Fiscal policy and VAT: tourism taxes in London, Paris, Amsterdam and Rome compared

Savoy Hotel in London

Among the taxes charged on tourism, the Vat is one of the most discussed.

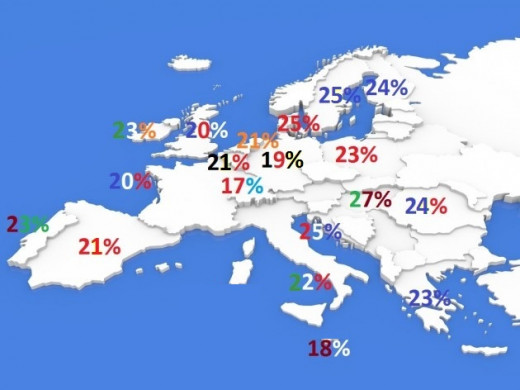

There are differences in the Vat rate from country to country and from sector to sector. The European standard tax, that is between 19 and 25%, is often not applied to the sector of tourism, which according to european regulation, can have reduced rates (ex. 15%). Some primary goods must have reduced rates (ex. 4%). But let's see how do the governments drive their decisions.

According to European law, there is a finite list of sectors in which Vat rate can be lowered than the standard. This list is set out in Annex III to the principal EC VAT directive (2006/112/EC). The following items are the most important:

Admission to shows, theatres, circuses, fairs, amusement parks, concerts, museums, zoos, cinemas, exhibitions and similar cultural events and facilities.

Accommodation provided in hotels and similar establishments, including the provision of holiday accommodation and the letting of places on camping or caravan sites.

Restaurant and catering services, it being possible to exclude the supply of (alcoholic and/or non-alcoholic) beverages.

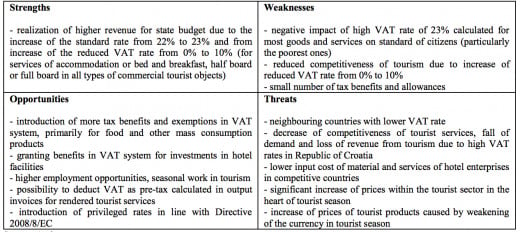

Swot analysis about a policy which increments Vat taxation

In the end, a favourable fiscal policy is very helpful from the point of view of the companies and anybody wants the Vat to have a reduction in his sector. For example in the United Kingdom, whether the standard rate is not particularly high (20%), tourism is comprehend on it ; and tourism and entertainment associations are arguing thathaving it reduced would provoke a prices cut, boosting sales and employment in this sector, which in turn would encourage growth in the wider economy.

France and the Netherlads have a lower Vat rate in tourism sector; in France this concerns all the tourism and entertainment sector, in the Netherlands it regards onlycinemas, active and passive sports, circuses, fairs, amusement parks, zoos, museums, swimming pools, restaurants, public transport, taxis and private

bustransport.

Anyway reasons for keeping the highest Vat in this sector are quite clear. Tourism depends on infrastructures and infrastructures can be done only by the public, funded through taxes, of which Vat is an important part. Would it be worthy to lower taxes and reduce Vat income risking infrastructures to be worst? And why should this be done in a sector traditionally connected with luxury, that is not primary need? However pressures from tourism linked organisations are strong.

Several european big cities have implemented another tax, due to tourist tendency to get the city overcrowd, that in the countryside is absent. The "bed tax" that is a fixed amount charged on the hotel fee, generally it's not over 2 or 3 euros. Rome and Paris already have it. Britain is discussing about its implementation. City of Camdenwould gain 5 millions pounds a year, The Guardian estimate.

Map showing level of the Vats in Europe