How Government Programs Increase Costs

The Unintended Consequences

Many of us look at the cost of things we need to buy and often get frustrated with how expensive certain aspects of the cost of living have increased. Yet often we really don’t take the time to try to understand the root cause of exactly why certain products or services are increasing at what seems to be a far too aggressive pace. The increase in price of anything is what we call inflation. There are only three things that happen to the price of a good or service. There is inflation, which is the measure of how fast the price of goods and services are rising. There is disinflation, which is simply a slowing in the rate of increase over a period of time, yet still increasing. Then there is deflation which is the actual decline in the price of a good or service. Inflation is the result of the money supply. As more money is chasing after few goods, prices go up.

There are two ways in which the Gov’t operates to affect economic outcomes. They are monetary policy and fiscal policy.

MONETARY POLICY

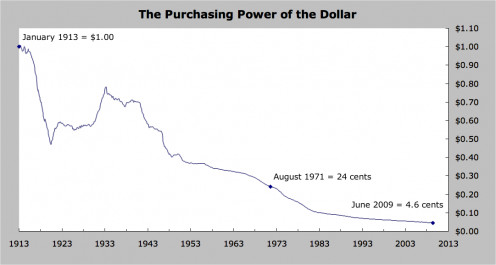

The Federal Reserve is the central bank of the USA. They serve many purposes, yet the primary mandates are inflation and unemployment. The Fed, can affect changes in prices through it’s monetary policy. This includes but is not limited to acts such as “open market operations”. This is simply the Federal Reserve going into the bond market and buying or selling Gov’t bonds to increase or decrease the money supply. Additionally they set the short term interest rates for things such as the overnight lending rates between financial institutions. In recent years the Fed has utilized numerous non-conventional measures. At one time the Fed’s actions of increasing or decreasing the money supply was constrained by the link between the US currency and the price of gold. The Fed has not had such limitations since the 1970’s. There have been numerous versions of central banking in US history, as well as long periods of no central banking. However the current form of the Federal Reserve has been in existence since 1913. Since that time the US dollar has lost more than 90% of its purchasing power. In my view this has greatly worsened since the decoupling of the US dollar to a Gold Standard. Often the actions of the Fed are a result of an attempt to solve problems that can result from reckless policy that originates in the legislative and executive branch of Gov’t. These branches control fiscal policy. For the purpose of this article we'll look more closely at the fiscal side rather than the monetary side.

FISCAL POLICY

The taxation and spending aspects of Gov’t are fiscal policy. These policies can have a sudden and direct impact on economic activity. In reality the most damage done by the legislative side of Gov’t is not just a function of taxation and spending on a broad scale. Often is comes from very specific programs implemented that produce unintended consequences through social engineering. While often they are well intended, the result can be disastrous. Let’s examine three areas of the economy that are under great stress and look at the current and historical policies.

HOUSING MARKET

As we all know, the US housing market has been through a recent substantial downturn that impacted the entire banking system. Many have been quick to point the finger at banks as reckless and greedy without actually examining the events leading up to this point in time. In reality this was a result of a series of Gov’t intrusions over many years.

One major factor was the creation of the Community Reinvestment Act (CRA). The CRA program was created in 1977 with the intent of preventing "Redlining". Redlining was the act of commercial banks ruling out issuing loans to lower income areas. Some felt that this redlining was a result of racial discrimination. While there may have been some instances of this, in reality banks care about only one color…Green. When the act was passed it was very strongly opposed by nearly all in the banking sector. They expressed concerns about mandating banks to lend money in areas were borrowers would inevitably have lower credit, less collateral and be a bigger liability risk with regard to their ability to pay back the amounts borrowed. Yet the social engineers who designed this act insisted it would elevate these areas. Over the years the CRA mandates grew, and banks with subpar CRA ratings would face penalties like limiting their ability to open new offices.

Another major and probably the most impactful aspect was the role of the Government Sponsored Enterprise’s (GSE) Fannie Mae and Freddie Mac. The creation of the GSE’s dated back many decades. However over the last couple of decades their mandate evolved. The GSE’s were permitted to become and artificial source of demand for the purchasing of mortgage backed securities. Banks through securitization of a loan can issue the mortgage to a borrower, then package the loan with other loans and sell them to other individuals or institutions as a bond. The securitization of a loan by itself is not harmful at all. In reality it can be an excellent potential investment for many. However, the demand for these bonds should be based on the marketplace operating without interference. If the demand for these debt obligations declines, then so will the issuance of loans. Once the GSE’s stepped in and accelerated the demand, the Gov’t gave a green light to banks to issue all the loans they want…The Gov’t will be there to buy them up. Many financial institutions knew full well that the market was growing out of control and not sustainable. Yet if the Federal gov’t with its unlimited resources through taxation is telling a financial institution they will buy up the supply of mortgages issued, then why would they stop.

