Banks and Government - Bail-Out, Bailed-Out or Investment :: Should Banks Have Bailing-Out Support

Government Financing of Banks - Bail-out or Investment

We have heard endless commentary on the News and read countless articles in the newspapers, and on-line, about the refinancing, undertaken by Government, of bank's hit by the banking crisis.

We are all aware that we have been in an economic rut, that we must steer out of, if we are to complete the ploughing of the banking system. We are just about seeing the first tentative awakening of the bull-flower poking its tender shoots of recovery above index-level.

There is a glimpse of optimism returning like the first day of spring. It is late, like spring this year, but it can be felt. The air is just that little bit warmer. The sun's rays cut through the epidermis and warm the bones of a recovery in the Stock Market. We can reassess our lives, our aspirations and our commitments. Summer is on the way. We feel brighter. We feel optimistic - just! We consider whether what we have sown will bring sustenance to our life and bread onto our table.

And where have we planted the seed. Well, like all citizens of our nation we have left that up to the farmer. We hope he has planted the seed deep enough, into fertile soil, and been fortunate enough that Mother Nature has watered it sufficiently for it to have burst forth and sprouted. If that has happened then all will be well in the stomachs of our Nation. We will be fed. And as a reward the farmer should get his profit from the sale of his produce.

Paraphrasing a children's rhyme partially conveys what has now become our enlightenment on whether the bail-out of the banks was a shrewd investment by our Government.

Gordon Brown - He had a Bank .....

Old Gordon Brown he had a bank,

Had a bank, had a bank,

But she got sick, I don't know how.

All she said was mooooo...re.

Pay, pay, pay!

Wouldn't you say

That would make it go away?

Pay, pay, pay!

Wouldn't you say

That's all for today.

Her friend, the bourse, brought humble pie,

Humble pie, humble pie,

To see if that would take her eye.

All she said was mooooo...re.

[Chorus]

The little bank brought her asset,

Brought her asset, brought her asset,

To see if that would clear her debt.

All she said was mooooo...re.

[Chorus]

The farmer's mate he looked askant,

Looked askant, looked askant,

To ease the pain of her transplant.

All she said was mooooo...re.

[Chorus]

The opposition brought scepticism,

Scepticism, scepticism,

To stop her standing on her own.

All she said was mooooo...re.

[Chorus].

The farmer brought the chancellor,

Chancellor, chancellor,

To keep the cow from going under.

All she said was mooooo...re.

[Chorus]

The tax-man brought her capital,

Capital, capital,

To keep the cow feeling able.

All she said was mooooo...re.

[Chorus].

The recession brought her to her knees,

To her knees, to her knees,

And still the poor cow couldn't budge.

All she said was mooooo...re.

[Chorus]

The recovery brought a ray of hope,

Ray of hope, ray of hope,

And then she didn't have the pain.

All she said was mooooo...re.

[Chorus]

The Stock Exchange it brought some profit,

Brought some profit, brought some profit,

To chase the farmer's debts away.

All she said was mooooo...re.

[Chorus]

Now you may want to sing some praise,

Sing some praise, sing some praise,

You'll have to write your own catchphrase.

All she said was mooooo...re.

Pay, pay, pay!

Wouldn't you say

That would make it go away?

Pay, pay, pay!

Wouldn't you say

That's all the speculation for today.

Farmer Brown - He had a Cow......

Old Farmer Brown he had a cow,

Had a cow, had a cow,

But she got sick, I don't know how.

All she said was Moo-oo.

Hay, hay, hay!

Wouldn't you say

That would make it go away?

Hay, hay, hay!

Wouldn't you say

That's all for today.

Her friend, the horse, brought lemon pie,

Lemon pie, lemon pie,

To see if that would take her eye.

All she said was Moo-oo.

[Chorus]

The little duck brought gingerbread,

Gingerbread, gingerbread,

To see if that would clear her head.

All she said was Moo-oo.

[Chorus]

The farmer's dog brought cherry tart,

Cherry tart, cherry tart,

To ease the pain above her heart.

All she said was Moo-oo.

[Chorus]

The old black sheep brought ham and eggs,

Ham and eggs, ham and eggs,

To help her stand upon her legs.

All she said was Moo-oo.

[Chorus].

The rooster brought her ginger ale,

Ginger ale, ginger ale,

To keep the cow from looking pale.

All she said was Moo-oo.

[Chorus]

The kitten brought her apple sauce,

Apple sauce, apple sauce,

To keep the cow from feeling cross.

All she said was Moo-oo.

[Chorus].

