Crude Impact: The Era of Oil is Over

Leading petroleum geologists have published studies explaining that more than 95 percent of all recoverable oil has now been found. The world has not extracted all the possible oil from reserves but the global oil industry has reached its limit to produce cheap oil. Fifty years of extensive research and analysis has revealed global oil producers have plateaued and reached a maximum possible production level or surpassed it and it is now declining. This is called 'Peak Oil'.

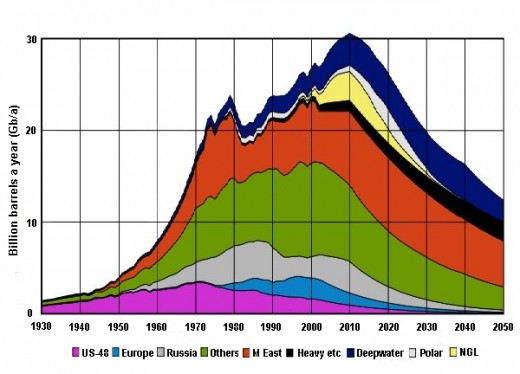

Peak oil production has now happened in 33 out of 50 countries. The peaked oil countries represent 98% of all global oil production. The key problem is a lack of new oil discoveries resulting in no growth and a sharp decline. There must be new reserves to feed future demand to fuel continued growth or growth stops, peaks and declines. An individual oil well will always increase in production and finally peak at the 50% point then the decline happens till it is dry.

Geologists have surveyed every country in search of the next big oil reserve so it has been determined that 95% of global oil has already been located. Trends indicate global oil production peaked in 1964 and has been since on a steady decline. Since the early 80s, the world has consumed oil four times faster than they could find it. 90% of all oil reserves are already in production and we are well advanced past the peak point and is now at a plateau. The world has consumed over 2.3 trillion barrels of oil or well over half of all known oil reserves. No new oil reserves have been found since 2003 in the world. This means the world is being powered on what is left in known reserves and time is running out.

In Alberta, some believed Saudi Arabia was sabotaging the market by flooding it with their oil driving prices down. Others are way out of touch and blame the new provincial government for halting pipelines and increases in carbon emission caps as the cause of this recession. Some can't even understand the scientific concept of Peak Oil point let alone global supply and demand data and think the failing market has to do with high costs vs low costs. None of these are the case.

Saudi Arabia is the largest global oil producer supplying 73% of the worlds oil and estimates of its reserves have been quite inflated putting more confidence in the market. The remaining 27% of world oil supplied to the market from other countries is relatively small and can't sustain the present or future global demand without Saudi Arabia. Studies now indicate their production peaked in 2004 and has been declining ever since and now 90% of their production plans have collapsed. They've even resorted to hydrofracturing the largest wells there with sea water to boost production which finally depleted those wells. Exploration has been exhausted and no new wells have been found in Saudi Arabia either. The whole Middle East is in oil production decline. Saudi may be able to maintain some level of its current production in the short-term but it won't be enough.

A historical study of trends and production by Kuwait Oil and Kuwait University based on a multicyclical model of 47 oil producing countries estimated a revised global peak date of 2014 and other studies estimate it will be reached anytime between now and 2020. The fact is things are so precarious, they cannot say when the end of the decline and bottoming out will take place. To admit such would be further stock losses but this is not new news to investors. The International Energy Agency estimates Saudi Arabia would need to double its current production to meet future global oil demands which grows by 2% each year. It is not going to happen.

There is also tremendous new demands for oil from emerging economies in developing countries where oil and gas consumption is booming. Future needs obviously can't be met. In fact, Exxon Mobile and Chevron have purchased full page ads in Europe expressing there will be challenges in meeting future oil demands. The price of oil will certainly increase again, when the last remaining oil reserves are exhausted and sold to the highest bidder. But the production boom days are long over. It has taken between 50-300 million years for oil reserves to form, and we have managed to exhaust well over half of it all in merely 125 years.

Global Oil Peak

Technology may have unlocked shale and the Mexico and Iran markets are opening up, but those are existing and accounted for reserves, they are not new news. Have you wondered why in a time where there seems to be excess oil are closed markets suddenly opening up? Because they have run the numbers and predict the trend, there is no way with all the reserves can they meet the future demand. No one wants to be caught with worthless oil stocks and so investors have liquidated them to save their shirts. So where are the investment funds to pay for remaining oilfield extractions and pipelines? It is gone.

Energy investors such as Warren Buffet, Bill Gates and Google as well as other billionaires quickly dumped their stocks in oil and gas and.. so is everyone else. They are getting out now while there is still some public delusion that there is still oil remaining ground reserves. Meanwhile once booming oil towns are bust in Texas and over 100,000 people are laid off in Alberta. There is false hope in these places that oil production will make a turn around and things will boom again but many aren't informed on the markets or aware of the science behind the studies. They only believe rumor and what they are told and frankly, the oil companies are not saying much.

The International Energy Agency (IRE) is a Paris based autonomous intergovernmental organization established in the framework of the Organization for Economic Cooperation and Development (OECD) which is another organization consisting of member countries. The IEA is essentially a group of governments created during the 1973 oil crisis. It addresses physical disruptions in the supply of oil and gas and reports statistics about the traditional and alternative energy industries.

It has been highly criticized by scientists and watchdogs of misrepresenting and bloating data about the oil industry, especially predictions on global reports that reported higher supplies in reserves and suppressing data about reaching the peak oil point. Reportedly, it did so under pressure from the U.S. which is the largest oil and gas market consumer. Incidentally, George W. Bush was President in 2008. He and Dick Cheney's families owned substantial investments in oil and gas, especially Halliburton.This infers that government representatives in the agency were manipulating data, reports and essentially the investment markets in the favor of oil and gas for evidently financial gain and to prolong the collapse of this market.

It also sabotaged and underestimated data about the alternative energy sector including solar and wind, progress and sales misleading people and creating doubt in this market. These misleading global reports kept investments in oil and gas stable with market confidence while decreasing investments in alternative energies.

It was realized later that solar and wind power technology sales were four times higher than what the IEA reported. With rising discontent at this obvious corruption, in 2009 the International Renewable Energy Agency was formed to be the new watchdog for the this global sector. IRENA recently published a notable report on its works titled REthinking energy, which encouraged "speedier adoption of renewable energy technologies," as "the most feasible route to reduce carbon emissions and avoid catastrophic climate change."

It was only the U.S. and then Canada who would not sign the Kyoto Protocol on Climate Change at that time and both countries did not agree to reducing carbon emissions from fossil fuels thus encouraging further growth and investment in an industry both governments knew were drying up fast. This effectively falsely protected oil companies and oil revenues and kept global consumers in the dark. Not signing the agreement caused this policy to fail and delayed progress on climate change policy till the next convention in Paris 2015. Kyoto would have been the only international policy to legally enforce law and penalties upon high emission countries. Incidentally, the Prime Minister of Canada at that time was Stephen Harper of the Conservative Party.

Sources:

USA Today, Crashing Oil Prices Decimate Texas Boom Towns. http://www.usatoday.com/story/news/2016/01/20/texas-oil-prices-boomtowns-crash/79086400/

Rational Exchange. Peak Oil. http://www.rationalexchange.com/index_transition%20initiatives_peak%20oil.htm

International Renewable Energy Agency. Wikipedia. https://en.wikipedia.org/wiki/International_Renewable_Energy_Agency

The End of the U.S. Oil Boom. Alberta Oil. http://www.albertaoilmagazine.com/2016/01/is-this-the-end-of-the-us-oil-boom/