Economic Impacts of Brexit

Overview

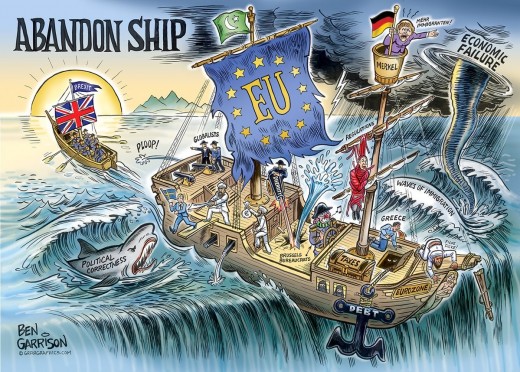

Just a few months ago, news broke that Britain had decided to leave the European Union. Britain’s decision is now known as “Brexit”. There were many theories as to what was going to happen to the economy from Britain leaving the European Union. Now that a few months have passed, we can review the overall outcome of the situation. We can also make guesses as to what will happen in the future. Britain leaving the European Union has had many effects on the European economy as well as the global economy. Many experts predicted that the economy would take a hit, and that the growth of the economy would slow down. After a few months have passed, Britain had proved them wrong with their economy going on the rise. Even with their economic growth, experts still project that their economy will fall. In the long run, Britain’s decision could pave the way for other countries to leave the European Union. Under those circumstances, this could lead to the collapse of the Euro, which would send the economy into a downward spiral.

Immediate Impacts

If another country like France were to leave the Union, it would be arduous for the European economy to stay strong. The Euro could collapse from this, and that would cause many countries’ economies suffer (Gillespie). The European Union is one of the world’s largest trade blocks, and if they were to fall apart, all of the trade deals would have to be reconstructed for each country. Reconstructing trade agreements is a lengthy process that would take years to get ratified. While Britain was in the European Union, there was a free trade agreement in place that allowed countries to not have to pay tariffs. Now, they will have to pay costs to ship their goods (Boulanger). Around 63% of Britain’s total exports go to countries in Europe, this could prove to be costly in the long run.

Speculation has occurred that other countries might leave the European Union. In that case, many experts think that this outcome is unlikely due to the fact that the countries would have to reinstate their old currency. Reinstating currency is a long, tiring process because everyone would have to transfer one to the other, and an exchange rate would have to be set. Britain was still using the pound, so they did not need to worry about having to implement a new currency.

Another issue is determining the restriction of immigration. In the European Union, citizens can move freely from country to country to find jobs. This helps the economy grow long term because it is easier for people to find jobs. Now that Britain has left the Union, they can say who can come into the country and who cannot. This will lead them to only letting highly skilled workers in the country rather than lower skilled workers.

Impacts on the United States

The U.S. dollar has increased in strength since Britain decided to leave the European Union. This may sound favorable to the average United States citizen, but it actually hurts business in the United States. Henceforth, the growth of the dollar leads to less sales for businesses due to the higher price in dollar strength. When foreign countries look at American companies, it makes them a lot less attractive to purchase from (Allan, Monaghan). Consequently, this leads to total exports declining from the dollar gaining strength, from the high costs companies would have to pay to buy American goods. Manufacturing companies rely heavily on exports. In the last twelve months, 39,000 jobs have been lost since the exports have been decreasing, and companies cannot afford to keep employees. On the contrary, imports are one of the few positives of the dollar gaining strength; they have become cheaper due to the fact that the United States can buy more with the dollar.

Long Term Impacts

Many experts deemed that the economy in Europe would suffer greatly from the exit. As a result, experts believed that the economy could fall a staggering 5% (Douglas). Britain’s economy has grown 2% in the third quarter. Therefore, Britain proved to be resilient through the first few months. The future is uncertain with many still believing that the economy growth will slowly decrease. This is due to the pound decreasing in value, which would drive up inflation. When there is inflation, consumers are less likely to spend money and invest. There is one certain company that is investing into Britain, it would be Nissan. Nissan believes in the British economy, with their decision to continue the production of 500,000 vehicles a year in the country. (Douglas)

Ending Thoughts

In conclusion, we learned that many companies were afraid to invest into Britain’s economy due to sheer uncertainty. For that reason, nobody can be 100% positive when it comes to predicting the future. The immediate impacts have not affected Britain’s economy greatly, but more so the global economy. In the next few years, it will be interesting to see where Britain’s economy is at, to see how the country is doing overall and to see if the exit was worth it.

Poll

Do you think it was worth it for Britain to leave the European Union?

Do you think Britain will continue to see economic success?

References

Allen, Katie, and Angela Monaghan. "Brexit Fallout – the Economic Impact in Six Key Charts." The Guardian. Guardian News and Media, 08 July 2016. Web. 31 Oct. 2016.

Boulanger, Pierre, and George Philippidis. “The End Of A Romance? A Note On the Quantitative Impacts Of A ‘Brexit’ From The EU.” Journal of Agricultural Economics 66.3 (2015): 832-842. EconLit with Full Text. Web. 31 Oct. 2016.

Douglas, Jason. "U.K. Government Hails Growth Data, Nissan Commitment After Brexit Vote." WSJ. Wsj.com, 27 Oct. 2016. Web. 31 Oct. 2016.

Gillespie, Patrick. "How Brexit Impacts the U.S. Economy." CNNMoney. Cable News Network, 24 June 2016. Web. 31 Oct. 2016.

![Isn't the European Union the Model Conservatives Are Actually Asking the United States to Morph Into? [127*-8]](https://usercontent1.hubstatic.com/6376132_f120.jpg)