Binary Options - Characteristics and How to Use Them as an Investment Tool.

Characteristics of Binary Options

A binary option is an investment option in which the return on the investment can be a fixed amount, an asset, or nothing. In general, only two results are achieved, hence the term “binary.”

Binary options give the investor a chance to speculate on an asset's behavior, instead of purchasing the asset outright. Whenever a binary option is bought, it creates a contract between the investor and the seller, where if the investor is successful, he can buy the asset at a fixed price within a certain time period established by a seller.

Binary options may also be referred to as:

• All-Or-Nothing Options

• Digital Options

• Fixed Return Options or FROs

This investment is especially appealing, as it works to give a possibility of high returns, without any real moves, whereas a regular option requires very significant moves to reward a return. The returns with binary options are determined by the fluctuations in the market within a determined period of time. The investor with a binary option can hope for high returns – even with slight movement in the market.

Perhaps the greatest advantage of trading binary options vs. regular stock options or any other asset class such as currencies, commodities, or indices, is that they are of shorter term and the amount of risk involved is decreased. Despite the fact that this leaves little room for flexibility, they are still relatively easy to trade. Another advantage of binary options is that the market can be understood much better than other financial options. A new investor can easily grasp the advantages and disadvantages in less time with binary options.

Ways in Which Binary Options Can be Traded

Here is a quick example of how a binary option trade would work: Let's say, for instance, the investor buys an Oracle binary option for $175, and the investor speculates that the shares of Oracle's stock will be higher than where they are at the point of purchase. If the seller agrees to a 72% return, and the investor is right, he would get a 72% return on top of his investment. If not, he would only receive 15% back. This is generally referred to as a “call above” binary option or a high/low binary option.

A second method or type is the ‘one touch’ method. Instead of forecasting that the price of Oracle stock would be higher or lower than the current price at expiry time, the investor predicts that at some time before the expiry time, the price of the stock will touch a particular price. If the price of the stock touches the target price before the selected time frame has expired, even for a brief moment, the investor will make a profit. If it does not touch the selected price before the option has expired, the investor will make a loss.

The third method is called range trading. The investor predicts whether the price of a stock will finish either outside or inside a certain price range. So for example, if a stock is currently trading at $189 and the investor selects ‘inside’ a price range of $188.80 to $189.50, and if at the expiry of the selected time period the price of the stock is $189.30, the investor will make a profit. If the price is above $189.50 or below $189.30 the trader will make a loss.

Investors can trade binary options on-line The job of the on-line broker is to facilitate the process of trading binary options. The investor should take note of the options, such as when it expires, what underlying assets are involved, current value, etc. The general payout from most brokers is between 65%-80%.

Binary Options Trading Platform

The Trading Platform

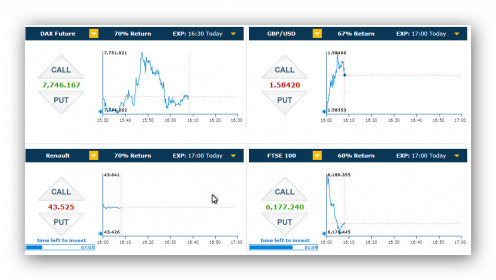

Web based platforms for binary options trading have grown considerably since their inception in 2008, with over 90 platforms since January of 2012. Web based platforms aid an investor by allowing the investor to successfully predict the trends of the assets involved. With these on-line platforms, a binary option cannot be purchased or sold when it is within 5 minutes of its expiry time. The graphic on the right shows a typical trading platform. Notice the buttons for trading either a call (price will rise) or a put (price will fall).

While many consider binary options to be appealing, many others believe binary options to be a form of gambling, not an investment. This could be because of the fact that an investor does not need to be completely knowledgeable about the market to trade.

However, it is always wise to research and learn more about any investment before getting involved in it. There are many websites which offer advice to the novice investor about binary trading and answer any and all questions that may arise.

I trade myself on a couple of well known trading platforms and I also build educational data bases for two popular trading platforms, so if you have any questions or advice please don't hesitate to ask me.