A Better Stimulus Package

Check out my American History book

The Impact of State and Local Government Job Cuts

The federal government of the United States today essentially provides two basic services. First, it defends the nation by paying contractors to produce weapons, directing our military forces, and running various intelligence agencies. Second, and more significantly in terms of spending, it provides various types of aid in the form of Medicare, Medicaid, Social Security, food stamps, unemployment checks, housing subsidies, and targeted education spending. But with the exception of the Veteran’s Administration, the federal government is not typically in the business of providing direct government services to the general public. Instead of providing services, the federal government primarily gives “handouts.” Essentially, the federal government serves as a conduit through which money is inputted by taxpayers and then distributed to others.

Most of the government workers who are on the ground providing direct services to the general public are working at the state, county, and city level: police officers, fire fighters, social workers, teachers, librarians, etc. And over the past four years, as local government tax revenues have been hammered by the Great Recession, the job situation has been ugly for these public servants, with roughly 650,000 jobs lost at the state and local level. Some would argue that this is a positive development, with the wasteful spending habits of many states and cities finally coming to a halt. But while I hope that some of these budgets cuts have led to greater efficiency, a reduction of bureaucracy, and significant efforts at pension reform, I find it hard to believe that you can cut 650,000 jobs without seeing some deterioration in the quality of services. Not all of those workers can be categorized as overpaid bureaucrats, and lavish benefits of retirees cannot be the only cause of the financial ills of state and city governments.

If you were to only pay attention to events in Washington DC over the past four years, it would seem that Democrats have been getting their way. Rather than significantly curtailing spending in the face of stagnant tax revenues and record deficits, federal spending has ranged between $3.5 trillion and $3.8 trillion per year, far more than the $3 trillion budget that President Obama inherited from President Bush. An $800 billion stimulus plan was passed, entitlement programs have not been significantly reformed, unemployment benefits kept being extended, and more people are on food stamps than at any time in history. But in spite of all of this government aid flowing, the economy is still fairly stagnant. Isn’t this evidence that the Keynesian solutions offered up by Obama and his fellow liberals have failed miserably?

Democrats, of course, have many legitimate excuses, most notably the financial implosion, drop in housing prices, and foreclosure crisis that began shortly before the 2008 election. But it is also too simplistic to argue that the Democrats have completely gotten their way. At the federal level, tax rates have been unchanged, and roughly one-third of the stimulus package consisted of further tax cuts. But it is at the state and local level that we have really seen the Republican vision realized, with most states and cities turning to budget cuts rather than tax increases to deal with their financial problems. And as I stated earlier, this has led to hundreds of thousands of people over the past four years losing their jobs. In theory, avoiding tax hikes should be good for the private sector, creating job opportunities for people driven out of the public sector. And over the long haul, the economy will theoretically be better off with more people getting “real jobs” in the inherently more efficient domain of private, for-profit enterprise.

At the moment, however, state and city job losses seem to be primarily causing pain. Loss of consumer demand (and confidence) that has resulted from these job losses has slowed an already weak economy. And although it is difficult to measure, one has to wonder if the deteriorating quality of state and local services has also had an economic impact. Some former government employees, of course, have made the shift to the private sector. Many others, however, made the shift to unemployment checks, food stamps, and disability benefits. So the country as a whole has cut the jobs of government workers that provide most of the actual government services while increasing the number of people collecting various forms of aid. And since the aid they receive is generally less than their former salaries, consumer demand has suffered.

But what options did our country have when the crisis started? First, states and/or city governments could have significantly increased taxes, which, for obvious reasons, was not politically viable in the midst of an economic crisis. Second, states could have cut spending by laying off workers, and instead of either the local or federal government giving out aid to keep them alive, these formers employees could have been allowed to drop dead. For humanitarian reasons, of course, most Americans would not accept that. Third, the country could do what it did: shift some of the burden of spending from city and local governments to the federal level. In other words, we could cut local government employees and turn them into federal welfare beneficiaries. This has had two advantages. Since the federal government faces far fewer restrictions on borrowing than state governments, we have been able to put off financial reality for a while. So people can be kept alive with government aid, and politically unpopular tax increases to pay for this aid can be avoided for the moment. Over the long haul, however, there are some obvious problems with this strategy. As many nations in Europe currently demonstrate, there are apparently even limits on the ability of federal governments to borrow, and if the FED keeps cranking out currency to keep interest rates artificially low, inflation will emerge at some point down the line.

But there was also another option. The federal government, through its stimulus program or by other means, could have spent more money shoring up city and state governments in order to minimize the number of public sector job cuts. Important services could have been maintained, consumer demand somewhat stabilized, and spending on federal welfare programs reduced. If the government in one way or another is going to spend money to keep people from starving on the streets, wouldn’t it make more sense to pay people to perform jobs for which they are trained than to give them food stamps or unemployment checks? Sure, it would cost more money. But the government would get some of this back in the form of higher tax revenues resulting from stronger economic growth. And maybe more importantly, government would be performing its role of providing services as opposed to giving handouts.

If you look at the federal budget, you quickly realize that things are out of balance. Enormous resources are spent providing aid to the elderly (in particular) and the poor. And as our country in recent years has become increasingly elderly, and as the recession has swelled the ranks of the poor, federal spending has snowballed even more. Clearly, entitlement reform must come at some point, and taxes must be raised above our current, historically low levels. But government also needs to renew its focus on providing actual services, services that are typically handled at the city and state level.

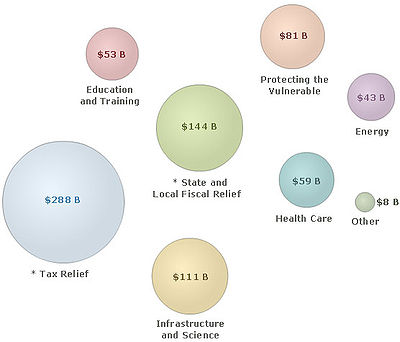

The Obama stimulus plan, which I have been reviewing over the last couple of days, made a certain amount of sense. The tax cuts (of $288 billion) were designed to stimulate investment and spending. Infrastructure investment of about $100 billion was supposed to both create jobs and get going on some long overdue infrastructure maintenance and upgrades. Basic education and medical services received about $250 billion in order to fill potential revenue gaps caused by the recession. Almost $100 billion was invested in extending unemployment benefits and providing other basic aid to the needy. All these actions likely lessened the blow somewhat of the devastating crisis and laid some of the groundwork for recovery and future prosperity

But there were two basic problems. First, $288 billion in tax cuts and $500 billion in spending – spread over a three year period – was not nearly enough the plug the hole created by the financial crisis. So even if the money was spent brilliantly, it was simply not enough to achieve what President Obama had promised. And second, the spending may have been more productive if more of it had gone toward maintaining state and local services and jobs. Some of the spending accomplished this, particularly the funding for education. But too much of it was geared toward tax cuts, medical services, and aid for the poor and unemployed. And by investing so much in the aid programs where the federal government had already been spending hundreds of billions, the tendency was to create a society that was even more dependent on federal government aid.

Unfortunately, the Obama administration only had one shot at a big stimulus program. Due to the explosion of debt and Republican success in the 2010 midterms, there has been little if any appetite for further significant stimulus in recent years. Fortunately, however, the number of state and local job cuts has been decelerating recently. Hopefully, this trend will continue. It should lead to more economic stability, better services, and colleges that actually offer enough classes for the flood of students who want them. And more importantly, I may someday get a legitimate shot at a full-time teaching job.