Fun Facts About the Federal Budget

Federal Budget Process

Each year the President of the United States is required by law to submit an operating budget to the United States Congress. Congress then votes on the budget after a series of negotiations and committee meetings. Eventually the budget becomes a binding document, after approval by both houses of Congress.

The Federal Ficsal Year

In Washington, the fiscal year begins on October 1 and ends on September 30 of the following calendar year

Not all expenditures are included in the budget

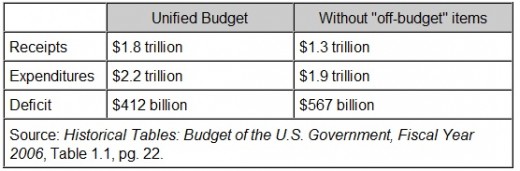

Some government programs are "off-budget", meaning that they will be funded, but not included in budget documents that the president submits to Congress. For example, Social Security has been "on-budget" and "off-budget" several times since its' inception.

Entitlement Reform

The term Entitlement Reform is sometimes used to refer to efforts to reduce the cost of some federal programs such as Medicare, Medicaid, and Social Security. No entitlement reform is being attempted in the President's proposed 2012 Federal Budget.

The Huffington Post

The website called HuffingtonPost.com recently published an article enumerating 6 popularly held concepts concerning the federal defect that are 'incorrect'. Concept 1, that the site claimed is widely and wrongly accepted as correct by many people, is that "deficits are caused by government spending. [1] "

