Battle of Black Debt And Red Debt Is Looming, How Can We Prevent It?

After the end of the Second World War, the victorious and superior nations under the auspices of the United Nations Founded the World Bank to provide loans to open countries.

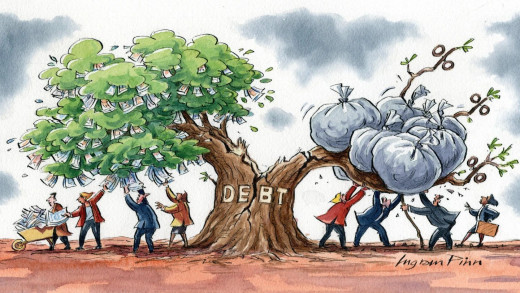

For years, we have heard the saying, "All business in the world is run on credit." But its true meaning and significance are now understood to mean that in the world we live in, everyone's business has always been on credit. And in the future too, the world economy will continue to flourish under the shadow of debt. That is, the world consists of two types of countries. One is the borrowers and the other is the lenders. You can also call the lending countries global moneylenders and moneylenders because these global moneylenders are interest-free. They do not lend to anyone and after issuing a loan they receive interest first and their real money later. After the end of the Second World War, the victorious and superior nations under the auspices of the United Nations Founded the World Bank to provide loans to open countries. The World Bank has grown the world economy under its shadow since its inception. All the terms currently used in the world to understand the modern economy are the brainchild of the global moneylenders who serve in the World Bank.

Under what principle will the value of money, the price of the gold rise, and under what regulation? When to apply gold? And when will gold prices be cut and oil prices set on fire? All this is decided by the moneylenders and moneylenders who serve in the World Bank. Borrowing countries are not allowed to talk about it. Interestingly, since the World Bank came into being, it has only propagated one thing with full force. It is becoming clear that the economies of poor and developing countries cannot stand on their own two feet without borrowing from the World Bank and its subsidiaries. This is why whenever a poor country borrows from the World Bank, its economic growth rating is downgraded from positive to negative. Sometimes, World Bank employees are just waiting for a loan from a lender's representative. Negotiating that the report of the World Economic Organization, the country's economy is starting to fly upwards. All this arrangement and incentive is given to the poor and developing countries only to get loans from more and more international institutions and become their priceless slaves and hide behind the global financial institutions.

