Accounting 101 for Conservatives and Others with a Hyperbolic View of the World [151*4]

ACCOUNTING 101

I JUST HAVE TO CHUCKLE

FIRST, LET ME ESTABLISH MY CREDENTIALS; I am an accountant by education, among other things, so I do know what I am talking about ... at least this time.

I didn't limit my category to just United States politics for this one, because I am sure this goes on world-wide and that is by applying intentionally or unintentionally malapropism to the field of accounting. For those of you who might not know what "malapropism" is (and it isn't a dirty word, in case you are wondering), it means, "a ludicrous misuse of a word, especially by confusion with one of similar sound.". Well, in today's (meaning from 2008 to now and beyond) political rhetoric, when conservatives speak of things accounting like budgets, deficits, debts, running government like a business or a household, debt ceilings, and the like, they are probably committing a serious case of accounting malapropism; largely because they haven't a clue as to what they are talking about. They shouldn't feel alone as many a Democrat doesn't either and neither do either of my two business partners (talk about frustrating!)

Another thought occurred to me this morning - it is interesting how brilliant these speakers on the economy think they are in believing they can cram two years of college level accounting courses into a few high-faluting, reasonably sounding sound-bite and bumper sticker messages they absolutely know you will believe. They really should be teaching the courses I took, could have saved me a lot of money.

I can deal with my business partner, but we are playing a very dangerous game when politicians start bantering about political sound-bites and slogans that are often opposite of reality as if they were telling the God's honest truth with millions of their followers believing them and passing it on to their friends and neighbors. In some cases these politicians, known to have Social Dominator Orientation (SDO) personalities, know they are lying and go ahead and do it anyway knowing that their Right-wing Authoritarian (RWA) followers will gladly and faithfully spread the word. (For those of you who follow me, or at least read some of my political hubs, you know what I am talking about, the rest can follow the links I provide at the end of this piece if you are interested.) In other cases, they just simply believe what they are saying is true without knowing any better, even though it is either an apple and orange or the truth is something else entirely.

OK, now I have just written 350 words and most of you probably haven't a clue as to where I am going with this. So, as Judge Judy might phrase it, let me 'splain.

THE "VERY" BASICS

I HAVE A THEORY and if there is anybody really familiar with the Meyer-Briggs MBTI reading this, I would appreciate your feedback. To understand accounting, one must be able to conceptualize, "feel" patterns in their mind and to be able to think through a sequence of steps. Not all people are wired to do such things, in fact, if I remember my Meyers-Briggs charts correctly, most people aren't. There are two letters associated with the "feel" ability and the "thinking or processing" ability, they are S-N, and F-T, respectively. I suspect most accountants fall into the NT group while those who have a very hard time understanding accounting fall into the SF group. (For more info on this gobbledygook, I have a link below for that as well.)

Why did I take this strange diversion? Because it really is extremely important, I believe, to understand that some people, really a lot of people simply "do not get" accounting, they just cannot understand the nuances of it and the inability to do that is HUGELY important in deciding who to believe in this political environment, don't you see. How do you know if you are being lied to if you don't know what the difference between a balance sheet and an income statement is or even WHY it is important to know the difference?

The importance comes down to this: below are a series of comments to a question from one hubber, in between, one other hubber or myself were responding, but our remarks are irrelevant here. (the surplus referred to in the beginning is the budget surplus of 2000).

- there was no such surplus. Bush came into office after Clinton with a national debt of over $4 trillion. How is that a surplus...is that new math?

- your point is like claiming you have money in the bank because even though you're in debt, you have a capital surplus because you have a bunch of checks. Fact Clinton started w/$4trillion left $5.9 trillion in debt. The rest is semantics.

- I don't disagree and refuse to defend Bush's spending as I'm one of the few conservatives consistently rip Bush. There was no surplus because the interest alone would eat that up. And plus there were other issues with the methodology used.

- Arguing with irrational thought? If you have $10,000 in your pocket, but owe $100 million - do you have a cash surplus? Using that same logic-would a private company using Clinton's #s be profitable or bankrupt?

That is a common line of reasoning I hear often on Hubpages, on CNN from politicians pontificating from the floors of Congress, and on my POTUS radio program ... and it is an absolutely beautiful example of someone who doesn't understand the first thing about accounting. So, let us begin.