Future Budgets

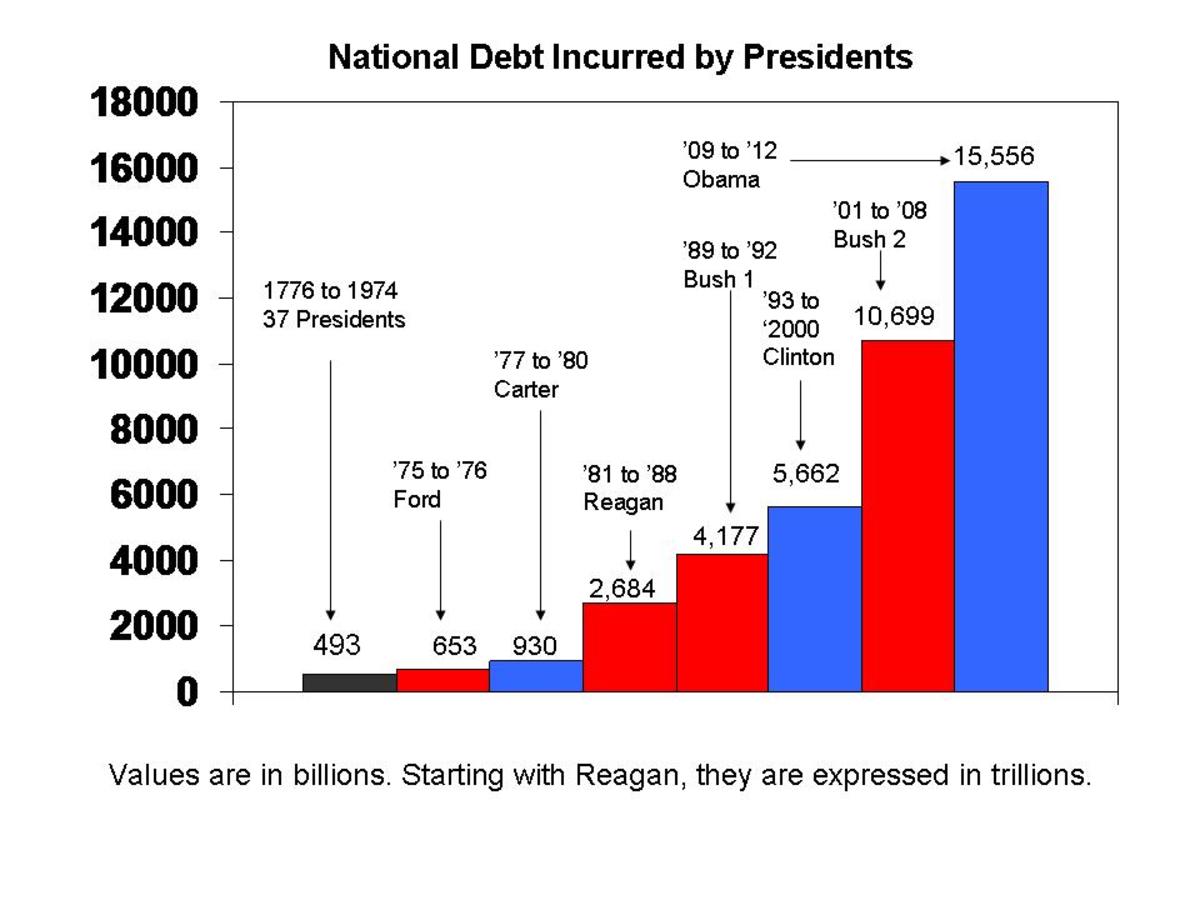

President Obama’s 2012 budget will cause the United States federal debt to increase from about $14.2 trillion to about $15.5 trillion. This will render the federal debt greater than the size of the entire U.S. economy for the first time in history.[2]

Social Security has aTrust Fund of IOUs

Since 1982, Social Security has had

surpluses ranging from $89 million to $190

billion per year. By law, these

surpluses must be loaned to the federal

government (the federal government issues bonds and then purchases those bonds with the surplus money), which is obligated to pay the

money back with interest.The money raised from the sale of the bonds then goes into the general fund for the country.

This

is referred to as the "Social Security Trust

Fund," and at the close of 2009, it had a

balance of $2.5 trillion that the government owes to itself. When the Social Security program experiences an annual deficit, it 'cashes in' some of the bonds, which the federal government fulfills by selling more bonds or allocating tax dollars. [3]

The Indian Health Care Service

The 2012 budget includes 4.6 billion for the Indian Health Service, which is a 14% increase over the initial funding that was enacted in 2010. [4] This program serves the American Indian and Alaska Native (AI/AN) population, calculated to be about 3.3 million people by the 2000 Federal Census. [5]

The Department of Transportation

The 2102 federal budget includes 129 billion for the Department of Transportation.

$7 billion of the budget will be earmarked to promote the use of seatbelts, get impaired drivers off the road, and ensure that traffic fatality numbers continue falling from what currently are historic lows.

A National Infrastructure bank has been proposed. It is intended to finance projects of national or regional significance. By working with credit markets and private-sector investors, the infrastructure bank will use limited resources to achieve optimal returns on federal transportation dollars (taxes). The bank is slated to initially receive $30 billion over the first six years. it will fall under the control of the U.S. Department of Transportation and be overseen by an executive director and a board of officials drawn from the Transportation Department and other federal agencies. [6]

The Department of Agrciulture

The current 2012 budget proposed by the President includes elimination of federal farm payments to U.S. farmers at the highest levels of adjusted gross incomes (AGI).

The Office of Management and Budget (OMB) estimates that the change would save about $2.6 billion over a 10 year period and impact nearly 30,000 people. The full cuts would take 3 years to be phased in. Once fully implemented, payments would be made only to people with less than $500,000 AGI (Adjusted Gross Income) (down from from $750 k) from agriculture or less than $250,000 (from $500 k) non-agriculture AGI. A reduction in direct payments from $80,000 per farm to $60,000 per farm is also proposed,[7]

References

[1] http://www.huffingtonpost.com/rj-eskow/six-things-everybody-know_b_823831.html

[2] http://www.newsrealblog.com/2011/02/17/hey-obama-how-about-tackling-obesity-in-the-federal-budget/

[3] http://www.justfacts.com/socialsecurity.asp

[4] http://navajotimes.com/news/2011/0211/021711budget.php

[5] http://info.ihs.gov/Population.asp

[6] http://www.dot.gov/budget/2012/fy2012budgethighlights.pdf

[7] http://naturalresourcereport.com/2011/02/federal-budget-update-farm-payments-epa-and-appropriations/