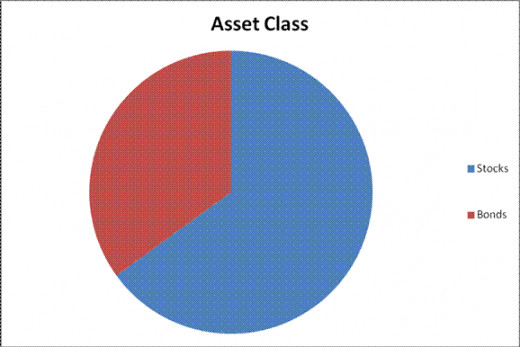

What Percent of Retirement Funds Should Be in Bonds?

When it comes to allocating retirement funds between stocks and bonds, the rule of thumb used by many financial advisors is to take your age and subtract it from 110. The answer is the percent of your retirement portfolio that should be invested in stocks. The remainder should be in bonds. For example, if you are age 45, then 65% of your retirement funds should be in stocks and 35% in bonds. This rule of thumb is a good starting point for making asset allocation decisions for your retirement portfolio. That said, there are good reasons to modify this rule of thumb depending on your individual circumstances.

Financial Advisors Disagree

While financial advisors generally agree that the percentage of bonds in a person’s retirement portfolio should increase with age, they disagree on the actual percentages. Some advisors follow the above rule of thumb which calls for taking your age and subtracting it from 110 to determine the percent of your retirement portfolio that should be invested in stocks, with the remainder in bonds. Others believe this rule of thumb should be modified to subtract your age from 120 to make it more aggressive, while still others believe it should be modified to subtract your age from 100 to make it more conservative. There is no “correct” answer, so feel free to use 120 if you can handle more risk, or 100 if you prefer less risk.

Risk Tolerances Vary

People with high risk tolerances usually prefer investment portfolios that are skewed towards riskier stocks having greater potential rewards. On the other hand, people who have trouble sleeping at night when the Dow Jones Industrial Average drops 100 points usually prefer portfolios skewed towards less risky bonds. Despite what any rule of thumb says, it’s important to get a good night’s sleep. If you stay awake worrying about your retirement portfolio, by all means ignore the rule of thumb by choosing investments that let you sleep soundly.

People are Living Longer

The average age of people living in the United States has increased substantially over the last 20 or 30 years. The average life expectancy is now 75.6 years for males, and 80.8 years for females. If you and your spouse are both age 65, there is a 45% chance that at least one of you will reach age 90. With people living longer, there is more need than ever to insure that retirement portfolios will continue to grow throughout retirement. Thus, an asset allocation formula that calls for a 65 year old to hold only 45% stocks may be too conservative. If you come from a family with long life spans, consider increasing the percentage of stocks in your retirement funds beyond the number suggested by the rule of thumb.

Other “Bond-Like” Assets

When deciding how much money to invest in stocks vs. bonds, many people ignore other assets they own which act like bonds. For example, since pensions and fixed annuities usually generate safe, predictable and fixed returns, they act like bonds. People owning such bond-like assets can consider including their values in the bond portion of their retirement funds, which will allow them to earmark more of their other funds towards stocks and less towards bonds. Otherwise, they may end up with a retirement portfolio that’s too conservative.

Imputed Income from Owning Your House

People who own their house receive imputed income representing the value received from living there. This imputed income has characteristics which are more like those of bonds than those of stocks. Thus, if you own your house outright, consider decreasing the percentage of bonds in your retirement funds.

Substantial Non-Retirement Investments

If you own substantial non-retirement investments in taxable accounts, you may want to increase the percentage of stocks in your non-retirement portfolio and increase the percentage of bonds in your retirement portfolio. Your overall allocation between stocks and bonds will be unchanged, but you’ll minimize the taxable income in your non-retirement funds while increasing the tax-free or tax-deferred income in your retirement funds.

Not Every “Bond” Acts Like a Bond

While bonds are generally considered to be conservative investments with less volatility than stocks, there are some bonds that are every bit as aggressive as stocks, complete with stock-like volatility. For example, high-yield bonds or bonds from certain emerging markets tend to act more like stocks than bonds. If you own such bonds, include them in the stock part of your retirement funds.

Alternative Investments

The rapidly increasing numbers of mutual funds and exchange traded funds have made it easy to buy alternative investments such as commodities or real estate. Investing a small percentage of your retirement funds in alternative investments is a good way to increase diversification, which can increase investment returns without adding risk. Modifying the rule of thumb to set aside perhaps 10% of your retirement portfolio for alternative investments can be a sound strategy.

Conclusion

Determining what percentage of your retirement funds should be in bonds using a rule of thumb is a good starting point. However, feel free to modify the result based on your individual circumstances.