THINGS and PROFITS

THERE WILL BE TWO EXPLANATIONS, a very simple one, presented first, and much more complete one, with charts and everything, later on when I get them built. But for now, words will have to do, and I will do my best to keep them to a minimum.

At its most fundamental level accounting tries to accomplish two things, 1) keeping track of how much money an enterprises earns over a given period of time, normally a year, and 2) the value of all of the things it possesses and debts it owes. It is as simple as that. There are two statements prepared from people to look at that present the information regarding these tasks; one is called an Income or Profit and Loss Statement and the other is called a Balance Sheet.

INCOME STATEMENT

INCOME STATEMENT

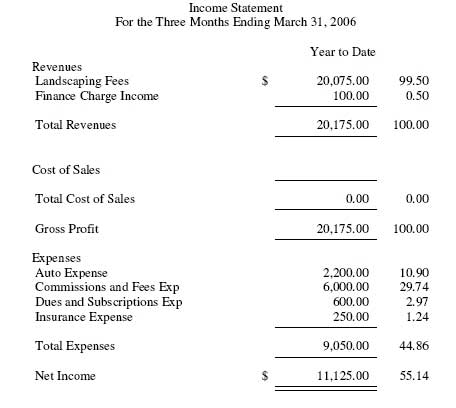

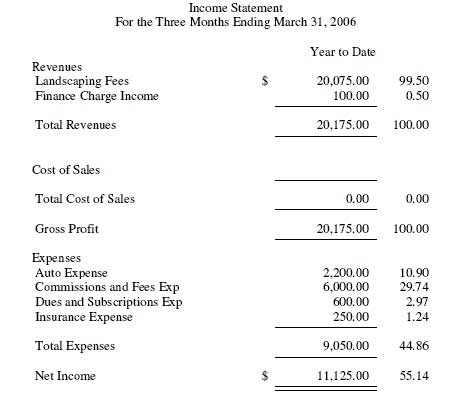

THE PURPOSE OF THE INCOME STATEMENT is to display, you guessed it, how much money the enterprise made or lost at the end of the day. It does this by accounting for all of the revenues it received during a one year period (normally thought of as Sales) and all of the money it spent earning that revenue (commonly referred to as Expenses). When you subract the Expenses from the Sales, you end up with Net Profit or (Loss).

Now, let's convert this, if you don't mind, to governmentese. The Revenue is basically the same thing, you hear it referred to as that today, but, instead of Sales, it is some sort of Tax or Fee paid to the government. Expenses are called Outlays; Net Profits are called Surpluses; and Net Losses are called Deficits. Simple, eh?

Conservatives like to compare government to businesses, well to this point, that is how you compare it ... hardest translation to understand, of course is that Taxes are equivalent to Sales just as Sales would be equivalent to Household Income if your tried to compare your household to a business, as is often done today as well.

Looking back at our hub conversation, the only pieces you have seen so far are Surpluses and Deficits. Were are the Debts? They are next.

BALANCE SHEET

BALANCE SHEET

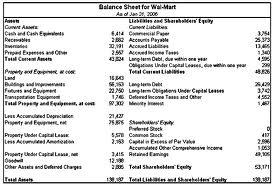

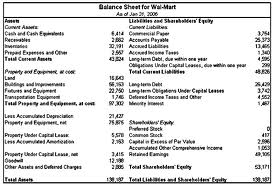

IT IS IN THE BALANCE SHEET where we see Debts first appear. The purpose of a Balance Sheet is to provide insight at a given point in time as to the state of an enterprises; it has absolutely nothing to do with how profitable a company is, I say again, nothing at all! Now you will see why.

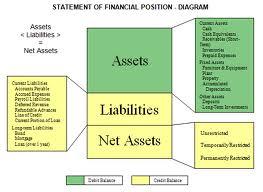

A Balance Sheet presents three pieces of information, 1) the value of the enterprises Assets, the things it owns, 2) the value of its Debts, what it owes others, called Liabilities and 3) the amount left over when you subtract the Debts from the Assets, general called Owners' Equity, or some such thing like Capital Equity. If that number is negative, the enterprise is insolvent.