Imagine that you sold straws for a living. You would only manufacture and place in inventory the amount of straws you presumed that you can sell. However if the Federal gov’t goes on a straw buying binge, you’re certainly not going to stand by and watch your competitors get rich, while you only produce enough for those customers that represent true organic growth. This is effectively what happened in the housing market. The Gov’t decided that all citizens should own a home regardless of how responsible they were. Through social engineering of the debt market they created the artificial demand to get banks to increase their lending. These incentives led to banks dropping their lending standards. It no longer mattered whether the borrower could pay off the loan. The banks would no longer hold the note anyway. They could simply sell them to the GSE’s. All the while the GSE’s where in dire financial straits, masked with scandalous accounting violations. When congressional hearings took place in 2003-2004 the members of congress whom supported these policies refused to look into the allegations with any serious investigation. Why ??? Because the GSE’s are actually private companies under the direct control of congress. Were there greedy bankers…sure. We’re all greedy at some point or another. However, the marketplace has an excellent antidote for greed…Its called risk !!! When the gov’t begins to subsidize the risk away, reckless behavior will grow out of control. Had they simply let banks do what they do best, which is analyze an individual’s ability to pay back that which they borrow, banks would be far more cautious and less lenient when they disperse funds. The result was a greatly inflated housing market. This is one major example of how the gov’t can distort prices and create market dislocation.

EDUCATION

The United States pioneered the concept of public education, yet today we are rapidly falling behind the rest of the world in academic competition. We produce dramatically less graduates in vital areas like engineering and mathematics. So what has changed ??? Most of us who are old enough to remember how things once worked can see the difference. Our parents have seen even greater changes.

At the grade school level, I witness this first hand as I am married to a public school teacher. In areas like the northeast, it is common to have a 5 figure property tax bill. Most of this goes to fund the local school districts. Public schools at one time saw greater control at the local level. Yet today, the Federal gov’t which collects income tax revenue then re-deploys the money to the areas that they see the best need. In order to demonstrate accountability for the funds you receive, teachers are held to standards created by a central planning bureaucracy led by those in Washington that have never led a classroom. Since nobody wants to say no to the money, they play along and the students suffer while teachers are forces to "teach to the test".

Yet most Americans don’t even realize that prior to 1979, there was no such thing as the Dept of Education. It simply did not exist. Has this Federal entity improved education…Apparently not if we are falling behind by various academic standards. The solution the gov’t has had is simply to throw money at problems with no realistic accountability. Yet what makes someone accountable ??? In reality the only thing that makes someone accountable for the work that they do is the consumer. If the service you offer is of value, then someone will pay you for it. Measuring teachers is particularly difficult. Some may teach in a lower income area with students who don’t get the best support at home. Some may have a terrible principal or dept head who is not evaluating their work fairly. Yet the consumer is the student and parent. This is who you work for. Shouldn’t they have a say in where and how they're educated ??? The problem is that teachers have no labor mobility. Because of the way the civil service laws and benefits are established, no teacher with seniority or tenure would walk away from their district to apply for work in another voluntarily. Imagine if you have been teaching for 15 years. If you work in a school that is poorly run and wish to leave you would drop to the bottom of seniority list and lose tenure. That means in a budget cut back you’ll be first to go. Furthermore if you have that much time, your income is tied to a state salary band and makes you less attractive to a new school district because of a higher income relative to a new younger teacher. Even if you wished to take a salary cut to work in place that was more convienent, like a school closer to your home...You Can't. It is against the rules. The salary bands are the same across the state. This is precisely the opposite of the private sector which would pay more for experience and tenure in a valuable role.

What about parents…Can they simply transfer to schools of their choosing ??? Not without uprooting your family or being fortunate enough to get into a voucher system in lower income areas. Parents can always send their kids to private school...But who can afford to pay both the property taxes and private school tuition. This is itself is a market distortion. The fact that you are forced into a failing system prevents private capital from competing in the private school arena. The increased competition through additional market participants would allow private schools to compete better and attract better teachers for better pay. Simultaneously this give teachers mobility to attract a following based on their reputation and credentials. The current system places no accountability on the spending of resources and gives the consumer no choice. At the same time it protects incompetent teachers while failing to properly reward those that go above and beyond for our children. The result is escalating property taxes and lower academic results.