The farmer's boy brought chocolate fudge,

Chocolate fudge, chocolate fudge,

But still the poor cow wouldn't budge.

All she said was Moo-oo.

[Chorus]

The farmer's wife brought cheese soufflé,

Cheese soufflé, cheese soufflé,

To try to chase her ills away.

All she said was Moo-oo.

[Chorus]

The farmer brought a load of grain,

Load of grain, load of grain,

And then she didn't have a pain.

All she said was Moo-oo.

[Chorus]

Now you may want to sing some more,

Sing some more, sing some more,

You'll have to write your own encore.

All she said was Moo-oo.

Hay, hay, hay!

Wouldn't you say

That would make it go away?

Hay, hay, hay!

Wouldn't you say

That's all for today.

And so to the recovery!

Shrewd Investment or Bail-out?

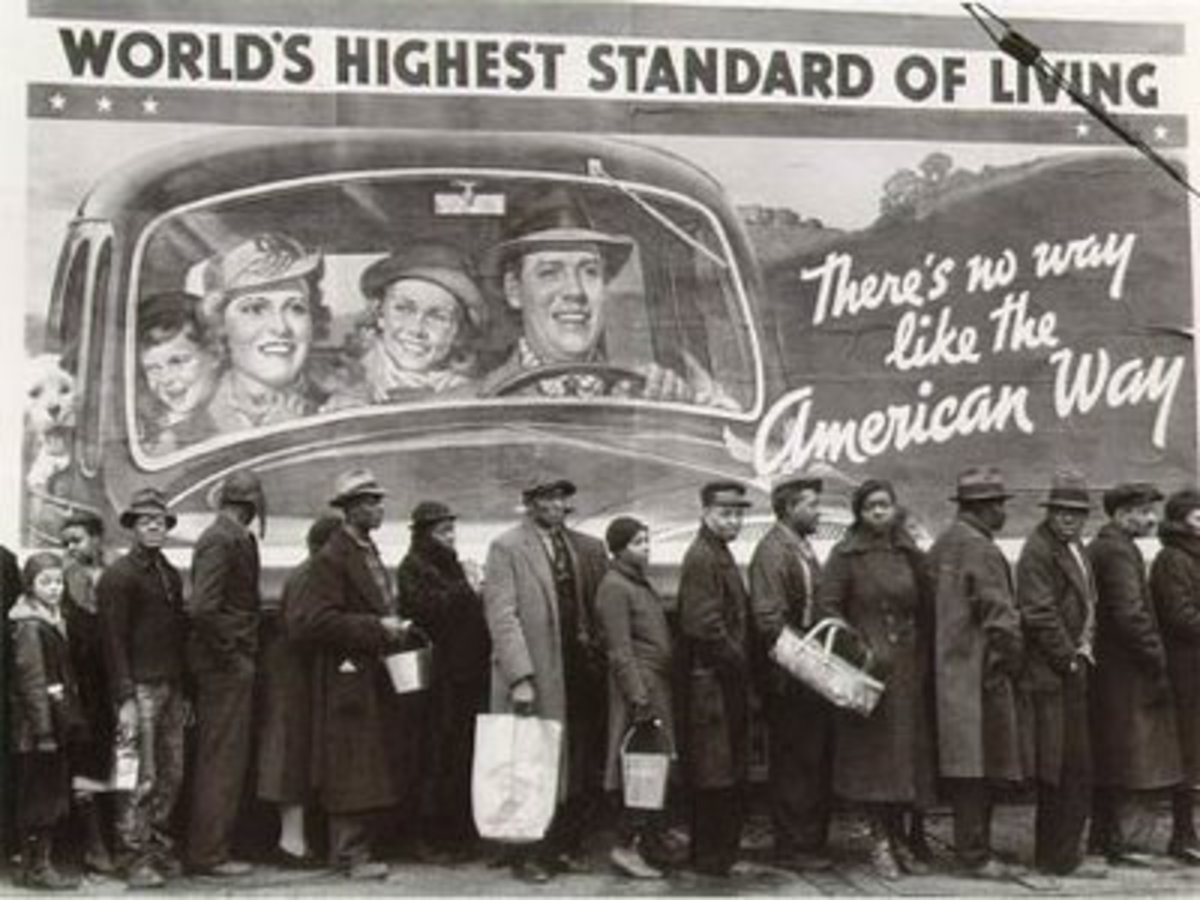

One thing is sure and was agreed by everyone: Something had to be done and fast! The disagreements are in the past so I will not dwell on the rights and wrongs about the actions that were taken. They were taken, period. Full stop on that one.