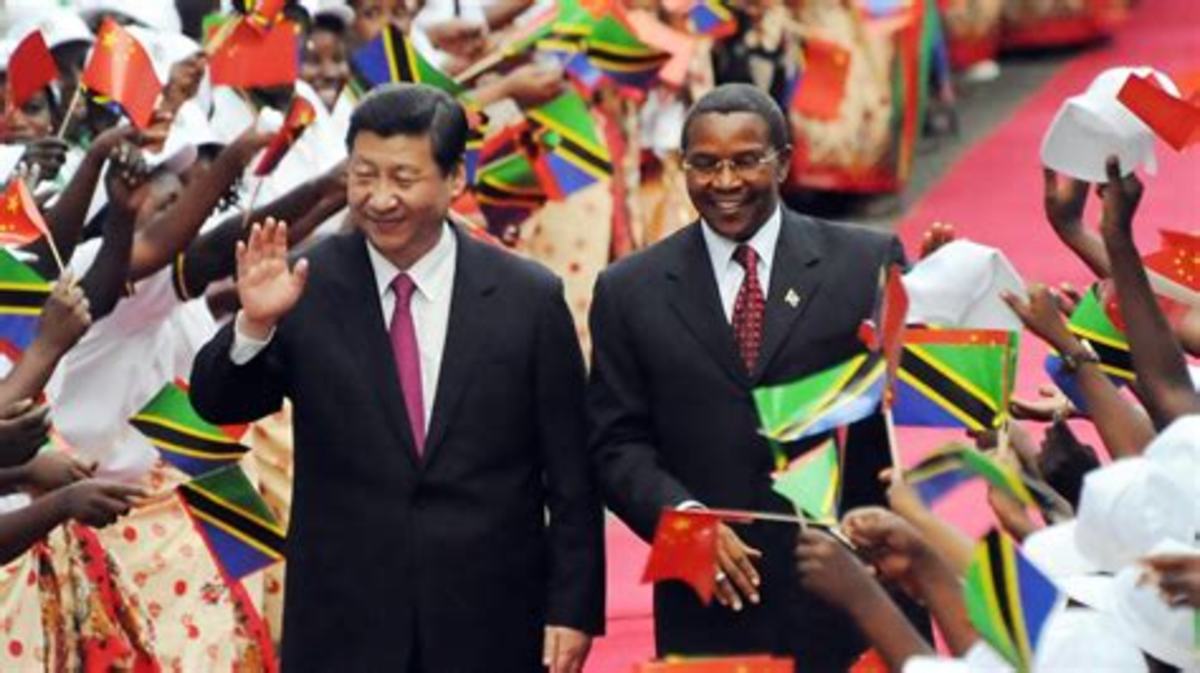

China suddenly rises to the top of the list of global lenders, every economic institution operating under the auspices of the World Bank since then has been deeply concerned about the indebtedness of poor and developing countries.

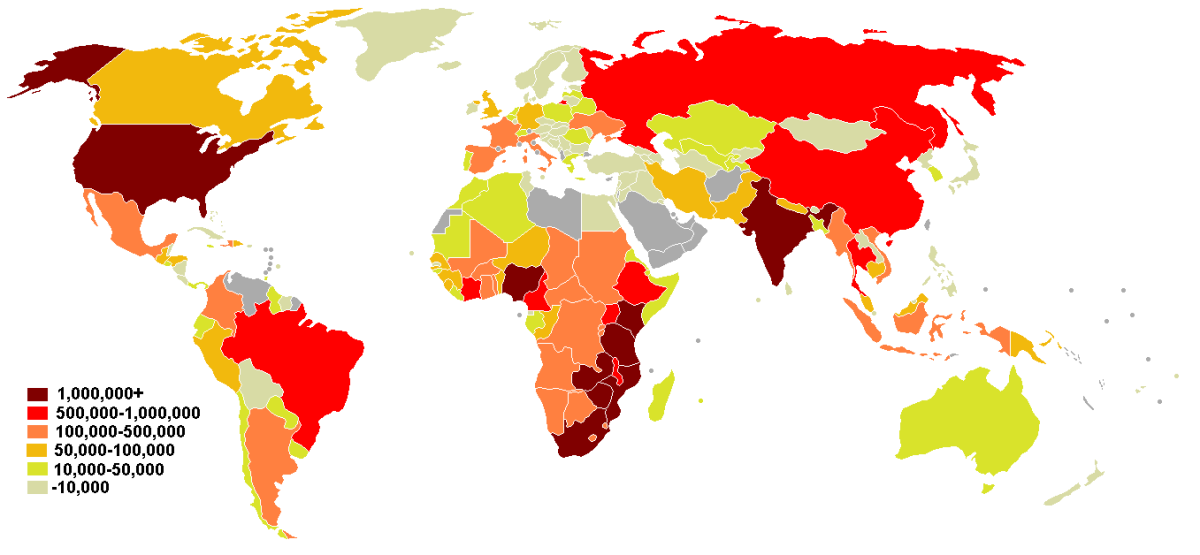

No international financial institution saw any harm in this lender and borrower, as long as the World Bank, or so-called global superpower America was lending to most countries of the world. But as China suddenly rises to the top of the list of global lenders, every economic institution operating under the auspices of the World Bank since then has been deeply concerned about the indebtedness of poor and developing countries. New research reports are coming out daily about the harmful effects of global debt, but strangely enough, all these reports are about the debt that China is providing. At the heart of these reports is the fact that Chinese debt is a huge loss to the economies of developing and poor countries, and it is suggested that if these countries want to avoid future economic instability, they refuse to borrow from China or report the details of these loans to your old World Bank. According to these reports, 122 countries around the world are burdened with debt. The situation of African countries is very bad. In other words, in Africa, which is considered to be the most backward and least developed continent in the world, the debt crisis facing many countries has become so severe that these countries are now in debt. Worried about returning and making no effort.

