Columns from the Whitstable Gazette: "Credit Rating Agencies Are Agents for the Banks."

Who are Standard and Poor’s?

The credit ratings agency Standard and Poor's has downgraded France's debt, from a prestigious triple A rating, to a less desirable AA+.

Meanwhile Austria, Italy, Spain, Cyprus and Portugal have also had their ratings downgraded, Portugal to "junk" status.

What this means is that the cost of borrowing has gone up for all of these countries, and the Eurozone has once again been thrown into crisis.

Several things strike me at once. Firstly that Standard and Poor’s is a private company, and yet it appears to hold the economic well-being of a whole continent in its hands.

I wonder if other people are as surprised by this as I am?

At what point did the European Union – a political organisation consisting of twenty seven states and several hundred million people - give its sovereignty away to a small number of private companies operating out of Wall Street and the City of London?

Next it is the inordinate amount of power these companies seem to wield. One word from one agency, and the whole financial world is thrown into chaos and the livelihoods of millions of people put at risk.

Finally I’m struck by how little like an objective process this is. Who are Standard and Poor’s? Have they been selected by some recognised body on the basis of their independence and economic expertise? No. They are a private company whose first purpose is to make a profit and whose loyalty is to the banks they serve, not to the public.

A credit rating is an opinion, not a fact. It is an assessment being made by a bunch of shady individuals, in a locked room, without oversight, on the basis of some criterion over which the rest of us have no control.

Who elected them? Who gave them their power? Who was it who decided that these companies and no other should have the right to assess the credit worthiness of whole nations? Where is the oversight? Where is the public accountability? Where is the peer review system able to judge the accuracy of their ratings? Who assesses the assessors, in other words?