You should notice there is no obvious connection between the Balance Sheet, presented here with its Assets, Liabilities, and Owners' Equity , and the Income Statement, presented in the last section, which had Sales, Expenses, and Profit (Loss). The translation of the Balance Sheet into governmentese is also simpler and more recognizable.

- Assets are the things the government owns such as planes, tanks, buildings, AND its bank accounts.

- Liabilities are the things the government owes, mainly the National Debt

- Owners' Equity. I am not really sure what this might be called because, if one assumes there is no National Debt for the moment, Owners' Equity equals the value of all the Assets and, since all of the Assets were purchased on behalf of the People, for the benefit of the People, I suppose you might call it the People's Equity.

You notice the words Surplus and Deficit (or Budget for that matter) showed up anywhere related to the balance sheet (I will drop the capitalization now). Why, because they belong with the income statement, so back to that.

BUDGETS, SURPLUS, AND DEFICITS

A BUDGET IS AT THE HEART OF ANY well-run, really profitable business, government, or household (you hear conservatives tell you that many times a day), but, only a small percentage of any of those use one and a smaller percentage of that number use one wisely (something conservatives never tell you). What does a budget do? It sets priorities and goals for the next year (the timeline should give you a clue as to which part of the accounting "equation" we are talking about, income or balance). In developing the budget, estimates are made of the revenues expected over the next 12 months, the outlays that may occur assuming a certain set of events will happen, and whether there is going to be a surplus left over or a deficit. At this point, the answer is independent of anything that is on the balance sheet side of the house.

Why is that? Because your budget is based on some sort of mission statement and vision created by the political leaders at some earlier point in time. This budget satisfies those lofty goals. But now it is time for the rubber to meet the road and the income statement to meet the balance sheet.

INCOME STATEMENT, PLEASE MEET THE BALANCE SHEET

THE INCOME STATEMENT MEETS THE BALANCE SHEET AT THREE POINTS, 1) in the Assets, the Liabilities, Owners' Equity. When the dust settles on the income statement side, all you are working with is Cash, an ASSET; you take in cash and you give out cash. It may take many different forms, but it is still fundamentally cash and where does cash reside? In a bank. It, Revenue, comes into a bank, in our case the Treasury, and it, Outlays, leaves the bank. Up and down it goes and at the end of the year, if you end up with more cash in the bank than you started, then your net income was a SURPLUS; if you ended up with less than you started your net income was a DEFICIT. That is one way you can relate your income statement with your balance sheet.

Simple right? Well yes, unless you run out of money in your bank, which we seem to consistantly do. If you do that during the year then what does the government do? Well, the exact same thing a business does or a household, it borrows the money it needs. (To hear the conservatives tell it though, because business always budget, they never need to borrow and therefore never have debt, at least that is the way they try to make it sound (or am I missing something in the translation?) To borrow money means we will owe to somebody else which means we have created a, yep, you guessed it again, Liability, another balance sheet account.

The physical process is we give somebody a piece of paper promising to pay them back, a balance sheet transaction, they give us money which we put in the bank, another balance sheet transaction. At this moment in time, the People's Equity HAS NOT changed, it has not diminished a penny even though we have taken on this Debt. It is only when we actually spend the money we borrowed does equity change because we took money out of the bank, a balance sheet account and spent it on something, an income statement account.

OK, why would we have spent that borrowed money? The only reason was because our revenues at the moment were not enough to cover our outlays.and we began running a DEFICIT on our income statement and there wan't enough money in the bank to cover it. Everything would be fine if, by the end of the year, enough revenues came in to offset all of the outlays and the government was able to pay off the debt; no harm, no foul, as it were.

But, what if revenues didn't meet projections, e.g., there was a tax cut with no offsetting gain in economic growth to generate more revenues, then we are faced with not having enough money left in the bank to meet our debt and it carries over into the next year.

