Differences Between Stocks and Bonds. Are Bonds Really Less Risky?

You should know the differences between stocks and bonds if you want to learn the risks and rewards associated with both. Many say bonds are less risky. Is it true? This post will help you.

Are Stocks Risky? Are Bonds Any Different?

You often hear from investors that stocks are riskier than bonds. (The same investors will also say that bonds cannot match the potential growth that stocks can.)

After reading this page, you will know the fundamental difference in the risk required for expected reward between stocks and bonds. Before looking into why bonds are considered safe, you will see what types of risks are attached to stocks.

What are 2 Important Risks in Stock Investment?

If you are a beginner investor or even an experienced investor who don't do much technical analysis, there is a chance that you are falling prey to 2 risks. They are as follows.

- You will not get fixed return from stock markets. (An extreme opposite is "CD", where you will be entitled to fixed interest from banks.)

- There is a lot of volatility in stock markets. There will be ups and downs in stock prices depending upon a variety of factors. You will see the most important factors in this post.

Risks Explained: Why Stocks are More Volatile Than Bonds?

To understand the risks associated with stocks, you have to understand the fundamentals first. Below you will find how stock returns are calculated and why they are volatile (risky).

If you buy even one stock of a company, you become one of the owners (at least theoretically) of that company. This is equivalent to running your own business along with thousands of partners. How do you think the owner of a company will make money? He makes it from profits earned. You know earnings of a business is dependent on too many factors. There will naturally be a lot of volatility (lots of ups and downs).

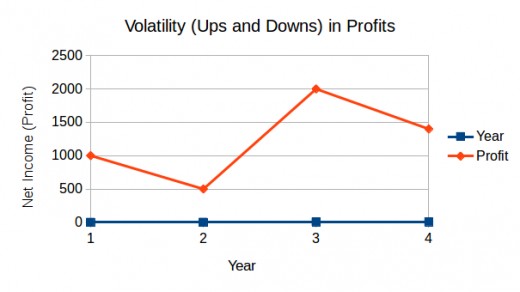

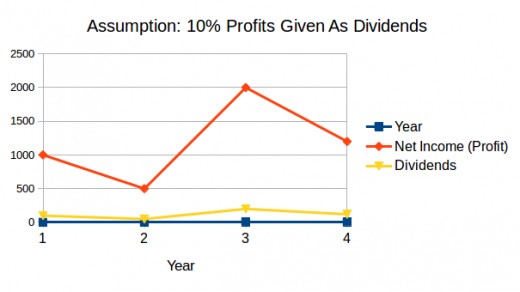

For example, consider a hypothetical company with a market cap of 100,000$. Let it make a profit of 1000$ in the first year, 500$ in the second, 2000$ in the third, 1400$ in the fourth and so on. Below is the chart for the above example.

In the above diagram, you can see that the profit growth will have many ups and downs. Though the above graph is for a hypothetical company, you can expect similar patterns for real companies. This is because a vast majority of the companies will not be able to produce consistent profits year after year. This volatility will affect the returns as well.

But How Volatility in Profits Affect Returns in Stocks?

There are two types of returns in stocks. They are as follows.

- Dividends

- Capital Gains

Why Dividends are Volatile?

As you know, some companies will decide to distribute a fraction of profit to all shareholders. Dividends depend directly upon profits and hence if profits are volatile, dividends are volatile too.

You just saw a chart representing volatile profits of a hypothetical company. Now assume that the same company decides to give 10% of profits as dividends. If you plot dividends, the chart will look as shown below.

As you know 99 percent of investors are not interested in dividends. Instead they focus on capital gains. But even capital gains can be unpredictable if profits are not consistent.

Why Capital Gain is Not Fixed

(If you are just beginning to invest in markets, here is your explanation for capital gain. If you buy shares of company at 100$ a share and if after 2 years the price becomes 120$, your capital gain will be 20%.)

Capital gain depends upon the current market price of a share. But the current market price is primarily dependent on PE. You may know what is a PE ratio. It is the ratio between the profit of a company to earnings per share. Generally speaking, the capital gain will increase if PE increases and vice versa.

But here is a catch. You know markets are not completely rational. In some cases, people would buy stocks in large numbers even if earnings is not much. This is because they may believe in the future potential of the company. In some cases, sentiments may play a crucial role in deciding the market price and hence capital gain.

As you saw in above two paragraphs, capital gain primarily depends upon PE, people's beliefs and sentiments. (There are also other factors that influence capital movement, including, expected growth rate of the industry as a whole, future estimated earnings projected by analysts, etc.) The bottom line is capital gains can be highly volatile at least in short to medium term. (There are studies which say that volatility will reduce over time.)