The action that was taken by the UK Government was to inject capital, from the coffers of the Exchequer. Our money! They gave our money to the banks! What had we done to deserve having our money given to those people that caused the crisis in the first place. We are never bailed out if we are bankrupt!

But then, in our case, we do not have assets. There is no equity in our situation. And that is what the Government took from the banks in exchange for the tax-pounds that were 'given' to them. Equity, that was on the floor, so to speak, admittedly. Much less worth in that equity than a few short weeks before. Catastrophically low, so our money bought a lot of it. After giving £20 billion pounds to Lloyds (with Halifax) we could show, with our equity stake, that we owned n% of the company, n = whatever number you see in the papers, it does differ from one to another.

So you and me, we, had bought a major shareholding in a group of banks that had no money. No money to do what they were supposed to do. Banks that had 'toxic debt' on their portfolio of investments. We had bought into toxicity. And it needed to be flushed out of our system. We needed to be cleansed. And cleansed we were.

Still no money to lend to the companies that could bring us out of the recession. Still no money to finance the property-movers. Still no money to pay a decent interest on the money we had deposited at the bank's. But we had bought into 'no money' with our money and we had paid dearly for it, had we not? Well, actually no. In total investment yes. In per share terms, No. We had effectively bought 'penny shares'. But still no money!

But there was money for bonuses. Indignation. How could they? Line them up against the wall and shoot the b.....y lot of them. All well and good. A typical, not uncommon, reaction. But take off your indignant blinkers and see the picture that is being painted behind that indignation.

If a bank can pay bonuses then it must be in profit?! Yes? If it has made a profit then it must be able to pay dividends!? Yes? If it can pay dividends then the shareholder will get paid a dividend!? Yes? Who's the major shareholder that will get this dividend???

Oh, it's me. It's you. It's us!

I am not going to calculate the total amount that will accrue from the dividend payments that will come from our shareholding's in the banks the Government bailed out. That can be left to the Financial commentators to calculate and disseminate. What I will say is that it is significant. Nowhere near enough to pay back what was 'given' to the banks, but significant all the same.