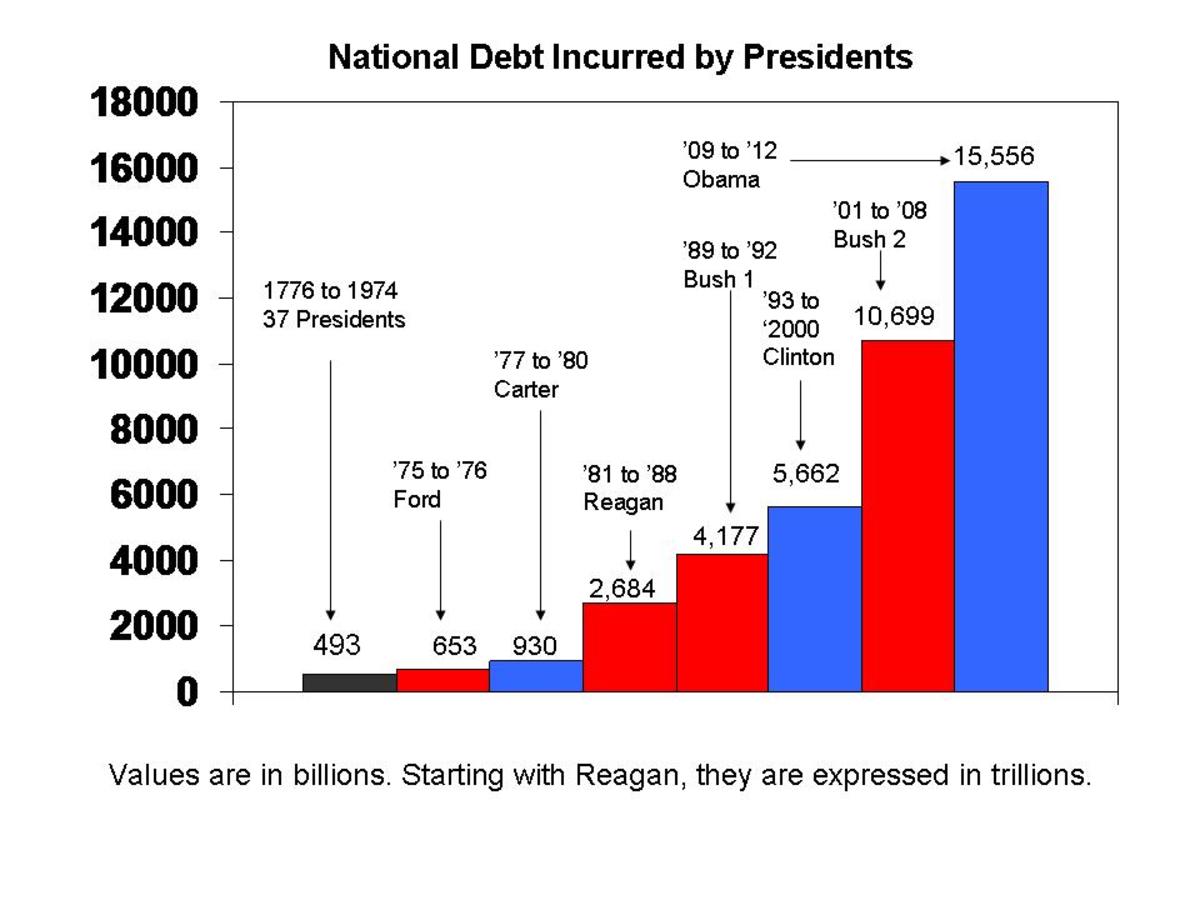

And so begins our National Debt.

TO PUT THE COMMENTS IN CONTEXT

LET"S LOOK AT THE COMMENTS I presented in light of the information just offered to you.

COMMENT - there was no such surplus. Bush came into office after Clinton with a national debt of over $4 trillion. How is that a surplus...is that new math?

ANSWER - It is not new math, just normal accounting. There was a surplus; the comment he was answering to was talking about an income statement set of transactions, revenues and outlays leading to a surplus and not balance sheet transactions - national debt.

COMMENT - your point is like claiming you have money in the bank because even though you're in debt, you have a capital surplus because you have a bunch of checks. Fact Clinton started w/$4trillion left $5.9 trillion in debt. The rest is semantics.

ANSWER - Again, he was confusing having a surplus on the income statement, which means (assuming one didn't pay anything toward principally on the national debt) there would have been more money in the bank account, an asset, at the end of the year, than at the beginning and the national debt, a liability, would have remained constant. If, on the other hand, the government actually paid down on the national debt, then that would have gone down, and there is no telling where the bank account would have been relative to its starting position.

