Free market systems analyzed as an algorithm - when do they manage resources well, or poorly

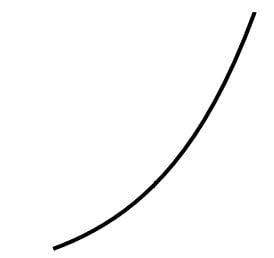

Number of market participants over time

The free market model

The free market system can be analyzed as an algorithm. It is interesting to do so, because Libertarian thought is quite influential in our society, and may be becoming more so. When reduced to its core, Libertarianism seems to be an unquestioning belief that a free market system is the best solution for every problem. However, as an algorithm, it has strengths and weaknesses that can be analyzed objectively, as any algorithm does.

A model of a free market consists of:

A desired, but limited resource. This limited resource could be raw materials, food, land etc., but for simplicity, let's call it, money.

Participants that need and desire this resource. They can acquire more of the resource than they need, but if they don't get enough of they will cease to be participants. You could say they will go out of business, or die, depending on your metaphor. New participants may also enter the market. This could be by existing participates cooperating to form a new business, or via birth, etc.

There are various methods and strategies for obtaining money. A participant could provide a good or service, inherit it, steal it, win it in a lottery, or beg for it, for example. Most methods will require some spending of money, in the hope of getting more. Some methods, may have an effect on other participants future behavior, such as, stealing might cause other participants to throw the thief in jail and deny him the opportunity to earn money for a period. The selling of shoddy goods or services might prevent other participants from buying in the future. There are no particular limits on methods. Participants may modify existing methods, or invent new ones. They can learn from eachother.

Finally, there is a guiding principal: every man for himself. In other words, there is no central coordination of behavior.

In the real world, we, in fact, don't apply free market principals to all of our activities. Criminal justice is one counter example. A totally free market legal system would just be, "might makes right". The natural world works that way, and there is no reason why our society couldn't also. However, we have opted for non-free market ideas, such as, morality, rule of law and justice, in this domain. We want it to be not ok to bash other guys on the head and take their money. So, we apply non-free market mechanisms to achieve that result. However, the question of when to apply free market principals and when not to is not relevant to analyzing how free markets work under different conditions.

Some observations:

The fact that new participants can learn from successful existing participants, and each participant can improve methods of making money, will tend to lead to better and more sophisticated methods coming into use over time.

The fact that there is no central coordination means that the objectively best methods will succeed.

If there is money that is unused, it will benefit a participant to find a method of utilizing that money. So, there will be a tendency to maximize the use of the scarce resource.

The number of participants will be bounded by the overall supply of money, divided by the money required to keep each participant in business.

This last point brings me to the thought experiments that I want to walk through. Depending on the nature of the money supply, the outcome for the whole system is very different.

If the money supply is fixed, the number of participants would tend to grow until the whole supply is utilized, and then the overall system would reach a steady state. I think this is how ecosystems work. There is a certain amount of sunlight, air, water and soil, and plants and animals tend to fully utilize what is available.

If the money supply can be grown, there really isn't an absolute limit on how many participants there can be. I think this is how financial systems work. If markets grow, or new markets come into existance, the money supply can grow to accomidate, you get exponential growth in the value of financial assests, and people, corporations and nations become more prosperous over time. This is the happiest of outcomes, and why there are so many adherents of free markets in the business world.

Conversely, if the money supply were non-renewable, in other words, if when a unit of money was used to sustain a market participant, it was removed from from the system, and there were a fixed initial supply, then the number of participants would still grow until the whole supply was utilized. However, at that time, there would be a dramatic reduction in the number of participants, because the only money left would the reserves of participants that had accrued more money than they needed. The reserves, too, would eventually be used up. I think this is the case with mined resources. There is only so much of any given substance in the ground. It is essentially what is happening when a fishery collapses, or a forest is clear cut, and the logging industry has to move on when the clear cutting is done.

So, we have three possible systemic outcomes. For any given situation, we would have to know whether the resources being managed are non-renewable, fixed, or expanding to know whether free market management of those resources will have a good outcome. Knowing this is more complex than it might seem at first, because sometimes there is a substitute for an appearantly non-renewable resource, or an appearantly fixed resource behaves like a non-renewable resource when it is exploited too quickly. For example when oil runs out, maybe we can use coal or urinium, instead. This would be a bad outcome for the oil industry, but not so bad for mankind. Or it could be that the combined effect of over-exploitation of fisheries and forests, and reliance on mined mineral resources means our entire economic system is based on non-renewable resources, and this situation will resolve itself through a large scale die-off of the human population.

I am not intending to advocate any particular political philosophy. Rather, I think the goodness of free market systems is often taken an almost religious tenant. When, if you think about them rationally, there are many good things about them, but they also have some severe dissadvantages in some situations.