Budget Debate: Difference is 1%

Argument is not about size or cost of government

Hearing all of this talk surrounding tax returns and budget battles lately... lemme try and offer y'all some perspective.

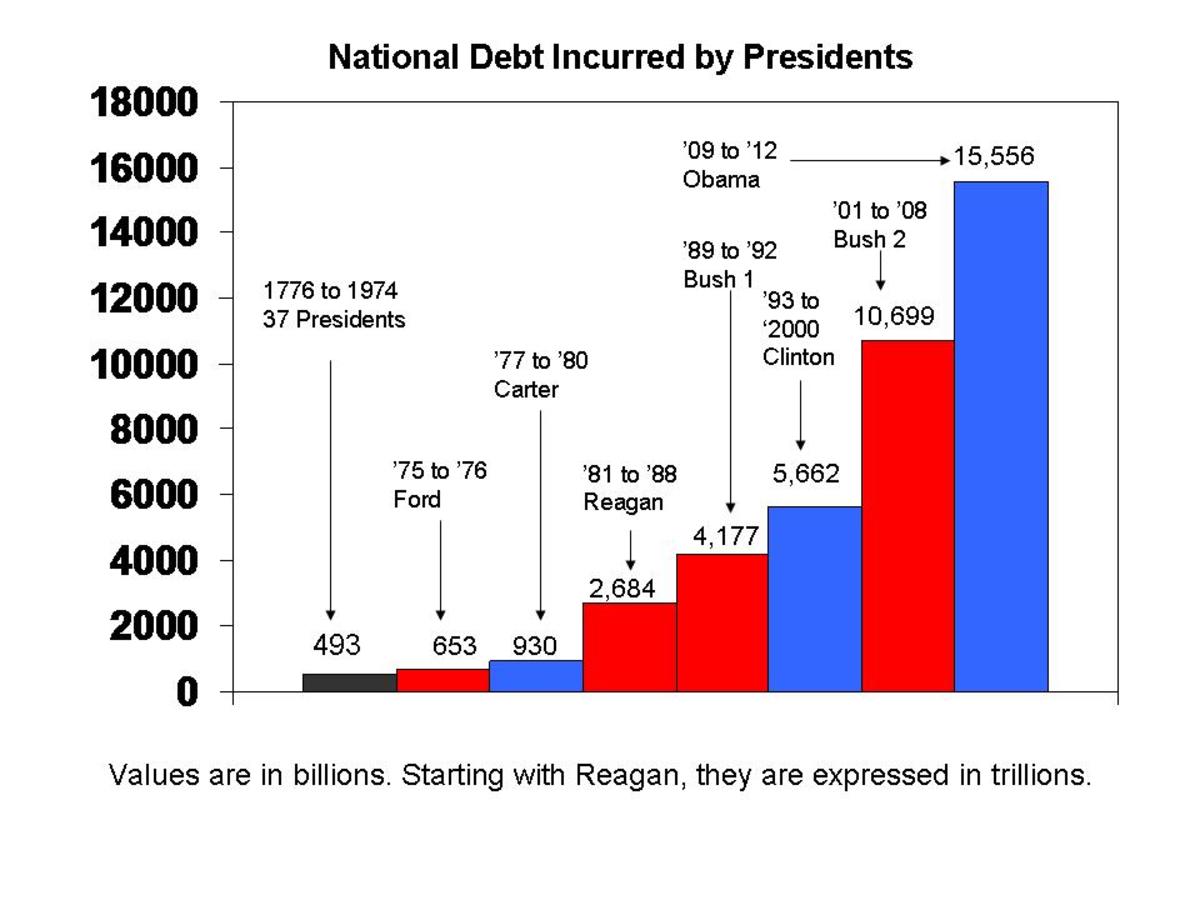

Obama’s plan (2013-2022) projects $45tr in total budgetary spending at a 5% annual growth rate.

Rep. Paul Ryan's budget projects to $40tr at 4% annual spending growth.

To put it another way, we are arguing over 1% in spending. It's not exactly freedom versus shackles here, but it's important to note the differences.

President Obama’s plan will bring us back to the top Clinton-era income tax rate of 39% and will bring tax rates on unearned income (dividends on capital gains and carried interest) up from 15% to 20%, after the first $200k (which is exempt); Obama's plan would also cut subsidies for Big Oil; and of course further implementation of Obamacare.

Rep. Ryan’s budget would lower the top income (and corporate) tax rates to 25% and would completely eliminate taxes on unearned income. Romney-Ryan would also repeal Obamacare. Under Rep. Ryan’s plan, which was voted upon and passed in the Republican-controlled House of Representatives, Gov. Romney would’ve paid a whopping .82% in taxes in 2010 (Romney actually paid 13.9% that year).

The stark differences we see between these proposed tax codes underscore the chorus of calls for #RomneyReturns.

And then there's that whole trust thing.

Rep. Ryan's refuses to identify the specific revenue sources (closing loopholes or rescinding tax credits) necessary in order to balance his budget, however. Instead he imagines extremely presumptuous growth rates and offers the elimination of the mortgage tax credit.

Gov. Romney has said that the details will be cleared-up for us post-election.

Romney has said though, that he expects 4% GDP to be set aside for defense spending which would mean spending $7tr on defense to Obama’s proposed $5.8tr (Obama's plan raises defense spending from 10.7% up to 11.8% of the budget). Paul Ryan would cut discretionary spending from 12.5% GDP down to 6.5% GDP. Under their stated scenario, Romney-Ryan would only allow for 2.5% GDP (lowest since 1930, with an average of 3.8% from 1968-2009) for non-defense discretionary spending (NDD) which includes mental health, law enforcement & immigration; most education; NASA; CDC; R&D; DSHS; environmental, workplace, consumer, food & drug safety and protection agencies...

Add in the mandatory spending items such as Medicare, Medicaid, SSI, Child Nutrition, Child Tax Credit, Unemployment Insurance, food-stamps (SNAP), veteran benefits...

Plus those interest payments on the deficit, and that’s basically the whole budget.

Once we are able to look past all of the hyperbole and through to the totality of the actual numbers in each budget, we see two vastly different plans that are yet and still remarkably similar in dollar amount.

And thus, our choice this election is not at all about the size of government or the level of deficit spending; it is instead about the real function and soul each party has envisioned for the government and our country.

8/21/12