From 2000 to 2017 alone, the total amount of loans that China gave to African countries for their infrastructure and other projects was worth 143 billion euros or 161 billion euros.

It should be noted that the loans provided to the needy and poor countries of the world by various international organizations and rich states are kept at such low-interest rates that these loans are later called "cheap loans". But the downside is that many of the countries that take out such cheap loans borrow more than they can afford, leaving them trapped in a trap that It is never possible for them to get out of China. From 2000 to 2017 alone, the total amount of loans that China gave to African countries for their infrastructure and other projects was worth 143 billion euros or 161 billion euros. Billions of dollars. Unlike the World Bank and its subsidiaries, the Chinese government has forgiven large debts owed to many African countries. This is the positive side of the Chinese moneylender, which has severely damaged the reputation of the past global moneylender America. By the way, global loans for financial assistance and business purposes have always been an important part of US foreign policy in countries around the world. But when it comes to China compared to the United States, one word that is heard and read a lot in the world media is "debt diplomacy", which means to establish its influence in the world through debt diplomacy. The word has been used interchangeably with China for no reason, even though the United States and its allies in the West have been doing the same thing for decades. is being done.

The international economic institutions that portray China as a hardline global moneylender would have forgotten that some time ago they were also on fire in this position and now if China has taken over this position then what is wrong with it? China, too, is lending to the world's poorest and developing countries at the behest of their leaders. Two decades ago, China was a creditor as a world economic power. It was starting to get stronger. This was the time when China adopted a policy of greater openness to the outside world. During this time, China's economic growth was accelerating and China's importance on the international economic scene was also increasing. At present, China has become the world's largest government lender. That is, no government in the world lends as much as China lends. Remember that China owes the rest of the world (including developed countries) more than half a million dollars. That's about six percent of the world's GDP. Twenty years ago, this debt was only one percent of GDP. Although China lends to all kinds of economies, it dominates low-income economies. Djibouti, Tonga is one of China's ten largest indebted countries. The Maldives, Congo, Kyrgyzstan, Cambodia, Niger, Laos, Zambia, and Samoa. In 2017, it grew to more than 15 percent of GDP. From another angle, 40 percent of the group's external debt comes from China. The group has the largest borrowers from China, three Latin American countries, Venezuela, Ecuador, and Bolivia.

Maybe that's why every country is trying to get maximum loans from China on the softest terms instead of getting loans from the World Bank or its subsidiaries on tough terms. This situation is totally unacceptable to the World Bank and the United States

There are many reasons for China's growing economic position in competition with the United States and the World Bank, but the most important is that China pursues a unique policy of providing maximum lending on very soft terms compared to its predecessor, the United States. He is a paramedic and often forgives his debts. This is a special incentive that no country other than China is currently in a strong position to give to any developing or poor country in the world. Maybe that's why every country is trying to get maximum loans from China on the softest terms instead of getting loans from the World Bank or its subsidiaries on tough terms. This situation is totally unacceptable to the World Bank and the United States, but the trouble is that they can't do anything because, over the past decades, China has made itself so economically strong that it can do all over the world if it wants to. Debts owed to developing and poor countries can be forgiven and doing so is not going to make the slightest difference to its economic momentum or status. Yes! It is certain that by doing so, China can become a benefactor and messiah to the developing and poor of the world, whom the world will gladly recognize as a world power. That is, the world is now rapidly pulling itself out of the swamp of black debt from the United States and the World Bank and moving into the "economic valley" of China's red debt. Can the red loan provided by China change the destiny of the world's poorest and developing countries? The answer will be found in the next few years, but not until a clear answer is found. Watch the battle of black debt and red debt over each other with utmost consolation and silence.

Can the red loan provided by China change the destiny of the world's poorest countries?

This content reflects the personal opinions of the author. It is accurate and true to the best of the author’s knowledge and should not be substituted for impartial fact or advice in legal, political, or personal matters.

© 2020 Rao Muhammad Shahid Iqbal