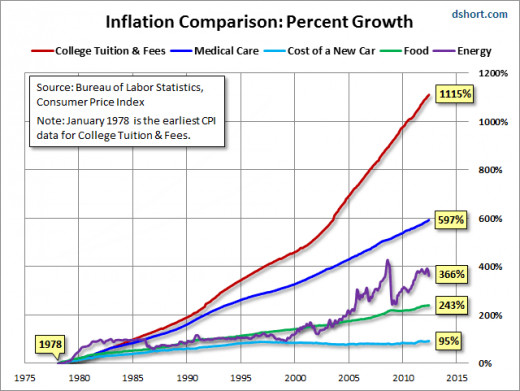

What about college…why so expensive ??? The cost of college has risen in recent years far faster than baseline inflation. The vast majority of students graduate from state run universities. So why is this ??? In fact it is another gov’t subsidy. Banks for years loaned out money in enormous amounts to students that have no collateral and no income. Today the Gov't does this directly to the student without the banks. Some would assume that if the gov’t didn’t do this then students could never pursue their education. This is a fallacy. Universities are well aware of these guarantees and have raised their tuitions dramatically over the last several decades. What if the plug was pulled on all these guarantees and high school students in large numbers stopped applying for higher education. Would the universities simply say "well...we had a nice run" then close their doors and scale back these immense institutions because there was nobody attending ??? Not likely. It’s far more likely that rather than have students compete just on the basis of grades, they would have to compete on price. Isn’t it strange that you negotiate the price of your car, but not your tuition rates. College is a business, and like any other business they are there to make money. These guarantees may be well intended, but simply create price distortions. In recent years the Federal gov't has opted to issue these loans directly rather than subsidize the loans through the bank. This will only further increase the price distortions.

HEALTH CARE

The health care field is the worst example of price distortions. How many of us send a bill to our auto insurance company every time we get an oil change, tire rotation, flat tire, or new washer fluid. Imagine if you could do this…wouldn’t that be great !!! Except your $1200.00 annual car insurance premium might be more like $10,000 per year. Insurance is a contract of indemnity and is there to replace a loss. Yet we expect it to cover general maintenance. Some may assume that it would be too expensive to pay for basic doctors office visits. Yet if you had the ability to negotiate with the doctor, which is illegal when you have an insurance provider, the cost would have to come down. Regardless of the industry you are in, you cannot constantly charge more than the consumer can pay. If you did you would simply go out of business. I am old enough to remember a time when Dr’s actually made house calls and you paid what you could afford.

So how is this a result of a gov’t distortion ??? One of the most interesting inflationary statistics is that of health care costs relative to more broad based inflation (CPI). The two correlated pretty closely until the year 1965, at which point the Federal gov’t created the Medicare and Medicaid programs. These programs are wildly popular among the public. That’s because most Americans don’t look beyond the cost of the Medicare premiums to see the real cost. Aside from all of the fraud, red tape and fiscal insolvency in these programs, there is a bigger issue. Doctors are often reimbursed as little as 8-10 cents on the dollar that they bill out for services rendered. The gov’t solution to cost control is to simply not pay the doctors. It has become such a problem that many doctors are simply opting out of Medicare or refusing to take on new Medicare patients. Those who are Medicaid recipients will find it even more difficult to find a doctor to accept the coverage as the rate of reimbursement is even worse. So how do doctors cope with the expense of not being adequately paid for their time ??? These two gov’t run programs now account for nearly half of all medical services provided in the US. That means that with an aging population, doctors must overbill private insurers for the additional revenue. This puts the insurer on constant defense and fighting with the doctor and patient over the cost and necessity of services. The insurers in the meantime have lost out on access to about 50% of the marketplace of consumers which reduces competition. Less competiton means higher prices. Despite all the distain for the health insurers, it is relatively low profit margin business. It doesn’t reward you with a return on your investment even close to that of other industries like the software field.

There are various other issues that have impacted the cost of medical care. Issues like malpractice insurance and the lack of tort reform are among them. Yet the price distortions are the most impactful.

Let's contrast this to areas like cosmetic surgery which is generally not covered by insurance at all with a few medical exceptions. Fifty years ago, cosmetic surgery was for the super rich individual like celebrities. Today this type of medical treatment is more available to the general public for hair transplants, tummy tucks, and breast augmentation than ever before. The technology and quality of these procedures has risen dramatically, yet the costs have gone down and availability is greater. So how can seeing a doctor that is not compensated by insurance or influenced by any gov’t program be more affordable. The answer is simple. There are no price distortions. You're are actually negotiating directly with the provider. In fact one of the most respected cosmetic surgeons in New York has an office not far from my home. He actually has a sign up that encourages people to come in for the summer specials on pricing...Amazing !!!

