Government Bailouts: Do They Help the Economy or Not?

From an economic perspective, are government bailouts a good idea? Do they actually help the economy, or is the government more worried about the livelihood of Americans? These are some of the questions this Hub hopes to adress, first using an economic perspective, and then focusing on the more normative qualities of the issue of government intervention.

So what is a bailout? A Bailout is when a business or firm receives capital or money from the government when it is danger of failing. The act is meant to save the firm from declaring banktrupcy and having to sell off its assets, but it is also used to help a company shut down gracefully by allowing it to pay off its debts.

Are bailouts a good idea?

The most recent government bailouts involved the auto industry and banks, the three most prominent companies being:

- General Motors

- Chrysler

- Bank of America

While the auto industry bailout was technically labeled a 'bridge loan' it is broadly referred to as a bailout, as it saved two of the big three car companies (Ford being the third) from failing.

So the question is, are bailouts good for the economy?

Purely from an economic standpoint, government bailouts are NOT good for the economy for several reasons. Assuming a perfect free market (a bit of a stretch, but economists rely heavily on assumptions that simplify extraneous information for better understanding), the government should never bailout a failing business.

One of the leading principles of a free market is the idea of "the invisible hand", which sounds strange, but is true. Without intervention of any sort, a free market will always be able to regulate itself in a manner that maximizes efficieny. This is because of the invisible hand, which is essentially guided by the collective selfishness of the population involved in the free market.

Continuing in our simplified model of a free market, we assume that all people are rational and act in their best self interest. A manufacturer is not going to provide goods for free, and people are not going to pay exorbitant amounts for that good either. The market will naturally regulate itself according to these desires to maximize your own self interest. The supply and demand curves will equal out and both consumers and producers will walk away happy.

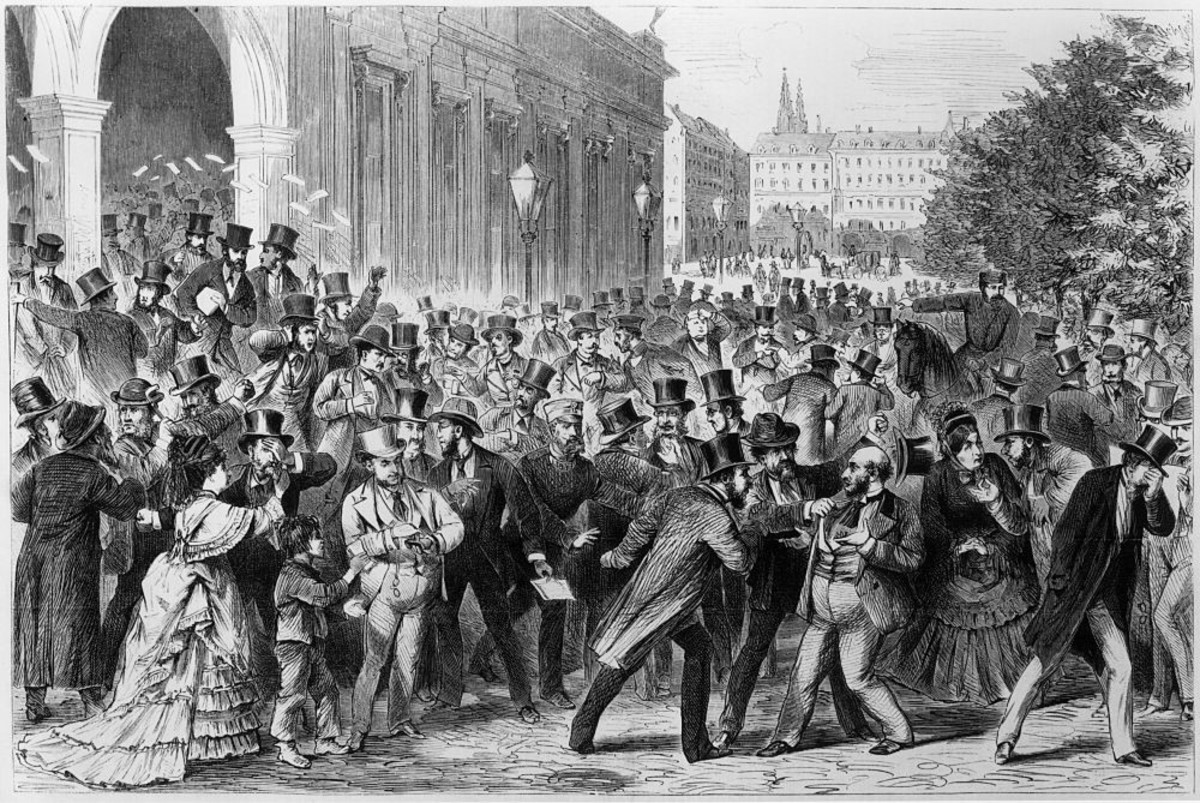

Bank Bailouts by the Numbers

Why do companies need bailouts?

We now have the idea of a free market where everything is naturally guided toward efficiency firmly established in our minds. Firms in this market exist in perfect competition, meaning that all the firms produce essentially the same product for the same price. One firm cannot demand a higher price, because consumers will just turn to the other firms.

Let's consider the auto industry, specifically General Motors. First, let's analyze why General Motors needed a bail-out.

Having grown up in Detroit, just up the road from a GM plant, the auto industry was something that involved the lives of the majority of my friends and their families. In fact, GM involved so many people over the years, that it couldn't keep up. GM had pledged retirement funds and fair compensation to all its workers, and as more employees retired and current employee's living standards improved, GM realized it could not keep up financially.

This was not the only reason GM began to fail. A lack of innovation left them behind other car companies and their profits plummeted. GM was operating at a loss. Normally, companies who run at a loss eventually shut down and will get out of the market, thus returning it to full efficiency.

However, GM was responsible for the livelihoods of many, many Americans and the government was pressured to step in and protect them from losing their jobs. So they bailed them out with a generous loan. Unless GM innovated and caught up with other firms in the auto industry, they would be able to continue producing for longer, but eventually, they would begin to operate at a loss again, when their loan ran out and the lack of efficiency would have cost the United States a lot of money.

If this happened, the loan would have been a waste and GM would still be in danger. The market signals provided by the invisible hand (IE, the losses) had been hidden for a while by various measures that protected the American auto industry and allowed it to remain unchanged and satiated. In effect, the American auto industry had grown complacent and was not making steps to keep up with competitors, so when some of those protective measures were removed and GM was exposed to those losses, it would have shut down had the government not stepped in.

Learn More About Economics

Bailout Responses

Luckily, General Motors and Chrysler realized they needed to make changes to operate at full efficiency again, or remain at risk. The General Motors plant up the road from my family's home shut down for a season and was re-tooled to produce more innovative cars that were in higher demand and sold at a higher price.

They retired several brands of low-performing cars and made plans to pay back the loan and return to efficiency again. From an economists perspective, this is good, but not all firms will respond in the same way, and the idea of a bailout can make many economists feel uneasy, as excess money given to a failing firm will cover their losses and dampen market signals that should push the inefficient company to leave the market so it can return to efficiency.

Continuning this as economically as possible, bailouts should be advised against, however life is never as cut and dry as economists would wish it to be. The livelihood's of many are at stake, and economics rarely considers fairness in its models or decisions.

Do you think government bailouts are good or bad for the economy? What about for Americans as a whole? Comment below!