American Dream: Conservative View - Did Conservative Economic Policy Work?

IT IS INTERESTING HOW things finally come together in your head. Ever since I began writing my hubs on politics and the economy, I knew what the answer was regarding this topic and have written thousands of words about it; but, I was mostly preaching to the choir on the one hand, or raising the hackles of many others on the other, and, in the end, probably convincing very few, who believed otherwise, of the correctness of my position. I even used charts and graphs in many of these hubs but I never felt my point was being made crystal clear, it is a very complicated subject, with many moving parts, after all.

Then, one morning, before actually fully waking up, which is when I do a lot of my thinking, I hit on it; a simple, easy to understand chart that brings a complex subject together in what I think will be a will be an undeniably clear picture of proof that one economic theory works, and the other doesn't.

EUREKA!!

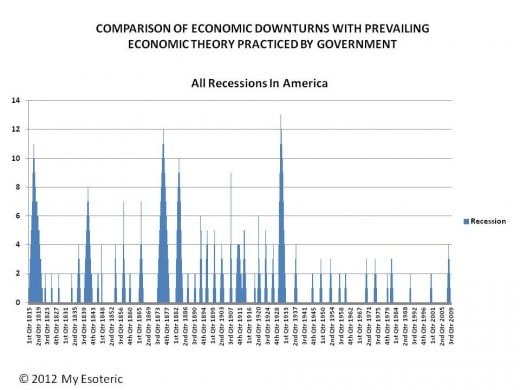

Of course, I am not going to show you this chart immediately, I need to lead you up to it a bit. Chart 1, below, shows you all of the recessions, depressions, and panics in America's history from 1815, forward; there were a few before that but all were related to external factors. The recessions listed here are for all reasons, internal and external, financial/monetary and non-financial.

THERE IS JUST A FEW THINGS TO REMEMBER about this, and the other two charts. First, each pyramid represents a single economic downturn of one variety or another. Second, the height of the pyramid indicates the severity of the downturn; here, a rating of 4 meas a severe Recession. Most downturns rated above a 4 resulted in depressions or panics, as classified by the National Bureau of Economic Research (NBER). Below 4, we are talking about recessions. Finally, where the pyramid begins its journey upward, is when the NEBR determined the recession beginning. Where the pyramid comes back to zero is where the negative growth ended, not when the economy recovered; that was generally many years later.

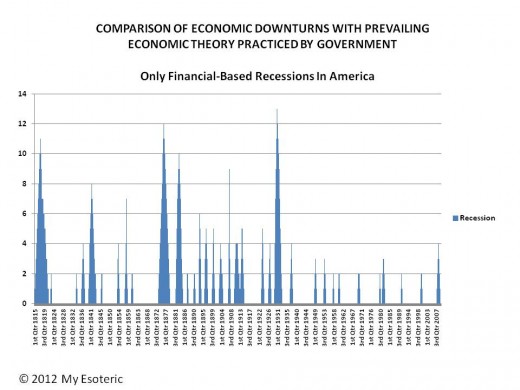

The next chart is simple Chart 1, without economic downturns caused by outside events. These are the recessions and depressions that would be reacting to the prevailing economic theory being practiced by the federal government leading up to and during the event.

NOTICE THAT MOST economic downturns in America since 1815 were financially- based This is important because this means that which economic theory that the federal government followed would be extremely important in determining the how well America was able to execute its economic growth and maintain its economic well-being.

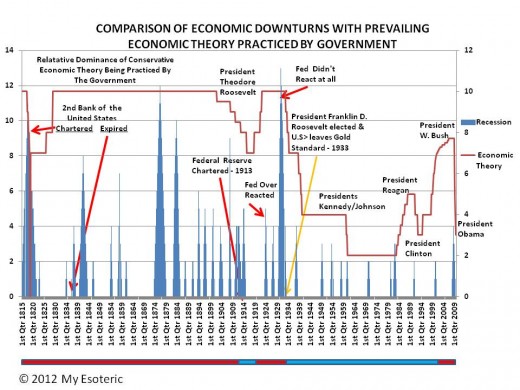

This brings us to our final chart, Chart 3. All Chart 3 is, is Chart 2 with more information added.

- Let's look at the very bottom of the chart where there is a red and blue bar running across it; that is simply showing you whether a Conservative or Liberal federal government was in power at that point in time.\

- Now look at the thick red line going up and down running across the top of the peaks on the chart. That line represents my estimation economic schools of thought with 10 being closer to the Conservative Austrian (Ron Paul) School and 1 being closer to the Keynesian (Johnson) School.

- The remainder of the chart are highlights and milestones to explain significant events.

I FEEL THERE ISN'T MUCH MORE TO SAY TO MAKE MY POINT; the chart says it all for me. Consequently, I will keep it short and hope I get a lot of comments.

To me, the landscape above the red bar, when the Conservative school of economic theory had full charge of the American economy is astoundingly and dramatically different than that above the blue bar which represents when a form of Keynesian economic theory held sway. Further, there is no question in my mind, which is better for America, I would there is in you're either now, whether you are Liberal or Conservative.

Before I leave this to you, let me define things a bit.

The Conservative, "Austrian" School of economic thought that was practiced for most of the period from 1815 to 1929, with a short pause during and just after President Theodore Roosevelt's administration. It was also being reestablished, starting in 1981, with President Reagan, and brought nearly to fruition under President George W. Bush in 2001; it came to an end in 2009 with the Great Recession of 2008, and the election of President Obama; this is the school of economic thought that Ron Paul, the Tea Party, and the other arch-social and fiscal Conservatives want to reestablish, if they can. Its basic tenants are what brought us the term "trickle-down" theory; you throw enough money at the rich, and it will flow down to the poor. A more common and appropriate name is "supply-side" economics in that government remove as many obstacles (regulations, oversight, and taxes) from the operation of a free-market, capitalistic economic system as possible and the result will be a market-based economy that will feed on itself and where market forces will determine prices, demand, and production keeping everything in balance. This is known as laissez-faire economics, the idea being that any government interference will simply gum up the works and knock things out of balance.

Keynesian economics, on the other hand, believes that the Austrian School is fundamentally flawed and is unstable. That once it begins operating, it quickly moves away from a free-market, capitalistic model to one of monopolies, monopsonies, oligopolies, major, destructive boom-bust cycles, and the creation of a great divide between the working and wealthy-class. Keynesian economics, at its core, believes that an efficient economy is that is demand-driven, but to do that, it must be prevented from becoming "supply-driven"; which is the natural course of things in an unregulated economy and hence the need for regulation.

Nobody today believes that pure Keynesian economics is the right answer anymore and many refinements have been perfected which have been applied since it was inaugurated back in 1940 until its near demise 2000. The main purpose of the regulations and oversight over business, mainly the financial sector, is to reduce the number of boom/bust cycles and, when they do occur, mitigate their severity.

Have These Charts Made The Picture Clearer For You

Have These Charts Changed Your Mind About Which Economic Theory Works Best?

© 2012 Scott Belford