COMMENT - I don't disagree and refuse to defend Bush's spending as I'm one of the few conservatives consistently rip Bush. There was no surplus because the interest alone would eat that up. And plus there were other issues with the methodology used.

ANSWER - Here, the interest charge on the national debt is being treated as if it were a balance sheet item adding to the liability account. That is simply not the case; it is an income statement account, part of the outlays and accounted for in the surplus.

COMMENT - Arguing with irrational thought? If you have $10,000 in your pocket, but owe $100 million - do you have a cash surplus? Using that same logic-would a private company using Clinton's #s be profitable or bankrupt?

ANSWER - Again, confusing balance sheet with income statement. The two figures he mentions are balance sheet accounts, the first an asset, the other a liability. The term "cash surplus" is nonsensical, in that "cash" is an asset and a "surplus" is what you get when revenues exceed outlays on the income statement. To answer his question, who knows without looking at both the income statement, the balance sheet (as well as a few more things like a cash flow statement, accounts receivables details, accounts payable details, etc.)

WRAPPING UP, FOR THE MOMENT

I HOPE THIS HUB WAS HELPFUL and shed some light on the arcane areana of accounting. To say the bumbersticker analysis rhetoric coming out from the Right regarding our debt and deficit is simplistically misguided should be painfully obvious by now, if it isn't, I didn't do a very good job and I am truly sorry for that.

If you will indulge my polls as well, I would be appreciative as well.

ANSWERING WAYNE'S COMMENT

LET ME START, WAYNE, spending and our businesses. In order to make a niche in my industry, we have to spend more than the normal bear on personnel (fixed) and independent contractors (variable) to make sure we are better than our much bigger counterparts. It has worked, we are well known throughout the industry for providing the best service with far fewer errors than anybody else; but we charge for it which makes getting clients a constant challenge.

In 2009, it took that long because our service, drug testing, is mandatory in the transportation industry and our clients are railroads and airlines, business sort of fell off, lol, and, as you said, cash flow is king ... king cobra in this case and it went negative (a DEFICIT). Any cash reserves were quickly eaten up and it was borrowing time again as we weren't going to 'throw the baby out with the bath water" and start cutting are one big asset, our quality of service which rested on personnel. Our next biggest cost was our IC rate, but it was variable already and further, the same quality reasoning applies. Rent (income statement) or mortgage (balance sheet) was the next big expense and we couldn't do about those cash outlays. (for those interested, the interest payment on the mortgage is an income item and the principle part of the payment is like making a payment on the nation debt, a balance sheet transaction and something my partners have yet to understand). The rest of our expenses are like the government's non-security discretionary spending --- invisibly small in comparison.

So, we cut where we could, got behind on a lot of payments over time, the same old story, and borrowed money. In 2010, things picked up, cash flow went positive (we were running a Surplus) a bit and the backlog started getting smaller. In the fall of 2011, it picked up a lot (this is known as a revenue increase which in government terms means more tax revenues either through economic growth or tax increases, the former is the preferred method) and we were ALMOST at break-even, with a "lot more debt" on the books.

At the beginning of 2012, our largest client cut back $40,000/month; guess what, can you spell DEFICIT again? Since then, they put back $10,000/month which leaves at status quo and we just picked up a new client we project will net us $10,000/month more after they get over the sticker shock and we will be back to paying everybody back off again.

I went through that long sad story to show 1) that it is impossible for the government to bring the budget into balance through spending cuts ALONE - impossible, unless you are one of the ones who want no federal government at all or at least no bigger or powerful than the Continental Congress and 2) that you CAN do it with revenue increases (but not just tax hikes by themselves) ALONE if the revenues principally derive from, in the end, economic growth. In fact, tax revenue growth is the ONLY way to ultimately balance a budget when you have cut spending to its core. That is what Clinton did. His tax hike brought in needed revenue, when coupled with strong spending cuts (Obama's plan as well) gave business the confidence that the government knew what it was doing and it, business, went back into a hiring mode; it always does that when the government stops yelling at each other and works together.