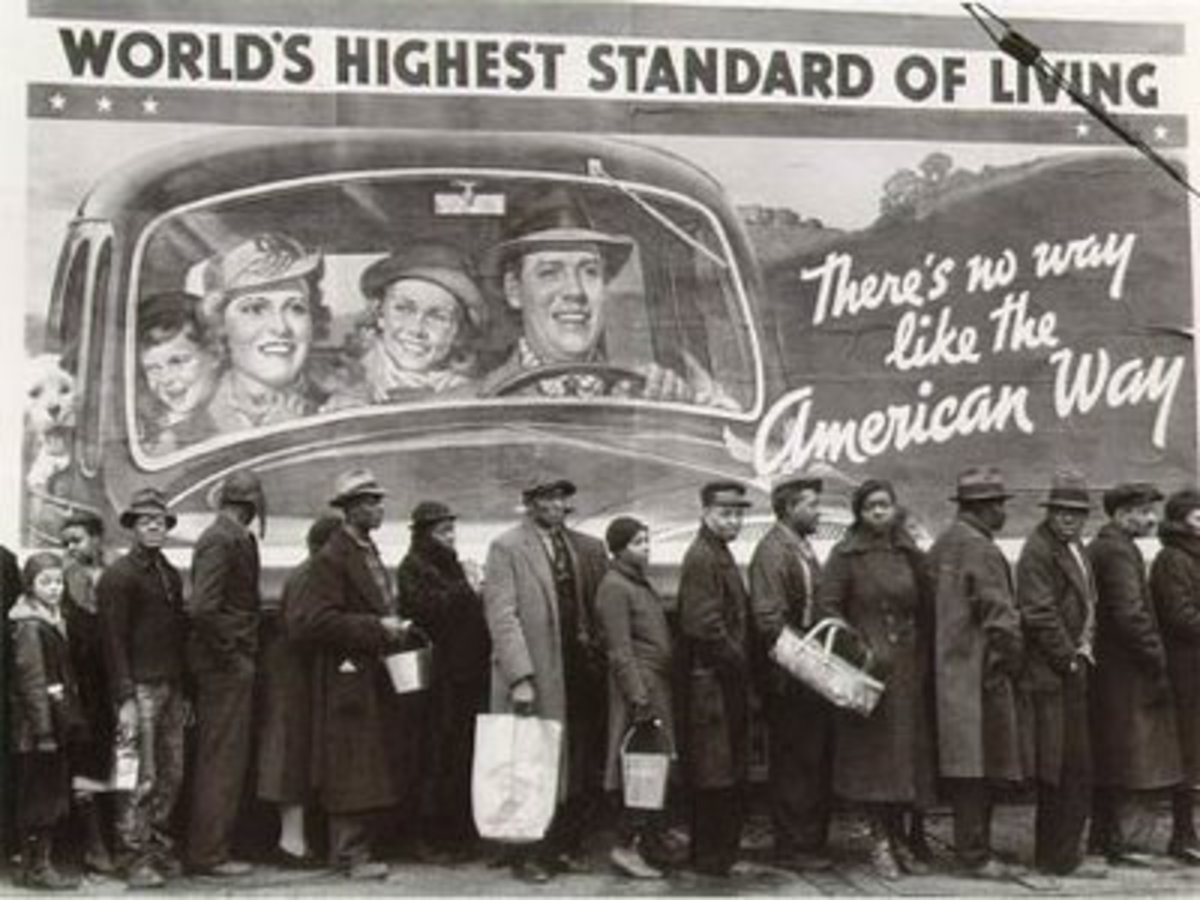

It was these same agencies, remember, who gave triple A ratings to the dodgy financial packages which brought the economic system to the brink of collapse in 2008.

What this amounted to was fraud, slicing up and repackaging sub-prime mortgages that the financial institutions knew were going to default as top grade investment opportunities.

The ratings agencies were fully complicit in this process, as was noted by the Financial Crisis Inquiry Commission in the United States in its report in January 2011: "The three credit rating agencies were key enablers of the financial meltdown. The mortgage-related securities at the heart of the crisis could not have been marketed and sold without their seal of approval. Investors relied on them, often blindly. In some cases, they were obligated to use them, or regulatory capital standards were hinged on them. This crisis could not have happened without the rating agencies. Their ratings helped the market soar and their downgrades through 2007 and 2008 wreaked havoc across markets and firms."

Parthenon for sale

Economist Joseph Stiglitz said: "I view the rating agencies as one of the key culprits...They were the party that performed the alchemy that converted the securities from F-rated to A-rated. The banks could not have done what they did without the complicity of the rating agencies."

In other words what they were doing in 2008 is exactly what they are doing now, wreaking havoc, but this time not only amongst firms, but across whole nations.

So what happens when a nation like Greece has its credit rating downgraded to junk status? Basically it can’t borrow, which means it can’t get money to service its debts. The IMF moves in, and the country is forced to sell off its assets to pay its debts. It’s like a garage sale of public assets. Everything must go, at rock bottom prices. And who benefits from this? Well the banks, of course. The banks get to buy up the public assets, which they can then “monetise”. They get to own the Parthenon and the Lottery and the country is forced into even greater debt, having now lost its only forms of income.

It is legalised theft, and all enabled by that fictional “credit rating” provided by the ratings agencies in the first place.

It is by this process that the world is being driven into further and further indebtedness to the banks.

More on the economy by CJ Stone

- Who Says Were All In This Together?

Economics is not science. It is propaganda for the corporate sector. How politicians blind you with pseudo science in order to disguise the corporate rape of our economy. - The Market has a Name. It is Goldman Sachs

The human race is in debt to itself for more money than there actually is in existence. Even if we all tightened all of our belts and starved ourselves to death to pay off the debt, we still couldn’t succeed. There just isn’t enough money to do it. - We do the work. Someone else takes the wealth.

Economics is easy to understand. It is work that makes wealth. It’s as simple as that - The Empire of Things. On The Social Psychology of Looting

In the social sphere, the financial sector is a kind of collective psychopath, destroying the health of the economy for its private gratification. - Useless Idiots: cuts, war-crimes and quantitative easing

While the banks are busy looting the world in what is effectively a financial protection racket, forcing the sell-off of public assets at rock bottom prices, the defence of those assets becomes a priority for all concerned citizens.

© 2012 Christopher James Stone