing a perfect and comprehensive set of products and services to attract more buyers.

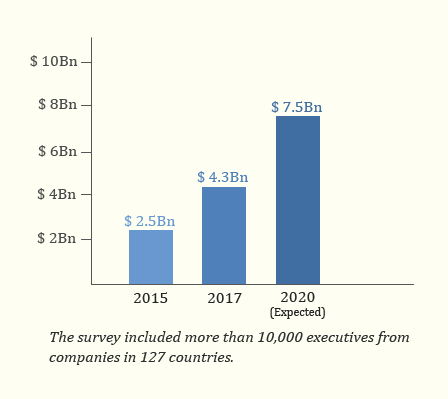

Growth of Cyber Insurance Market

Let’s dive into challenges faced by the insurance industry in this cyber insurance market and solutions to avoid them:

Inadequate Cyber Data Leading Poor Underwriting

Most insured companies because of laws don’t reveal their data breaches outside, as it is related to consumer data. That’s the reason many insurance carriers don’t know the exact number of hacks happened in reality till date! What is the impact? Insurers face rampant reporting prejudice that is tough to interpret into policies. This ultimately hampers the efficiency of underwriters to write better policies.

Solution- To overcome this situation, insurance firms can execute risk-formed models contradictory to definitive predictive models and break down data silos across the industry to better pool underwriting resources.

Disastrous Accumulation of Cyber Exposure

Some insurers fear being overwhelmed by a sudden accumulation of losses, in which a third-party service that works with swath width of businesses gets hacked and leads to service failures for all of its users. This type of unfortunate events could create havoc for the insurance industry.

Solution- Insurers should consider implementing more rigorous underwriting policies to start minimizing accumulation risk.

Constant Development of Cyber Risks that Challenge Exposures Predictability

As the basic exposures are shifting, insurers embrace to one type of attack only to face a new intimidating technique. This makes risk management an enduring dilemma. Technically, improvements in the business like loT and independent vehicles are posing cyber-attack possibilities that need to be evaluated and insured.

Solution- To avoid this, you should try to become the client’s full-time cyber-risk executive as well as their main risk-transfer vehicle.

A Narrow View of What Creates Cyber Risk Eventually Limits the Appeal of Cyber Insurance Products

Many insurers have a narrow vision when it comes to writing cyber policies, focusing mainly on marketing cyber products for individual classifiable data hacks and overlooking many other cyber risks that company’s face. This insurance coverage is quickly becoming commoditized and price-sensitive, restraining long-term growth and profit potential.

Solution- To encounter this, insurers can segregate products while educating risk awareness among buyers.

Poor Standardization in Outlining and Underwriting Policies

Cyber coverage is often written via tailored policies, resulting in various terminology from carrier to carrier. Worrying over potential coverage breaches seems to be a key reason why many businesses that want and need cyber insurance are passing for now.

Solution- Insurance companies can come out of this situation by working together to create a standardized policy language.

Buyers Usually Don’t Understand Cyber Risks or Their Insurance Choices

Many consumers and often sophisticated buyers running small businesses aren’t aware of the cyber risks challenging them, and depend completely on insurance coverage. Let alone the insurance coverage choice available.

Solution- The insurance industry should take proactive steps to better-educate their buyers and motivate them to implement risk-management programs and buy coverage. The best way to achieve this is by improving direct outreach struggles via marketing and advertising.

Cyber insurance also helps agents and brokers by providing risk awareness and loss control resources, which include the website, podcasts, and tip sheets well as referrals to cybersecurity authorities.

The Legal and Governing Landscapes Remain Instable

Cyber coverage case law is yet confusing because cyber coverage clashes haven’t made their way through the court system, buyers fear to contest disputed claims due to variances over which policy applies or whether policy language specifies coverage. More so, state norms are often redundant or conflicting, resulting in potential exposures and coverage gaps.

Solution- ISO observed that standardization in terminology could help you evade the possibilities for coverage clashes along with the prolonged and expensive lawsuit that might result. In the long run, standardization should lower the risks for prospective coverage disputes that elevates claims management prices for insurers, destabilize assurance in the certainty of their coverage and hamper efforts to increase sales.

Bottom line

In this tech advancement world, even students are available on social media and are vulnerable to online stalking or harassment. That’s the reason the insurance industry has to come up with pro ideas to secure every individual and business with cyber risk.

© 2019 Willox Gaulard