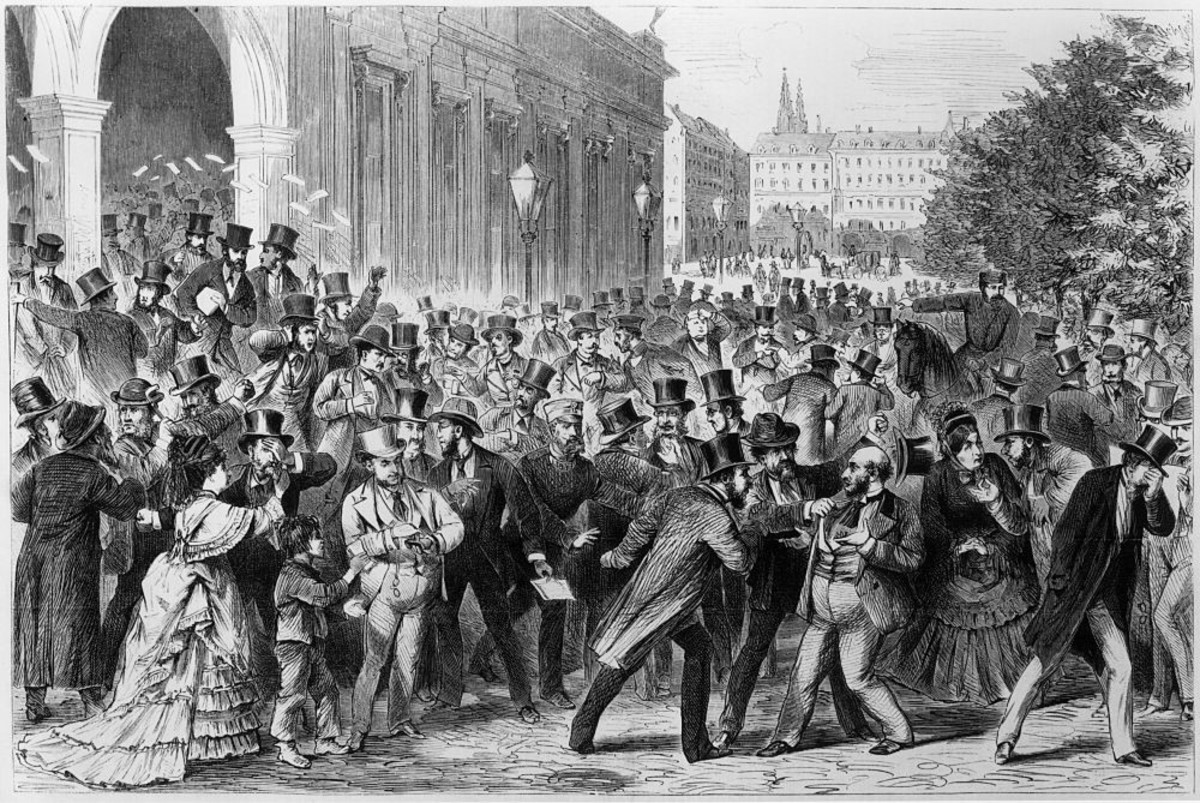

So what does that do for us? There are many good things that does for us and the political and financial commentators can be relied on not to tell the full story. There is an Election on, for Christ's sake! What is less obvious is what it does for confidence. We have been too busy chidding the banks to notice that little turn in sentiment by the investment brigade.

Seeing a profit from the banks means to them that the banks have hit the nadir in their value and that the investors are going to revalue the potential of an investment into the banking sector. And that revaluation will be upwards. And what good is that to me, us?

Well, we own a major portion of the shares in certain banks. We bought them, through the Government bail-out, at a rock-bottom price. And now we have seen a slow increase in the share price to the point where it is above the price that was paid, on our behalf, by the Government. Whoopee, we are in profit. Yes, you, me and every other person in the British Isles is in profit. But remember, at this point it is only a paper profit. A now-you-see-it now-you-don't kinda sorta like profit. We cannot spend it yet as it is incorporated in the shares themselves. A paper.profit.

Paper Profit to Investment Return

What can we do with the paper profit?

We can leave it there. Let the market do its job in revaluing the share. Let them decide how far and how quickly their sentiment takes it to new levels and see the return on investment increase. But how much is the investment worth and how much profit has been made for us?

If we bought £20bn in shares and those shares have returned to the price level at which we bought them, then our stake in the bank is Worth £20bn. Our money, that was 'given' to the banks is still our money and it is worth £20bn.

Now if I gauge the sentiment right and the share price increases by say 1% (that's less than 1p on today's share price) then the new valuation of our £20bn is now £20bn and £200 million on top. What does £200m pay for?

If it rises by 5% or around 4p then that's an extra £1bn in paper profit (it's still there, waiting). Ten percent rise = £2bn, are you starting to get my drift? And today I have heard predictions that over a two-year period the share price could be 100% to 200%. What would that mean?

Well, I don't know what the Government strategy will be on selling our stake in the banks but if their policy is a medium-term one then it would not be out of the question that they would keep the investment for 2 years. If it were sold then our actual profit (not paper profit - because we would then have secured the price with a sale) would be £20bn if the share price had doubled.

And there is no reason to believe that the share price of Lloyds would not return to £1.40 or so - a doubling of today's price (27.04.2010). Now I do not know what price the Government, on our behalf bought in at but assuming that it was today's price of 70p, then on selling, an addition £20bn would be paid back into our tax-payer pot. And that is on top of the £20bn that would be returned to the pot, equating to our original stake. Our bail-out cost.

But that's not all. We would also have benefited from the dividends paid in the meantime.

Shrewd Investment

Of the two: bail-out or shrewd investment, I vote for shrewd investment.

Our Government, on our behalf 'bailed out' the struggling banks and in return received lots of devalued shares. The Government took the contrarian view to the market that in the long term the shares would return and surpass the value that was current at the time. They made an investment in the banks. They did not spend money that would never be returned. They took an equity stake and now we are to see the benefit.

£20bn returned + £20bn profit + in dividends = £40bn+ back to the Exchequer or Treasury or wherever it came from. Back to us 'cos it came from us. What can be done with £40bn+? Lots, but that's another article. And that is from one banking group = Lloyds + Halifax.

What will happen if and when RBS and Northern Rock return to favour? Will that be another windfall of the same magnitude? Well I think RBS 'got' about £20bn also. I can't remember what Northern Rock 'got'. But lets say a total for the two of £30bn. With the same calculation as above the return to the Government would be £60bn+.

Total so far £100bn+. That would go a long way.

What Should be Done?

Let it ride for a year or so. Whatever the rises get out before the share price hits its zenith. Take a reasonable but not greedy profit. Use the money to reverse the spending cuts that will be needed in that time.

And what should Brown do?

Shout it from the roof-tops. "See I told you so!". Especially as the next Leader's Debate this Thursday is on the Economy. Whatever was going to be said by the two opposition parties will need to be revised as this bit of News comes at a most opportune moment for Brown. The Election could still be all about the Economy.