Fixing The Tax Code

Introduction

The US tax code is currently over 70,000 pages. It is time for major reform. It needs to be simplified and made fairer.

-August 2015

Face of IRS

What Is The Purpose of The Tax Code?

First, what is the purpose of an income tax? It is to collect funds necessary to run government functions including national defense and building infrastructure and maintain law and order etc.

The revenue collected benefits all of us. As citizens, we want to have a well funded government. The issue becomes what is the best way to collect these revenue. The IRS was established to do this. It is suppose to be an independent agency without the political influences of any particular party or elected officials. As we have experienced in recent years, that is not always the case.

In addition, the tax code has been perverted by lobbyists and politicians who wants to use it as a mean of social engineering and crony capitalism.

What Is the Best Way?

Suppose you were asked to design a system to collect money from the American public from scratch. What should be the goal and what would it look like?

Goals:

- It must raise the amount needed to run government.

- it should be fair. This is a loaded word for some. What is fair for one may not be for another.

- It should be as simple as possible and easily implemented and easily for the public to comply.

- It should be easily enforceable.

- It should be independent and not influenced by any political parties in power.

Some Other Considerations

- Tax exemptions such as mortgage and interests...

- Income from Capital Gains

- Estate Tax

- Exempt organizations such as charities and religious organizations

- Tax on Corporations and income from foreign operations

- Is FICA considered a tax?

Some Various Options...

- Progressive Tax System (the rich pay a higher percent)

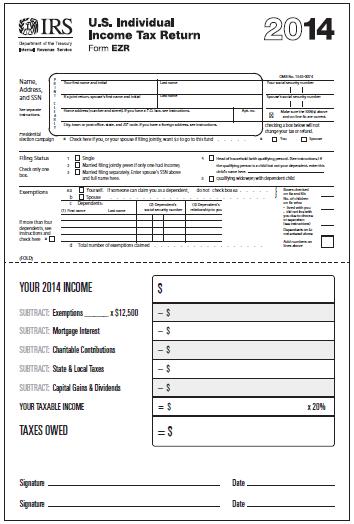

- Flat Tax (everyone pay a flat percent equally)

- Sales Tax or FairTax (Consumption tax for example 23% proposed to replace current income and FICA combined)

- A combination of the above

- Do nothing (leave it as is)

Sample Flat Tax Form

Summary

The tax code is too large and too complicated and in my opinion it was done by design. If the intent is to create a huge bureaucracy so that tax liabilities can be challenged in courts and allow some to gain advantage over others through loopholes, the current system is perfect. It is not designed to be easy and fair. Of course, any new proposal will be revenue neutral compared to current law. The same amount would be raised, just a different distribution and hopefully a lot simpler and will put tax accountants out of business.

Some Related Information

- How FAIRtax Works | FAIRtax.org

Americans For Fair Taxation® (AFFT) was founded in 1995, by three Houston entrepreneurs. It is a nonpartisan 501(c)(4) grassroots organization solely dedicated to replacing the current income tax code with a national retail-level consumption tax.