More and more doctors are opting out of all forms of insurance. Recent surveys reveal that 1 in 3 Doctors will not take on new Medicaid patients. And 20% of them won't take on new Medicare patients. The term NEW is what is paramount. Many that still accept this insurance will limit the number of Medicare/Medicaid patients they will take. Often waiting for one to die in order to take on another one. The lack of acceptance is higher in area's of greater poverty where it is needed the most. Ultimately, a doctor cannot operate a practice based on a large percentage of gov't insurance and expect to remain in business. The Association of American Physicians and Surgeons - AAPS has actually posted a guide on their site with instructions on how to opt out of Medicare. http://www.aapsonline.org/index.php/article/opt_out_medicare/.

The highly respected Mayo Clinic opted out of Medicare in 2008 in numerous states. http://newsblog.mayoclinic.org/2009/10/13/difficult-business-decisions-on-medicare-medicaid-at-mayo/

While the American Medical Association has taken a different position, it should be noted that a very smaller percentage of US doctors are AMA members. In fact their membership is in decline while the AAPS is growing.

As many doctors nationally have opted out of both gov't insurance and private insurance, an interesting phenomenon had developed. Those doctors have cut their prices often in half, while the rest of the medical industry has seen year over year annual healthcare costs inflate at double digits. A Portland Doctor, Michael Ciampi was one such example reported recently who was able to not only reduce his prices by in some cases 50%...But he also makes house calls !!! Is he crazy...he must think this is 1950 !!!

http://www.economicpolicyjournal.com/2013/05/real-healthcare-reform-doctor-stops.html

The one common denominator in all three of these areas of out of control escalating costs is that the negotiation of payment between the provider of the service and the recipient is virtually non-existent. There is always a third party forced into the equation which suppresses price discovery. Nobody knows how to spend your money better than you. The only way to bring down expenses while improving both quality and availability is to give the consumer the choice to choose their provider of services, and both the consumer and the provider of the services rendered the freedom to agree on a price that is acceptable. So the next time you hear a politician telling you that they have a new program to bring down costs, think about the larger picture. Imagine how the other counterparties will be affected. There are no free lunches, no matter what they’ve promised you.

Suggested Reading

- Should I Pay off My Mortgage Early ???

For many Americans, the ability to pay down their mortgage sooner is simply not realistic. However in some cases it is quite possible. The Question of whether or not you should accelerate mortgage payments or use liquid cash to eliminate the... - Annuities: What You Need To Know

What is an annuity ??? Annuities can generally be summarized as two basic types of insurance contracts. They are either immediate or deferred annuities. Over the years these two types of contracts have been expanded to encompass many different... - Prioritizing Your Debt's

Quite often individuals find themselves under a pile of debt for various reasons. Sometimes we fall upon hard times due to a set of unfortunate circumstances beyond our control. Other times we may have simply lived irresponsibly for periods in our... - What Are The Hidden Costs of Mutual Funds ???

When it comes to analyzing mutual fund fees, you most often have to turn over more than a few stones to find them all. Mutual funds costs can be broken down into three basic categories. Load funds, no-load funds and no-load funds with a transaction.. - Passive vs Active Management…The Case for ETF’s

There has been an ongoing debate for decades about the benefits of actively managed mutual funds versus their passive counterparts. Those counterparts would be the exchange traded fund market (ETF’s) as well as traditional index funds. Those in... - Recently Unemployed...Some Things to Think About

In recent years the US population has had no shortage of those whom have had the unfortunate experience of a job loss. As of August 2012 we currently have and official unemployment rate of in excess of 8% of the population. This data is based on the. - Financial Concerns of a Divorce

The process of a divorce from your spouse can be a traumatic experience on both of you as well as your children. It can be particularly traumatic to your personal finances. In far too many cases the divorce attorneys are the only ones who reap any... - Starting A New Job...Understand Your Benefits Packag...

If you’re fortunate enough to have been hired into a new job there can be a number of things that need to be addressed at the beginning of employment. Often times it can be a little overwhelming to address all the issues that come up with regards... - Refinancing to a 15 or 30 year mortgage ???

Over the course of the last few years I have received numerous calls from clients asking me whether or not it makes financial sense to refinance their mortgage as a result of this unprecedented low interest rate environment. And in many cases the... - Preparing For The Tax Law Changes In 2013

The topic of taxes is always one which is greatly debated from both a political as well as an economic perspective. Regardless of one’s political persuasion on such issues, one constant always remains the same. We each do all that we can to avoid...