Why Bonds Are Less Volatile Than Stocks?

You just saw how returns associated with stocks are volatile in nature. Now you will see why bonds are considered less risky. You will also find a special circumstance in which bonds may become riskier than certain kinds of stocks.

You must know the basics of the bond market to understand why its returns are different (compared to stock market returns).

(If you already know the fundamentals of bond market, you can skip the next few paragraphs.)

What Is The Bond Market? How It Is Different From Stocks?

A company may need funds for expansion or recovery. There are two prominent ways. One is to issue stocks, which you saw earlier. The other way is to issue bonds.

If you buy bonds from a company, it is equivalent to becoming a lender to the company. This is similar to how banks operate. Assume you get a home loan from a bank. You will repay the whole principal along with interest. Bonds operate the same way. The company which issues bonds will state a particular rate of interest on bonds. Unlike stocks, you don't have any ownership in the company. Therefore, you are not entitled to profits. But you will get fixed returns like banks do.

Bond Returns: Why Bonds Are Less Risky Than Stocks?

Bonds yield two types of returns. They are as follows.

- Interest paid semi-annually.

- Principal (after maturity).

To learn about interest payment you would get on bonds, you should know what is called current yield.

Current yield is nothing but fixed interest that company agrees to pay to bond holders. For example, assume that a company has issued bonds worth 100$ each. Let the company fix an interest rate of 10%. Your annual return will be 10% of 100$ i.e 10$. This is independent of the performance of the company. The company may do good or do bad, you don't have to worry (unless the company goes bankrupt, which we will discuss later).

Usually, bonds are traded at prices that are different from the original price issued by the company. The original bond price declared by the company is called par value or face value. For example, if a company issues bonds worth 100$ each (of 10% interest), after a year, the value may rise above 100 or fall below 100. For example, assume that the company's bond price goes to 105$ after 1 year. One important point you have to remember is regardless of the market price, the interest is always calculated on the par value of the bond. Therefore, your annual payment will always be 10$.

After a certain number of years, the bonds will mature. At this juncture, you will get the principal back. (Principal is nothing but bond's par value multiplied by the number of bonds you have. If you don't understand this yet, don't worry. In next paragraph, you will find an example to help you understand better.)

An Example For You to Understand Bond Returns

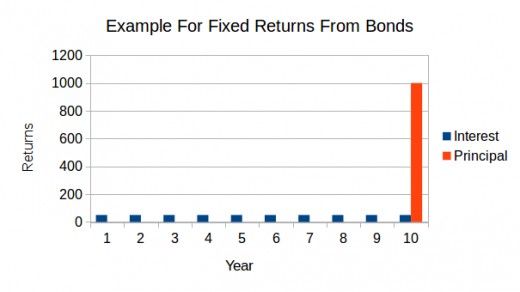

To get a real feel of the fixed nature of yield you will get by investing in bonds, here is an example. Assume you bought 10 bonds worth 100$ (par value) each. Let the maturity period be 20 years and interest rate be 5%. Now let us calculate your returns.

Every year, you will be paid 5% of total value of bonds. You have bought 10 number of 100$ bonds. Your total value of bonds becomes 10 x 100 = 1000$. 5% OF 1000$ is 50$. So every year you will receive 50$ as interest. This will continue for 10 years. At the end of 10th year, you will get your principal of 1000$ back. In total, you will get 1500$. If you draw a chart to see your bond earnings, it will look like as shown below.

In the above chart, blue bars represent the interest you will get every year. Orange bar represents the principal you will get after maturity.

What Are Bond Credit Ratings? How They Can Determine The Risk?

Bonds are just another name for debts raised by companies. You are willing to lend to a company but how would know if the company is trustworthy? After all, you do not want the company (in which you invested) does not go bankrupt. To help you, analysts like Moody's rate bonds by credit worthiness. Ratings range from "AAA" to "C". "AAA" is considered extremely safe and a bond with "C" rating is extremely risky.

Bonds of companies with low credit ratings will trade at a discount from par value. For example, a bond of par value 100$ could trade as lower as 80$. Naturally, your yield will be very high than a higher grade bond. Hence, if the company does not fail, you could potentially get high returns from low-grade bonds. This is a reward for the risk you are willing to take.

In fact, many analysts would advise you against junk grade bonds because they can be riskier than stocks. In fact, many analysts would direct you to buy stocks of good companies than bonds of low credit rated companies.